In a wave started and fueled by MicroStrategy, one of the U.S. richest real estate moguls, Rick Caruso, will begin holding Bitcoin in their balance sheets.

Admittedly, after years of skepticism, banks, established firms, and investment funds are flocking to Bitcoin in droves with various goals in mind.

Amid fiat debasement, most consider Bitcoin as a store-of-value. It is because of the coin’s fixed supply and deflationary nature that qualifies it as a valuable and flexible hedge against inflation.

Bitcoin is here to Stay

Some, according to Rick, are endorsing the coin as money. Just like Tesla accepting BTC—and holding it, Rick’s real estate firm plan to accept rental payment in the world’s most valuable digital asset.

Beyond just accepting Bitcoin as a means of payment, the real estate firm has entered a partnership with Gemini. It would also be allocating a portion of their treasury in Bitcoin.

The billionaire is convinced BTC is here to stay:

“We believe that cryptocurrency is here to stay. We believe that Bitcoin is the right investment for us. We’ve allocated a percentage of what would normally go into the capital markets into Bitcoin.”

Hash Rate Spikes to an All-Time High

At the same time, the Bitcoin hash rate rose to an all-time high, reaching 180 EH/s as miners continue to funnel billions in resources to the network.

The trend will likely continue in days ahead as trends show that miners now prefer holding BTC rather than liquidating them via OTCs and open markets.

Bitcoin Price Analysis

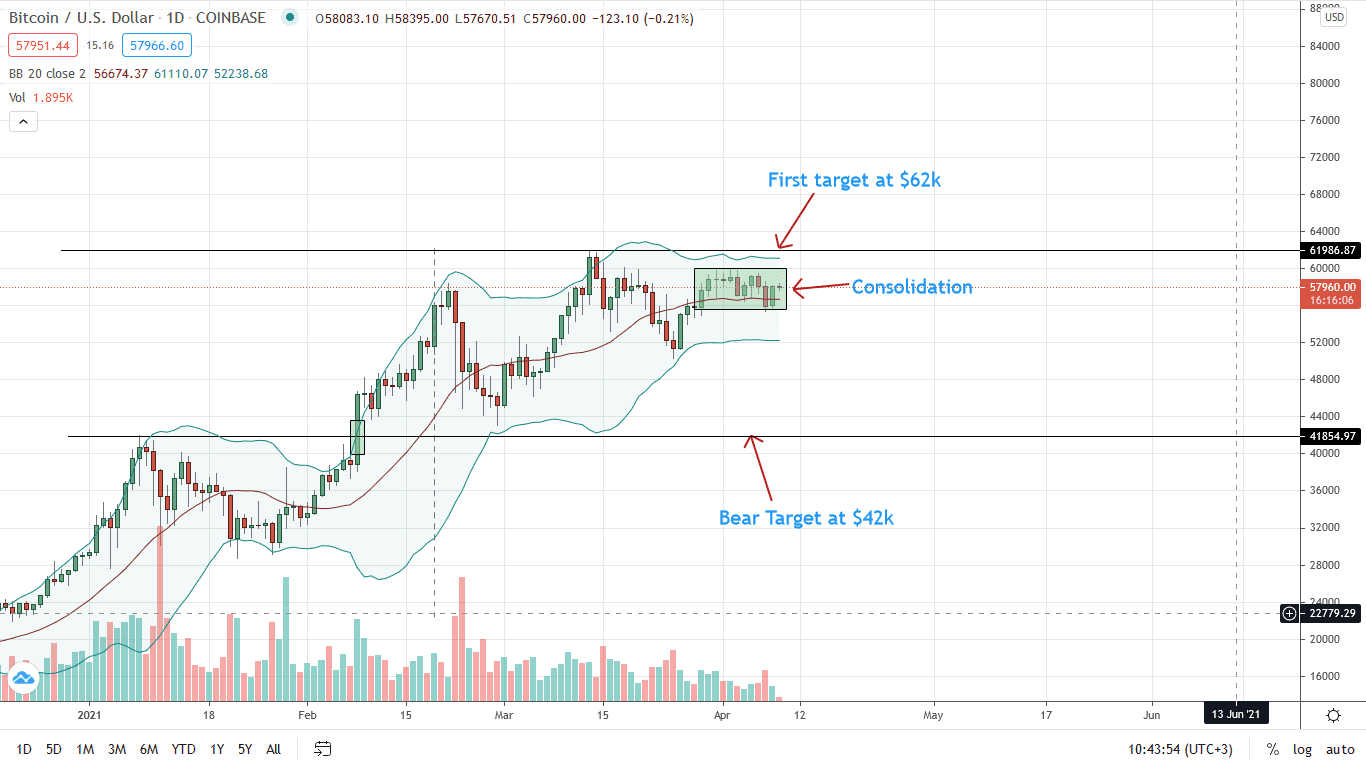

The BTC/USD price remains in range mode, paring losses of Apr 7.

As of writing, prices are within a more expansive $3.5k zone, capped at $60k on the upside and $56.5k on the lower end. Technically, buyers are in charge.

However, in the next few days, the breakout direction would provide guidance, either thrusting the coin to new levels above $62k or triggering dump towards $42k—or Jan 2021 highs.

If buyers take charge, the BTC/USD price would easily glide to $94k—the 1.618 Fibonacci retracement level of the Q1 2021 trade range.

On the flip side, sharp losses below $55k are enough to trigger a dump first to $50k—a psychological support level, and later $42k, in a much-needed retest.

Chart Courtesy of Trading View

Disclosure: Opinions Expressed Are Not Investment Advice. Do Your Research.

If you found this article interesting, here you can find more Bitcoin news