There is a slight pullback of the Bitcoin price but overly, buyers are in charge; thanks in part to the institutional influx.

Observers note that MicroStrategy are reaping huge benefits after their brave decision to invest in Bitcoin, going against the grain and setting the pace of other public companies to reconsider BTC as part of their investment strategy.

In just two months after channeling $475 million, the company is in green, earning roughly $100 million following the past few week of stellar BTC gains. However, it isn’t MicroStrategy alone. Square who invested $50 million weeks after MicroStrategy set the pace is in profits.

In all this, perhaps the biggest gainer is Michael Saylor, the CEO of MicroStrategy who revealed that he owns upwards of $230 million in Bitcoin detailing that he bought each coin at just sub-$10,000.

At this rate, the CEO is 30 percent in profits and could gain more assuming the Bitcoin price rallies past $14,000 towards $20,000.

The Iranian Legitimization

As investors raked in profits from price gains, the announcement that the Iranian government is now using cryptocurrencies, and predominantly Bitcoin, as its funding mechanism for imports is a massive development for cryptocurrencies and alternative currencies not issued by central banks.

Iran is currently grappling with US-imposed sanctions and can’t use the USD for imports. Besides, there is hyperinflation and its currency is near worthless after losing over 34 percent, rapidly depreciating against the greenback.

Towards this end, the country has policies in place to encourage Bitcoin mining and now mined coins will be directed to the country’s central banks as a means of by-passing US sanctions.

Bitcoin Price Analysis

The Bitcoin price is flimsy above $13,000.

At the back of supportive fundamentals and legitimization from the Iranian government, the coin is up five percent against the USD in the last week of trading, stretching ETH as a result.

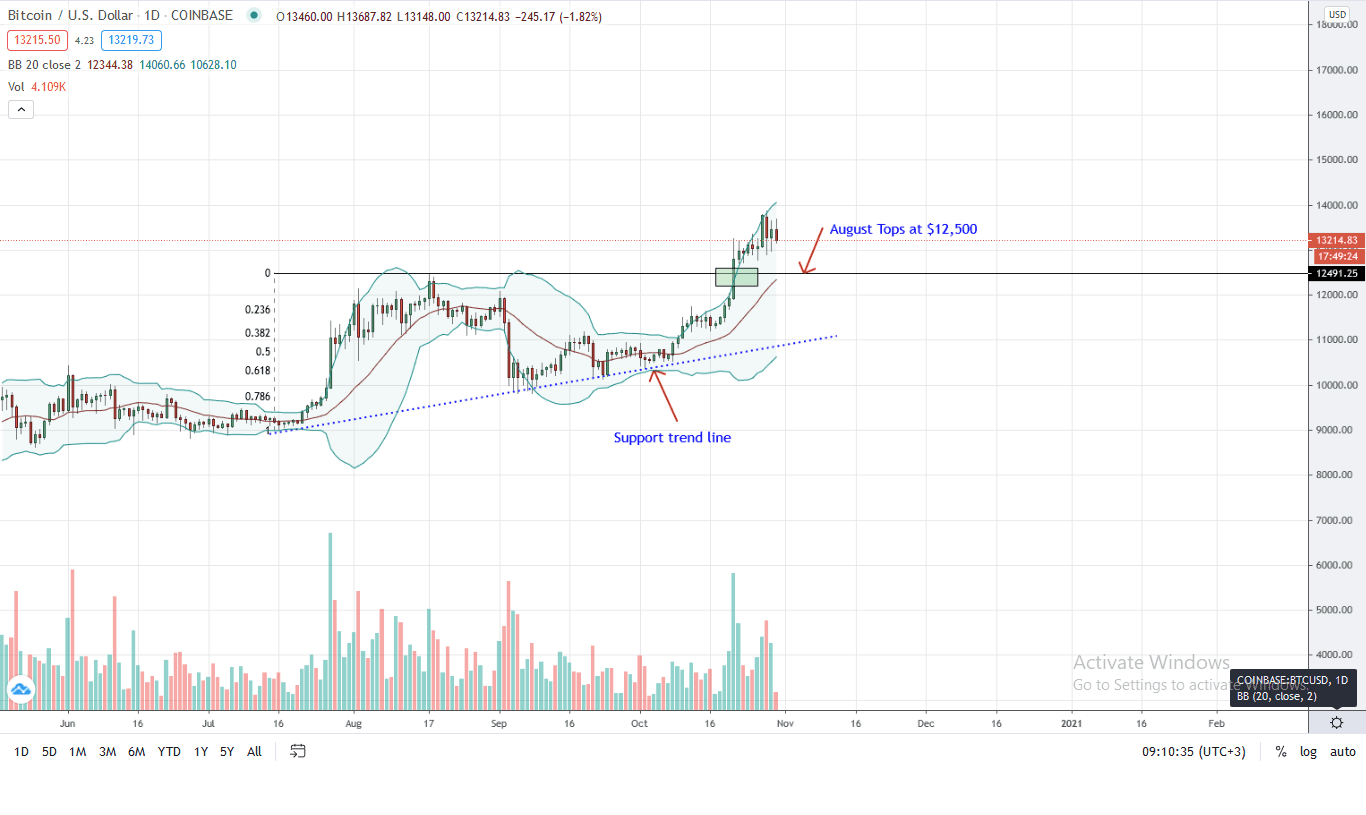

From the daily chart, the BTC price continues to maintain a bullish trajectory above August 2020 highs. As long as prices are trading above $12,500, every pullback provides another ramping opportunity for aggressive traders.

However, for the risk-averse, a strong close above $14,000 complete with high trading volumes preferably exceeding the break-out volumes of Oct 21 (Coinbase date) may see the BTC price glide towards $20,000 and register a new 15-month and 2020 high.

Conversely, steep and equally high volume losses below $12,500 could see the BTC price glide back to $11,200 and even $10,000; proving a fake bull breakout.

Chart courtesy of Trading View

Disclaimer: Views and opinions expressed are those of the author. This is not investment advice. Do your research.

If you found this article interesting, here you can find more Bitcoin news