The Bitcoin price may be struggling under the wave of sellers, but traders are optimistic reading from on-chain data.

Bitcoin Mining Difficulty Drop by 28%

The exit of mega-mining farms from China did cause destabilization as the hash rate plunged to spot levels.

However, over last week, the network readjusted, causing difficulty to drop by a massive 28 percent. It was the second time in 10 years that Bitcoin’s mining difficulty had fallen by those margins.

Bitcoin just ended its 343rd mining epoch.

Difficulty fell by a record -28%, dwarfing the prior largest difficulty drop of -18% in October 2011. While Chinese miners are scrambling to relocate their machines, everyone else is in for a nice payday.

Here's some data. $BTC pic.twitter.com/vmzfKQGTD0

— Zack Voell (@zackvoell) July 3, 2021

Still, it came as a relief for platform users who had to wait for long before a transaction settled at some point last week.

More importantly, it was a relief for Bitcoin miners.

Unlike last week, mining BTC is now profitable—and cheaper as hash rate requirements are relatively low, translating to a faster rate of investment recoupment.

For this reason, analysts are confident hash rate will recover above 100 EH/s in the days ahead, following BTC/USD prices.

Favorable Bitcoin On-chain Data

At the same time, there are now more new Bitcoin users reading from on-chain data.

Even with BTC/USD contracting in the past six to seven weeks, there has been a steady stream of new users.

If anything, this is a bullish divergence that can also help fundamental traders identify opportunities.

The spike could be because of increasing BTC and crypto popularity as mention count from influencers increase. It may also be due to users positioning themselves to scoop BTC on dips.

Bitcoin Price Analysis

The crypto and Bitcoin market remains wavy.

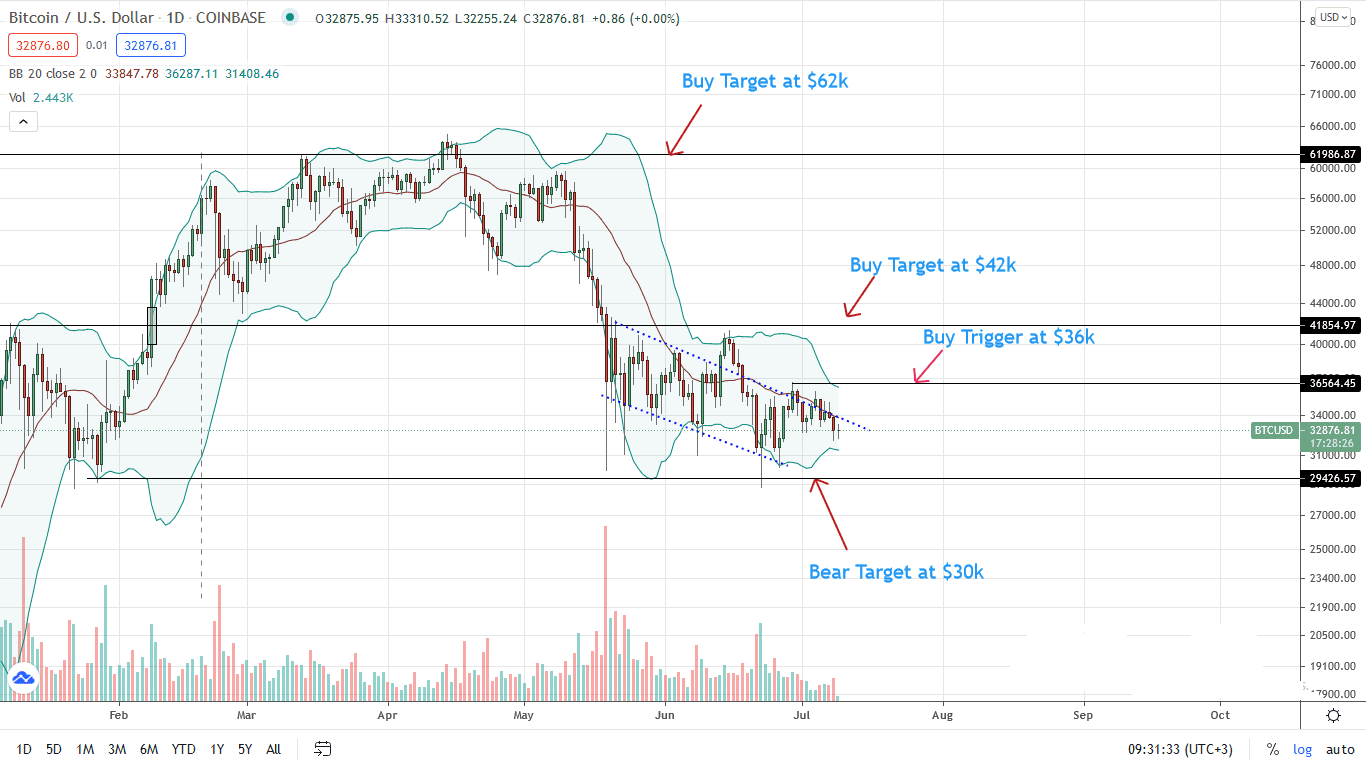

After touching highs of $36k mid this week, BTC/USDT prices contracted to around $32k on July 8 as bears flew back.

Of note, from the daily chart, Bitcoin prices are trending lower inside a descending channel, sharply reversing from the $36k liquidation line.

Even as prices fall, traders are defiant because of several reasons.

The drawdown of July 8, for instance, is with relatively low trading volumes—contracting from those of late June 2021. At the same time, BTC/USD prices are within bull bars of June 22-29.

Ideally, a close above $36k could see BTC rally to $40k and even $42k in a buy trend continuation pattern.

On the flip side, if prices continue to bleed and July 9 inches lower, sellers may find unloading opportunities on pullbacks with targets at $30k.

Chart Courtesy of Trading View

Disclosure: Opinions Expressed Are Not Investment Advice. Do Your Research.

If you found this article interesting, here you can find more Bitcoin news