Following 9 days of nine consecutive positive inflows, Bitcoin exchange-traded funds (ETFs) recorded a modest setback of outflows of 4.5 million, indicating the temporary cooling of the markets after historic trading volumes. Nevertheless, it is considered as a short-term adjustment by analysts since institutional demand is high.

With the rotation, investors are shifting their focus to other assets including Ethereum, Solana and new projects like MAGACOIN FINANCE, which is gaining momentum prior to the next presale phase as the best altcoin to buy.

Bitcoin ETFs Pause After Strong Inflow Streak

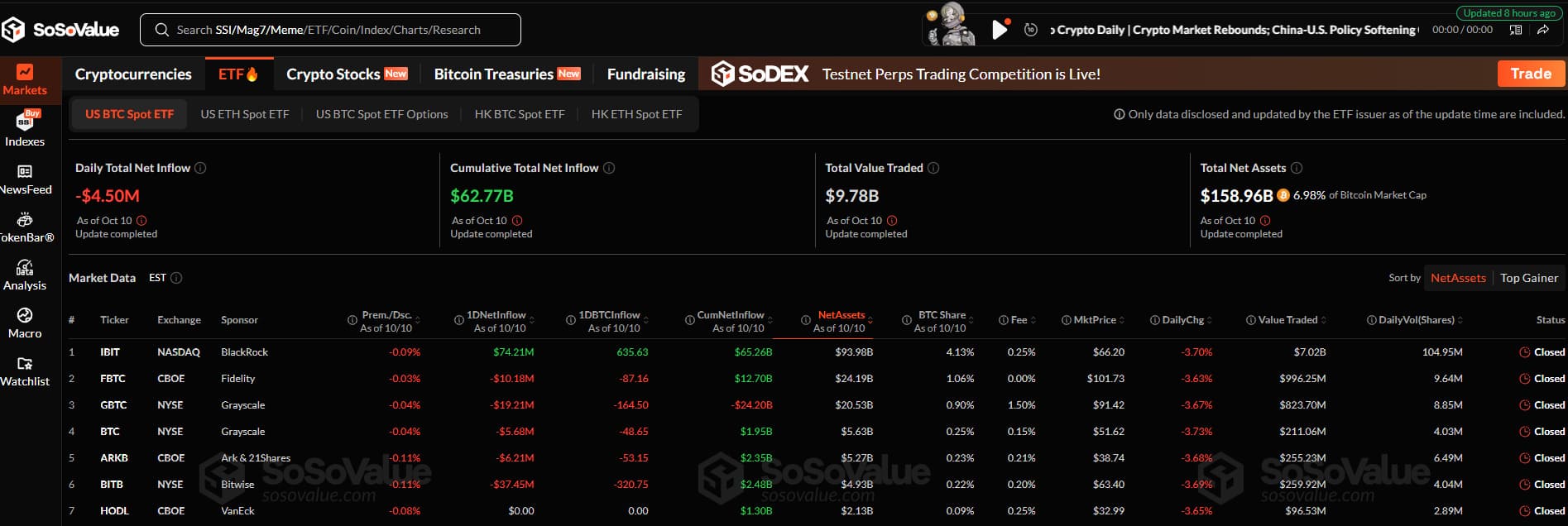

Bitcoin ETFs had a net outflow of $4.5 million, the first in almost two weeks. The pullback followed a period of high trading activity where volumes had reached $9.78billion. Although the total net assets across funds have slightly declined, there was still a strong performance of $158.96 billion, which indicates continued institutional interest.

Among the fund flows, BITB by Bitwise recorded the highest redeem of $37.45 million, then GBTC by Grayscale reported redeeming $19.21 million and FBTC by Fidelity recorded $10.18 million of redeems. In the meantime, the IBIT of BlackRock was notable, registering inflows of $74.22 million, which served to buffer the selling pressure. The fund currently has more than $65 billion historic inflows and is still the preferred institutional means of exposure to Bitcoin.

Source: SoSoValue

The actions of IBIT strengthened the belief in the inclusion of Bitcoin in the traditional markets. Over the last week, alone, overall inflows into Bitcoin ETFs hit $2.71 billion, continuing to see investors engaging despite minor price swings in the short term.

Ethereum and Solana Show Renewed Market Strength

Ether funds were recording outflows of up to $174.83 million, but the market activity was an indication of revival of trade by the traders. The Ethereum price went up to approximately $4,134, having dropped to $3,686 in the October 10 flash crash. CoinGlass reports that Ethereum futures volume increased by more than 52% and open interest increased by 9.3%, which indicates new funds are entering the market.

Solana price also demonstrated a sharp recovery, and it is trading at $196 following an 8% increase in a day. Despite being lower than at the beginning of the year, the technical stance of SOL is stable over 200-day simple moving average at $171. According to market analysts, Solana experienced a decline in relative strength index to about 36, which showed less selling pressure. The trading data showed an increasing confidence with long-to-short ratio of 4.14 that favored bullish positions.

Source: X

Concurrently, crypto analyst Jelle has predicted the SOL price may see a breakout to $600 should the bullish potential persist. Though this week is volatile, analysts consider both Ethereum and Solana as rebound traders, with renewed investor positioning and developments in ETFs.

MAGACOIN FINANCE Gains Investor Attention

With the focus now on the new altcoins, MAGACOIN FINANCE has already become one of the most popular early-stage projects of 2025. The project was recently audited both by CertiK and HashEx, and the smart contracts were verified to be secure. Also, the audits have revealed no major weaknesses and this has strengthened the trust of investors before MAGACOINFINACE goes to the exchange listings.

The project has currently attracted more than 18,000 investors to the tune of more than $16 million due to its clear roadmap, authenticated audits, and active online community. With a current presale price of less than $0.01, it provides a cheap entry point to investors hoping to get growth as the market liquidity cycles around again.

According to analysts, tokens that are verified and community-driven such as MAGACOIN FINANCE perform well during crypto rallies and are, therefore, the best altcoins to buy this week.

Conclusion

While Bitcoin ETF flows briefly turned negative, market data suggests strong institutional participation remains intact. Ethereum and Solana are showing early signs of recovery as traders re-enter the market following recent volatility.

With its verified audits, active community, and growing investor base, MAGACOIN FINANCE is drawing attention as one of the best crypto to buy this week for those seeking early exposure in the next market cycle.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Access: https://magacoinfinance.com/access

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.