The Bitcoin price is cooling off after an exemplary performance in mid-October. There were concerns that bears would wreak havoc following a worrying close below $60k to around $58k.

However, when writing, the BTC/USD price is solid above the psychological mark and on track to retest $66k in a buy trend continuation.

Fanning demand is an array of factors, most of which are fundamentals. Understandably, BTC prices are around all-time highs, and a burst above $66k leads directly to price discovery and infinite resistance levels.

Thus, how fundamentals stream in would shape the Bitcoin short to medium-term trend.

El Salvador Bought the Bitcoin Dip

At present, the doubling down—once more by El Salvador—this time purchasing an even more significant chunk of BTC is a bullish statement on the project.

On October 27, President Nayib Bukele said they bought 420 BTC, as they bought the dip.

It was a long wait, but worth it.

We just bought the dip!

420 new #Bitcoin🇸🇻

— Nayib Bukele (@nayibbukele) October 27, 2021

El Salvador made history when it became the first country to legalize BTC, affirming it as a currency for settling liabilities, including tax obligations within its borders.

Institutional Flow to Bitcoin Futures ETF

Meanwhile, the launch of the first Bitcoin Futures BTC saw more institutional traders flow in, diversifying into the Bitcoin tracking instrument, indirectly offering support.

Valkyrie’s application was also approved and is yet another option for institutions considering cryptocurrencies.

NOW: Valkyrie #Bitcoin Futures ETF is now trading pic.twitter.com/2bmearmZzA

— Blockworks (@Blockworks_) October 22, 2021

Still, the SEC’s permitting Bitcoin Futures ETF is considered not a real deal with skeptics on the wings waiting for the agency to, in the long term, approve an ETF directly tracking Bitcoin prices.

Bitcoin Price Analysis

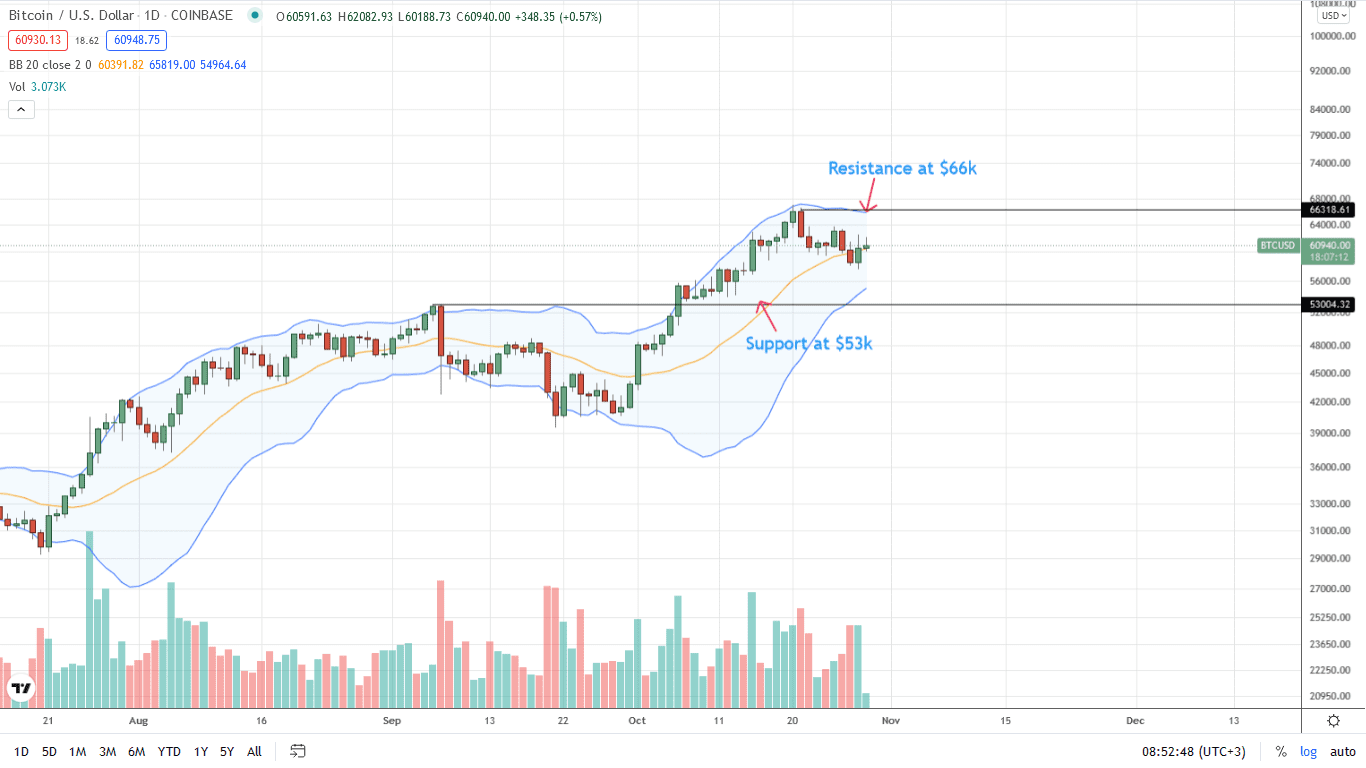

BTC/USD prices are steady above the $60k level following sharp losses on October 27.

Despite gains, traders are skeptical of the uptrend, subsequently adopting a wait-and-see approach in the short term.

Ideally, considering the burst of the previous days, every low may offer entries with targets at $64k—H1 2021 highs—and all-time highs at over $66.5k.

Even so, the validation of this upswing ought to be with above-average trading volumes with a satisfactory reversal of October 27 losses, plugging the bled.

On the reverse side, if sellers stream back, unwind progress of October 28, the odds of BTC/USD prices plunging below $58k in a bear trend continuation would be high.

In that case, sellers may begin searching for entries on pullbacks below $60k, targeting a swing lower to $53k or lower.

Technical charts courtesy of Trading View

Disclaimer: Opinions expressed are not investment advice. Do your research.

If you found this article interesting, here you can find more Bitcoin news