Bitcoin is once again in focus as analysts say the next leg of the rally could push prices toward $150,000. As BTC shows signs of recovery, MAGACOIN FINANCE is catching attention as an undervalued altcoin quietly preparing to benefit from the same market rebound.

Bitcoin ETF Inflows Return as Rate Cuts Approach

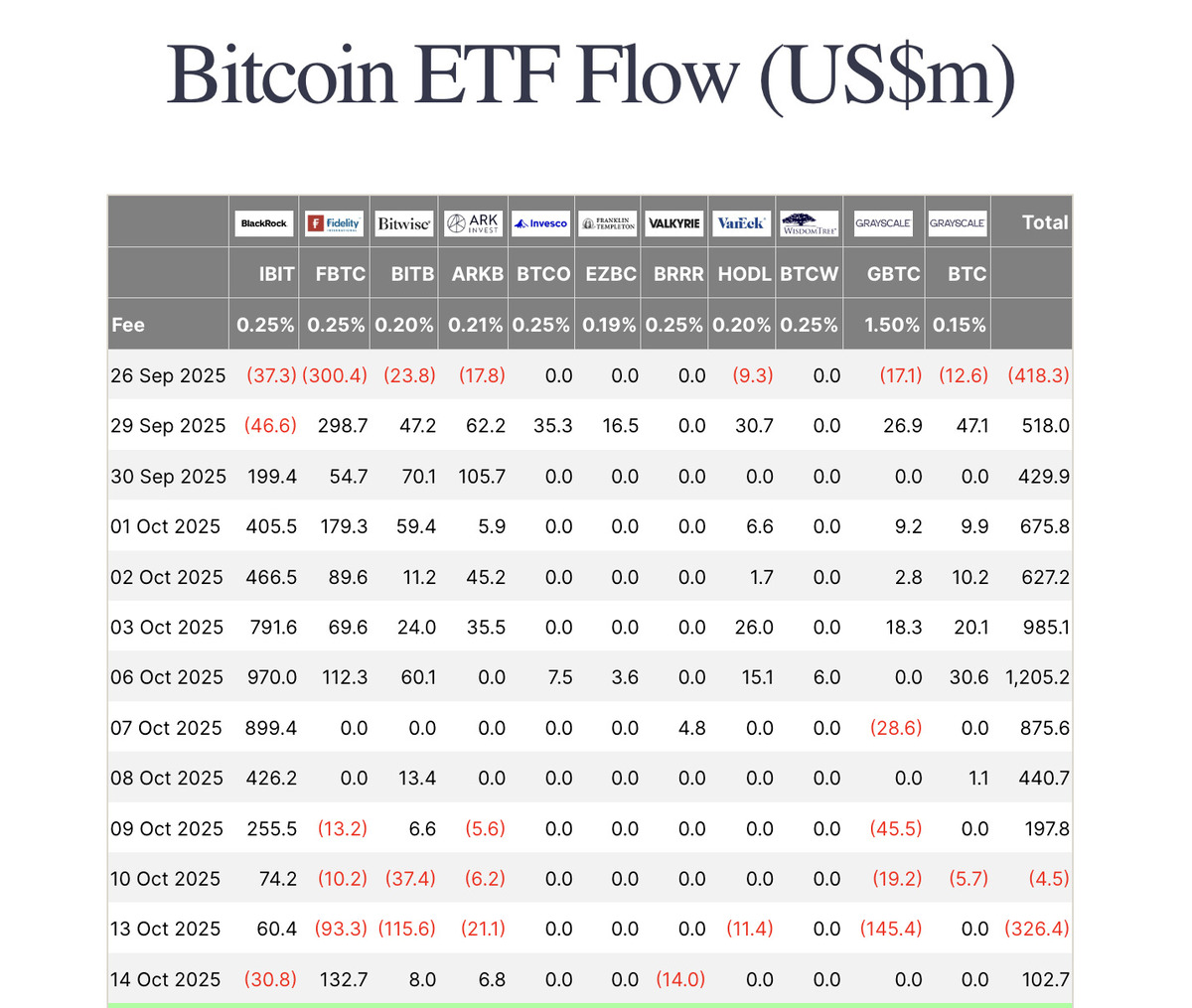

Spot Bitcoin and Ether ETFs are back in positive territory after suffering steep outflows during last week’s market drop. Data from SoSoValue shows Bitcoin ETFs saw $102.58 million in inflows, recovering from a $326 million outflow a day earlier. Fidelity’s Wise Origin Bitcoin Fund led the rebound, pulling in over $132 million, while BlackRock’s iShares Bitcoin Trust saw a small withdrawal.

The turnaround comes as Federal Reserve Chair Jerome Powell signaled possible rate cuts before year-end. Powell said the central bank could end its balance sheet reduction soon, suggesting liquidity might return to markets faster than expected.

Analysts believe easier monetary conditions could lift digital assets again. Vincent Liu of Kronos Research told Cointelegraph that rate cuts would “send liquidity back into ETFs and crypto,” adding that investors are already positioning for the shift.

Total Bitcoin ETF assets now sit at $153.55 billion, or about 6.8% of Bitcoin’s market cap — a reminder of how much institutional influence continues to shape BTC’s price direction.

Bitcoin Price Outlook: $150K Still in Play

Bitcoin recovered above the $115,000 level this week, a key milestone after Friday’s crash that erased more than $20 billion in leveraged positions. Analysts remain confident that BTC’s uptrend is intact, pointing to data showing rising demand from short-term holders.

Frank Fetter, a quant analyst at Vibes Capital, said Bitcoin’s return above its average short-term holder price of $114,000 shows “the show goes on.” This level has historically marked the continuation of bull cycles.

Other traders share the same outlook. Michael van de Poppe, founder of MN Capital, said Bitcoin’s bounce from its weekly average “provided a massive opportunity” for buyers. Daan Crypto Trades and Jelle both noted that BTC’s structure still supports a move toward $150,000, possibly higher if ETF flows remain steady.

If this rebound continues, analysts expect a test of the $140K–$200K range, where long-term holders may begin to take profits. Until then, traders see every dip as a chance to accumulate before the next wave up.

MAGACOIN FINANCE: The Undervalued Altcoin Whales Are Accumulating

As Bitcoin regains traction, MAGACOIN FINANCE is becoming one of the best cryptos to buy now. Its price sits below $0.0006, and market watchers say it could cancel two zeros once Bitcoin crosses $150K. Large holders have reportedly started accumulating, expecting it to ride the same liquidity wave.

This altcoin’s low entry price and limited supply create a sense of scarcity, while a CEX listing has already been announced, adding to excitement. Traders see it as a simple way to position for upside, with the potential to turn small buys — like $100 — into much larger gains if the broader market continues higher.

How Traders Can Position Now

With ETF inflows rising and rate cuts ahead, Bitcoin looks set for another leg higher. Traders may consider accumulating while prices remain under pressure — both for BTC and undervalued altcoins like MAGACOIN FINANCE, which tend to move fastest once liquidity returns.

Visit magacoinfinance.com today to learn more before the next breakout begins:

- Website: https://magacoinfinance.com

- X: https://x.com/magacoinfinance

- Telegram: https://t.me/magacoinfinance

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.