The Bitcoin price is on fire. Not only is the world’s most valuable digital asset drawing the attention of new age investors as per a J.P. Morgan and Chase finding, but the coin is resilient. After days of printing higher highs, the correction of last weekend was quickly reversed as buyers soaked in sell pressure.

Bulls in Control

At the time of writing, Bitcoin prices are steady above $11,500, and looks likely to edge past $12,000 as optimistic traders aim at $14,000.

The path towards this level is marked by minor hurdles and if buyers thrust past this mark, odds of BTC flying to $20,000 by the end of the year cannot be discounted.

This will perfectly sync with analyst’s projections. Often, BTC prices tend to pump a few weeks before a halving event. However, it will take several months (18 to be precise) before new highs are reached.

In November 2017, BTC was trending at around spot rates but it only took roughly two weeks before BTC doubled and printed new highs.

Unlike three years ago, the crypto market is more developed with more sophisticated market participants and laws that protect the investor.

BTC Flowing from Centralized Exchanges

Sparking demand are recent fundamental events. As central banks ease, slashing interest rates to near zero and printing money at record levels, Bitcoin and safe haven assets stand to be the biggest beneficiaries.

Digital and censorship resistant, BTC bears properties that are far much better than physical gold. This may explain why—as J.P. Morgan and Chase observe, young investors prefer the coin over gold, a competing asset trusted by institutions and governments over the years.

Perhaps reflecting the demand of Bitcoin, analysts note that the number of BTC held in different exchanges fell indicating the preference of traders to hold and not liquidate.

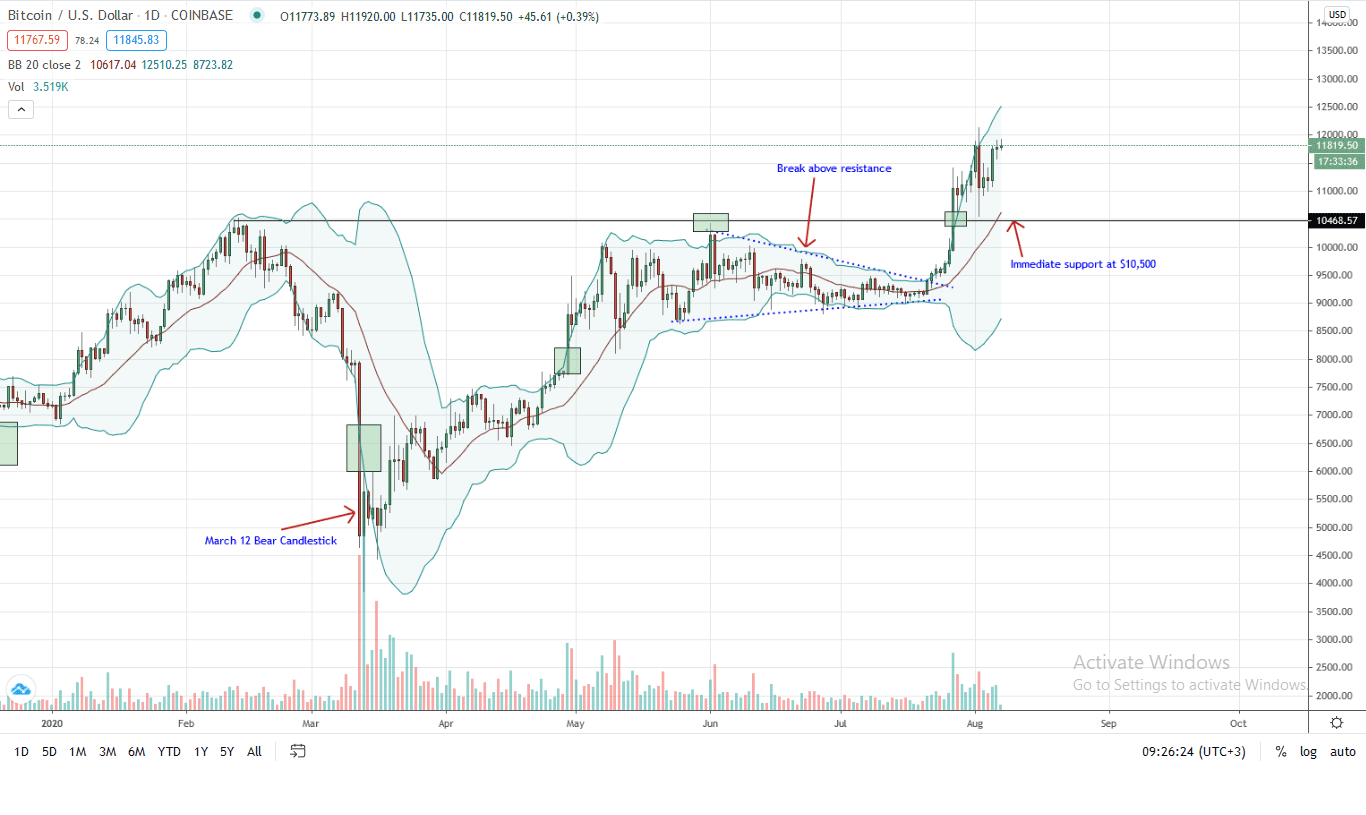

Bitcoin Price Analysis

At the time of going to press, the Bitcoin price is changing hands at $11,813, up six percent in the last trading week but still trailing ETH.

Candlestick arrangement in the daily chart suggest strength. Of note, BTC prices continue to edge higher albeit with low trading volumes inside Aug 2 trade bar.

Bearish, price action around this conspicuous bar will likely determine the immediate term projection of BTC. In the meantime, the failure of bulls to close above $12,000 and reverse losses of Aug 2 is bearish from an effort versus result point of view.

In that case, aggressive traders can post orders in sync with the trend aware that losses below $10,500 nullifies this projection. Immediate target remains at $14,000.

Chart courtesy of Trading View

Disclaimer: Views and opinions expressed are those of the author. This is not investment advice. Do your research.

If you found this article interesting, here you can find more Bitcoin news