The Bitcoin price remains firm and fixed on an uptrend judging from events and price action in the last few days.

Of note, there is even more pressure from institutions to gain exposure to BTC. Leading the pack is Goldman Sachs, one of the world’s largest investment banks and a global finance player.

Goldman Sachs and Morgan Stanley have Plans for Bitcoin

According to Bloomberg, on Wednesday, Goldman Sachs plans to offer crypto exposure to clients of its private wealth management unit. This wing manages billions of billionaire’s money.

At the same time, on Thursday, Morgan Stanley—another BTC critic, has already filed with the U.S. SEC to add Bitcoin exposure across a dozen institutional funds.

However, it won’t be direct exposure but instead through cash-settled futures offered by regulated providers like CME or CBoE.

Alternatively, it could acquire GBTC shares by Grayscale Investments. Grayscale Bitcoin Trust reports to the SEC, providing a safe, tested, and widely used route for the bank to gain BTC exposure.

The announcement is barely a month after Morgan Stanley said it was planning to offer its private institutional clients exposure to BTC-related funds.

Mass BTC Withdrawal from Exchanges

Amid the news is a mass withdrawal of BTC from centralized exchanges to HODLing accounts.

As captured by on-chain trackers, only 2.4 million (or less) BTC is held by exchanges, a potential crunch for new retail or institutional traders seeking direct BTC exposure.

Bitcoin Price Analysis

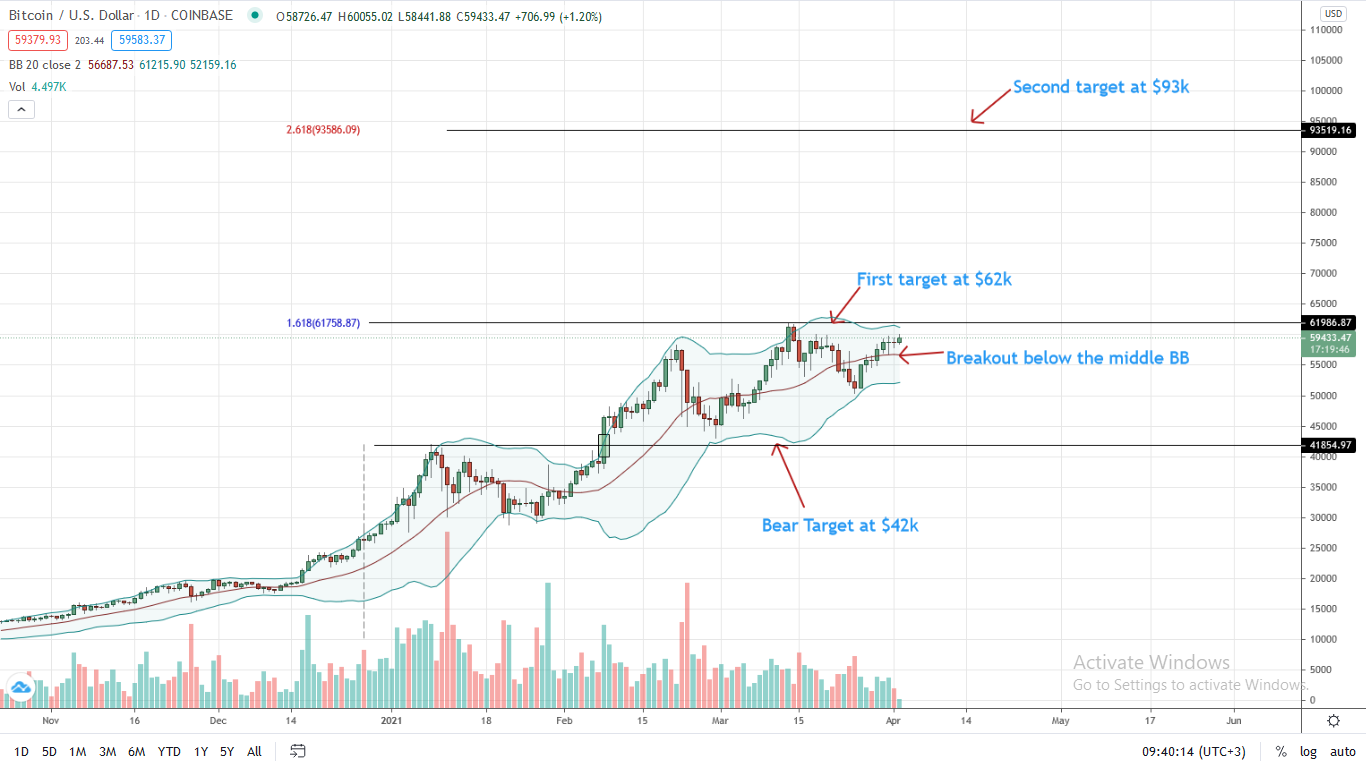

The BTC/USD price remains in an uptrend, briefly soaring above $59k highs as buyers are firmly in control.

As of writing on Apr 2, the BTC price was trading at $59.4k, adding 14 percent week-to-date and stable on the last day versus the greenback.

From the daily chart, the BTC price started the month with spinning tops—a series of inverted hammers at around Mar 2021 highs. With the influx of institutional investors and a BTC scarcity across centralized exchanges, BTC demand would likely lift the coin above $62k.

Before then, traders can take a see-and-wait approach. A close above $62k with high trade volumes would mark the next wave of higher-highs, lifting BTC/USD prices towards $93k—the 2.618 Fibonacci extension level of the Q1 2021 trade range.

On the flip side, sharp losses below $56k will confirm sellers of late February, sparking a sell-off that may see prices crash below $50k towards $42k in yet another retest.

Chart Courtesy of Trading View

Disclosure: Opinions Expressed Are Not Investment Advice. Do Your Research.