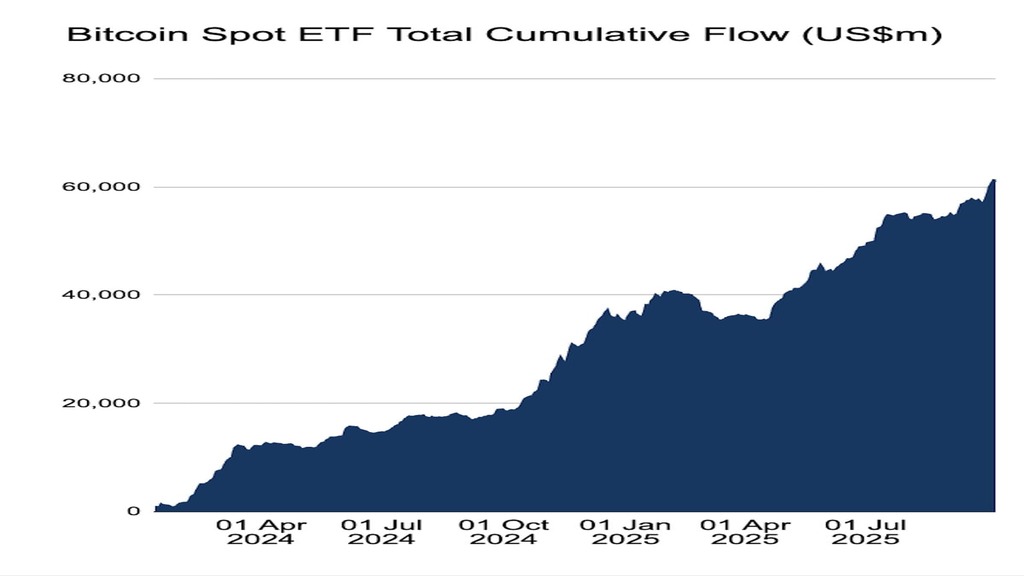

Bitcoin’s extraordinary rally is entering a critical phase as institutional demand reaches levels never seen before. Wall Street’s fascination with digital assets has evolved into a massive, steady flow of liquidity that’s reshaping the entire market. Spot Bitcoin ETFs are now attracting between $5 billion and $10 billion in new capital every quarter – a pace that analysts say could make this one of the most sustainable bull markets in Bitcoin’s history.

At the same time, many individual investors are beginning to diversify their portfolios, looking toward promising new opportunities before Bitcoin’s dominance begins to decline and the long-anticipated altcoin season ignites. Among those emerging opportunities, MAGACOIN FINANCE has quickly drawn attention for its strong momentum and expanding ecosystem, which experts believe could deliver returns up to 50x for early adopters.

Wall Street Turns Bitcoin Into a Strategic Asset

Unlike the speculative rallies of previous years, this new cycle is being powered by institutional participation through regulated investment vehicles. According to Bitwise CTO Hong Kim, ETF inflows have become a permanent fixture of the market. “These inflows arrive like clockwork,” he explained, describing the shift as an “institutional revolution” that has broken Bitcoin’s traditional boom-and-bust rhythm.

This growing involvement from pension funds, hedge funds, and asset managers has transformed Bitcoin’s role in the global economy. What was once considered a risky investment has now become a strategic hedge and store of value. Bitwise data shows that total assets under management across crypto funds have surpassed $250 billion, signaling that mainstream finance is now deeply embedded in the digital asset world.

Institutional Demand Far Outpaces Supply

The supply-demand imbalance tells the story. Institutions have accumulated over 944,000 BTC so far in 2025 – compared to only 127,000 coins mined in the same period. That means large investors are buying Bitcoin roughly seven times faster than it’s being produced. This dynamic has pushed Bitcoin’s price higher and reinforced the perception of digital scarcity as a core value proposition.

The momentum began in early 2024 when the U.S. Securities and Exchange Commission finally approved spot Bitcoin ETFs. That decision opened the floodgates for institutional money that had previously been sidelined due to regulatory uncertainty. Since then, inflows have grown each quarter, and analysts warn that if this pace continues, 2026 could witness one of the most severe liquidity squeezes in Bitcoin’s history – where demand vastly exceeds available supply.

The Shift from Resistance to Reliance

The turning point came when BlackRock launched its iShares Bitcoin Trust, transforming Bitcoin from a speculative instrument into a respected financial asset. The approval not only boosted market confidence but also prompted other large institutions to follow suit. Even corporations with government ties have started including Bitcoin in their treasury strategies, marking a new phase in adoption.

Bitcoin’s halving events – historically seen as the main catalysts for price growth – may no longer be the defining factor. Instead, institutional allocation and macroeconomic conditions are now driving price movements. With global monetary policy still leaning toward easing, Bitcoin has become an attractive asset for both diversification and inflation protection.

New Opportunities on the Horizon

While institutions build their positions in Bitcoin, retail investors are increasingly turning toward projects that could outperform during the next wave of market expansion. MAGACOIN FINANCE stands out as one of the most promising among them, thanks to its transparent audits, strong community engagement, and rapidly evolving ecosystem.

The project’s consistent performance has sparked comparisons to the early stages of legendary tokens like SHIBA INU and DOGECOIN – coins that once delivered life-changing returns for early backers. Analysts tracking MAGACOIN FINANCE believe its current trajectory, combined with its expanding use cases and scarcity-based tokenomics, could drive returns up to 50x as mainstream adoption grows.

The growing enthusiasm surrounding the project has made it a focal point among forward-looking investors who want to position themselves ahead of the next altcoin wave. For many, MAGACOIN FINANCE represents not just a speculative play, but a strategic entry point into a project with tangible momentum and strong fundamentals.

Bitcoin’s Technical Picture Strengthens

After a steady climb from $112,000 to $125,000, Bitcoin is currently consolidating near $121,000 – holding firm above its key support levels. This consolidation period is viewed by many traders as a sign of strength before the next potential breakout. According to Bob Lang, founder of Explosive Options, Bitcoin’s rally is far from over. Speaking on CNBC’s Power Lunch, Lang said he expects BTC to reach higher levels before the year ends, citing renewed investor enthusiasm across both digital assets and crypto-related equities.

Lang highlighted Coinbase as one of the clearest beneficiaries of Bitcoin’s growth, noting that the stock often mirrors BTC’s movements. “When Bitcoin moves, Coinbase tends to follow,” he explained. The correlation suggests that confidence in the broader crypto ecosystem is growing, as both traditional investors and traders look for exposure through multiple channels.

Despite his bullish outlook, Lang emphasized the importance of managing risk in volatile markets. He recommended securing partial profits and repositioning call options to stay protected while maintaining upside potential – a disciplined approach that could prove valuable as Bitcoin navigates this critical phase.

The Road Ahead

With institutional inflows showing no signs of slowing and retail investors hunting for the next big win, the crypto market appears poised for a major shake-up. The coming months will likely determine whether Bitcoin maintains its dominance or begins to share the spotlight with fast-rising altcoins.

If current conditions persist, 2025 could mark the start of a new era – one where institutional capital solidifies Bitcoin’s foundation while projects like MAGACOIN FINANCE lead the charge in innovation, adoption, and exponential returns. Investors are preparing for what could become one of the most pivotal chapters in crypto history.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Access: https://magacoinfinance.com/access

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.