The Bitcoin price is undoubtedly one of the top performers. Quite literally, the most valuable digital asset has been tearing higher, blasting past $20k, and is now stable above $23k. For doubters, the coin has proven a point. Analysts project even more gains in 2021.

Bitcoin Bulls Have a Chance

Anthony Pompliano is on record saying the Bitcoin price will rally to over $100k by Dec 2021. Coupled by institutions flowing in and the global economy still shaky despite the Coronavirus vaccine, investors are hesitant to pump their funds back to traditional assets like gold.

Ruffer Investment, for instance, is reducing their gold exposure and consequently allocating three percent of its $25 billion portfolio to Bitcoin.

Meanwhile, MicroStrategy is doubling down on Bitcoin, earlier this week announcing their purchase of an additional $650 million of Bitcoin pushing their total haul to $1.15 billion.

There is a Bitcoin Shortage

The demand for leading digital assets saw Grayscale temporarily suspend the purchase of leading trusts, including GBTC.

There was no explanation as to why. However, according to their latest report, the total asset under management has expanded to above $16.4 billion, adding $500 million on the last day, according to Barry Silbert–the CEO of Digital Coin Group (DCG), the firm managing Grayscale.

While Grayscale ramps up, the CEO of Pantera Capital, Dan Morehead, has said there is a growing Bitcoin supply shortage problem.

He blames institutional buyers like PayPal for buying most Bitcoin that is mined. Overly, in Pantera’s projection, the Bitcoin price is on pace of rallying to $115k. In their assessment, at spot rates, the BTC/USD price is “nine weeks” behind schedule.

Bitcoin Price Forecast

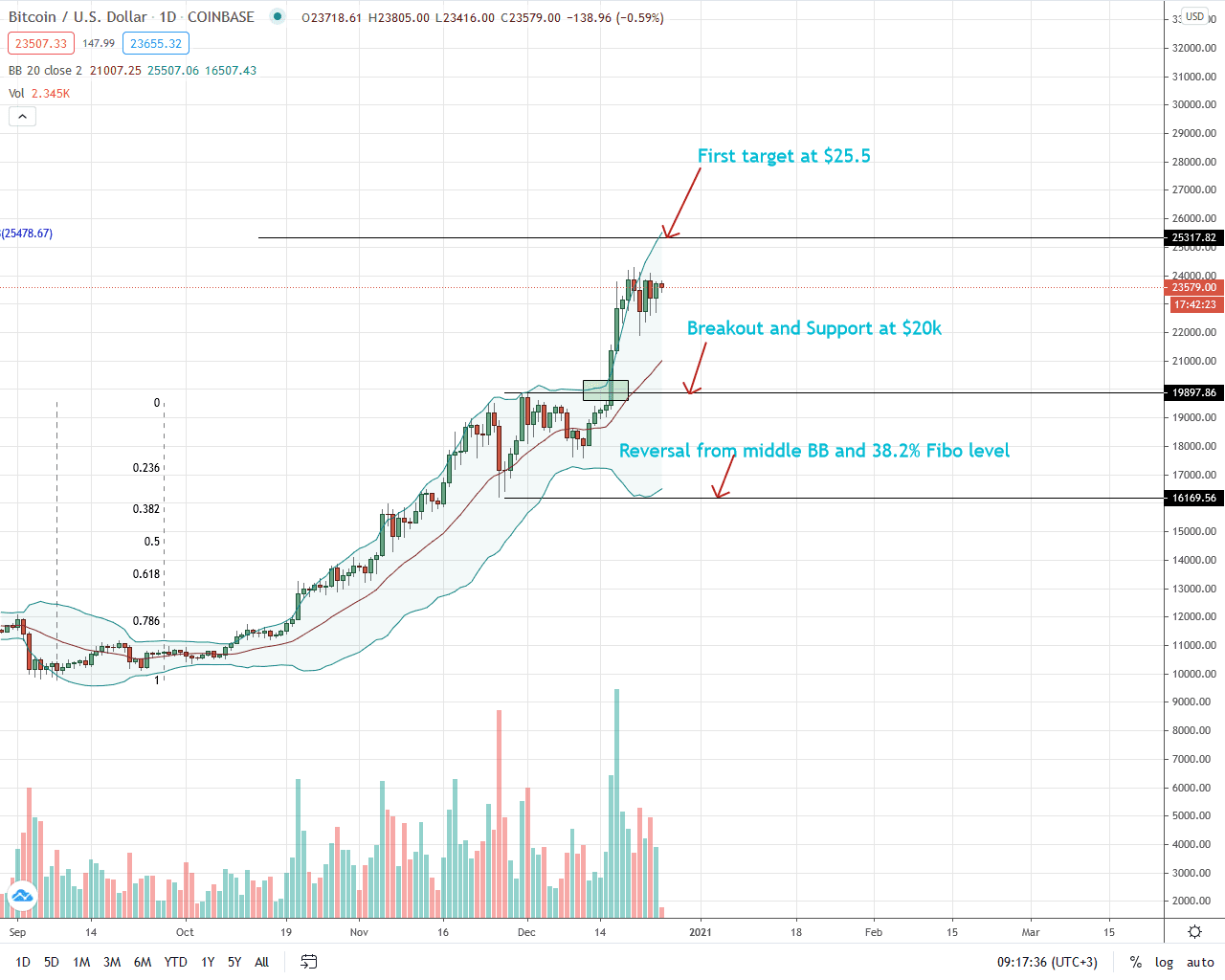

After over two months of gains, the Bitcoin price is consolidating below $24k. At the time of writing, the BTC price is stable in the last week, posting gains versus ETH but adding two percent on the last day versus the greenback.

Technically, the path of least resistance is northwards as long as $22k holds.

Notably, the Dec 16 and 17 bull bars are setting the pace for buyers aiming for $25k in the immediate term. On the other hand, the consolidation could be a distribution especially if prices slide below $22k, confirming losses of Dec 21. While volumes were below average, a dip below this mark could easily spark a sell-off back to $20k in a retest, correcting the over-valuation of Dec 20.

Conversely, gains above $24k could easily see the BTC price expand to $25k, the 161.8 percent Fibonacci extension level of the October and November trade range. Ideally, the confirmation above $24k ought to be with high trading volumes exceeding those of Dec 17 (Coinbase data).

Chart Courtesy of Trading View

Disclosure: Opinions Expressed Are Not Investment Advice. Do Your Research.

If you found this article interesting, here you can find more Bitcoin news