TL;DR

- Bitcoin inflows to exchanges have dropped by 64% since November, indicating a significant decrease in sell-side pressure.

- The low selling volume may signal the beginning of a new bullish phase, supported by rising structural demand.

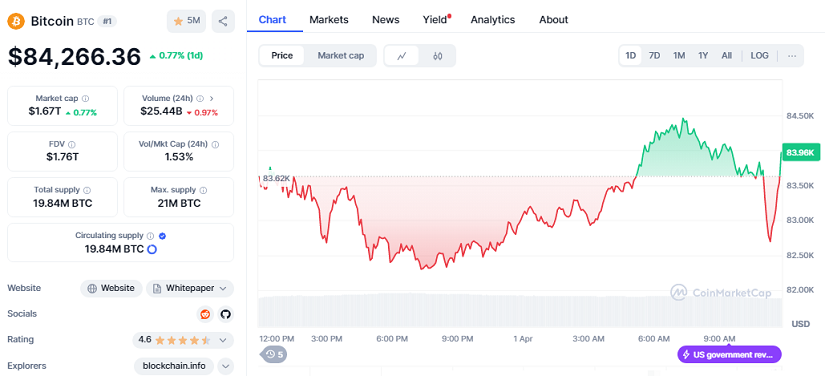

- BTC is currently priced at $84,266.36, with a 24-hour gain of 0.77% and a market cap of $1.67 trillion.

Bitcoin is entering an intriguing phase of calm for investors. According to fresh data from on-chain analytics platform CryptoQuant, weekly Bitcoin inflows to exchanges are now at their lowest point in nearly two years, possibly signaling one thing: sellers are disappearing from the market. Axel Adler Jr., a prominent analyst at the firm, stated that the selling pressure has “dried up”, setting the stage for a potentially explosive market shift.

Since November 2024, the average daily BTC inflow to exchanges has dropped sharply from 81,000 BTC to just 29,000 BTC, marking a 64% decline. This is occurring despite Bitcoin recently reaching all-time highs, surpassing $100,000, and currently trading around $84,266.36. At first glance, this mismatch between lower sell volumes and high prices may seem counterintuitive. However, for pro-crypto analysts, it signals a healthy market consolidation rather than a downturn.

Could a New Supply Squeeze be Around the Corner?

The logic behind this trend is simple yet powerful: fewer Bitcoins flowing into exchanges means fewer coins are available to sell. And if demand stays strong or increases, prices may be setting up for another major move. This is what Adler refers to as the “zone of asymmetric demand”, a critical turning point where limited supply meets growing buying interest.

Over the past 24 hours, BTC has seen a slight increase of 0.77%, reaching a market capitalization of $1.67 trillion.

Additional data from platforms like Binance and Coinbase show that short-term traders are adopting a more neutral stance, with a dramatic drop in BTC sent to Binance, only 6,300 BTC versus an average of 24,700 BTC sent to other exchanges. This supports the idea that many investors are opting to hold their Bitcoin in cold wallets, away from impulsive selling.

Outlook for April and May: Consolidation Before The Next Breakout

April may mark a strategic pause before the next major bullish wave. Analysts see a market structure that’s stable, free from speculative excess, and supported by fundamentals that hint at an upcoming supply crunch. If this trend holds, the coming months could present golden opportunities for those betting on the long-term vision of the crypto ecosystem.