The Bitcoin price remains in range mode, backed by solid fundamentals and bulls confident of more upsides in the coming days.

Will Twitter Hold Bitcoin as Part of their Treasury?

While MicroStrategy and Square are both doubling down on the digital gold, adding to their shorts, it is now emerging that over 75 percent of Twitter employees own Bitcoin.

The company’s Chief Finance Officer (CFO), Ned Segal, while appearing in CNBC’s SquawkBox, said if any of their employees or vendor asked to be paid in Bitcoin, they would oblige.

Consequently, the social media giant would have to hold BTC as part of their treasury. Their CEO, Jack Dorsey, and Square Inc., the Cash App’s parent company, advocate and facilitate digital gold purchase, respectively.

Furthermore, Twitter plans to raise funds by issuing convertible notes. Speculation is rife that the social media giant may use a portion of their funds to buy Bitcoin.

More Retailers Flow to Bitcoin

Meanwhile, as the crypto community speculates, on-chain data shows that more retailers are flowing back to the cryptocurrency.

Judging from historical price action, their entry precedes a Bull Run. Technical candlestick arrangements may not favor Bitcoin buyers. However, increasingly, more investors continue to hold Bitcoin or use the network to transfer value.

On-chain data shows that the network helped move $3.5 trillion worth of value without intermediaries.

At the same time, only a small portion of the world population, two percent, holds the cryptocurrency.

Bitcoin Price Analysis

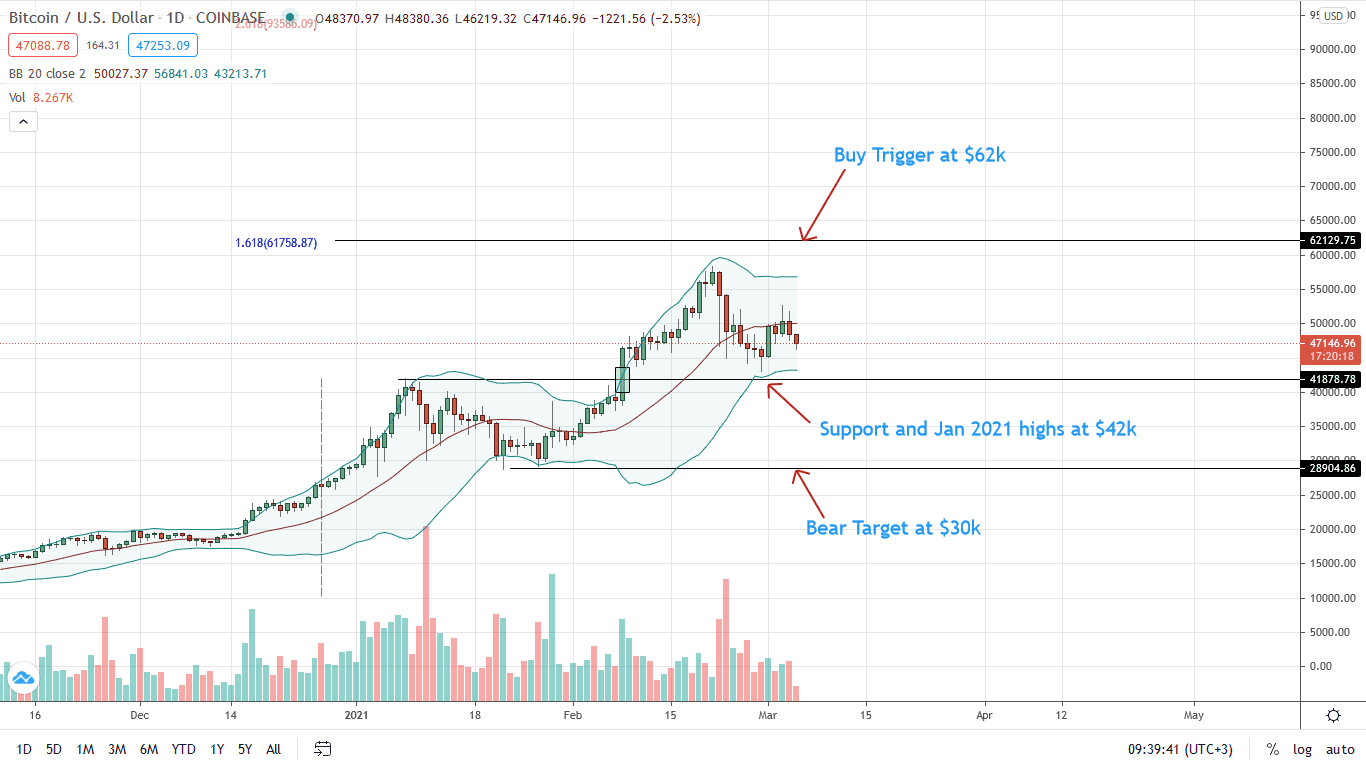

Trackers show that the BTC/USD price is under pressure, and bulls can’t sustain prices above $50k. Week-to-date, the coin is stable versus ETH but down five percent against the greenback.

From the daily chart, there is a double bar bullish reversal pattern from around Jan 2021 highs.

Although this may present hope for bulls, the failure of a strong high-volume follow-through suggests weakness and cautious traders. Notably, BTC/USD prices have been consolidating within Feb 22 and 23 bear bars.

Technically, this is bearish from an Effort versus Results point of view. However, if bulls flow back and push prices above $58k—Feb 2021 highs, it would invalidate bears and set in motion another wave of higher highs that may lift the BTC price to over $90k.

Conversely, a reversal of Mar 1 gains and confirmation of late February 2021 sellers could see the BTC/USD price slide back to $30k.

Chart Courtesy of Trading View

Disclosure: Opinions Expressed Are Not Investment Advice. Do Your Research.

If you found this article interesting, here you can find more Bitcoin news