The Bitcoin price, for the first time in three years, is trading above $16,000. Bulls are in charge and coupled with several fundamental factors including the sticky political situation in the United States, it appears as if traders are opting for safety than sinking funds into risky assets.

Talking to CNBC, Nicholas Pelecanos, the head of trading at crypto exchange NEM, said:

“The US Election helped push BTC over the 14K resistance, both sides want more stimulus which is positive for equities which BTC has been correlating closely with throughout the year. With a Republican Senate and Democratic President, stimulus might be slow coming, which could force the Federal Reserve System to run a more aggressive quantitative easing (QE) program to help keep the economy running.”

Notably, the Bitcoin price is rallying at the back of Pfizer’s news. The giant pharmaceutical company, in collaboration with a Biotech company, announced their successful conquest of the coronavirus. Pfizer now has a vaccine with an efficacy rate above 90 percent.

It will save lives but investors are cautious.

The viral disease has damaged the global economy forcing governments to intervene monetarily. Most of them involved debasing fiat through helicopter money and record low interest rates.

For this reason, institutions and public companies are turning to Bitcoin for strategic purposes. Square and MicroStrategy said Bitcoin is a shield against inflation and their participation is a diversification from the greenback which may weaken days ahead.

Bitcoin Price Analysis

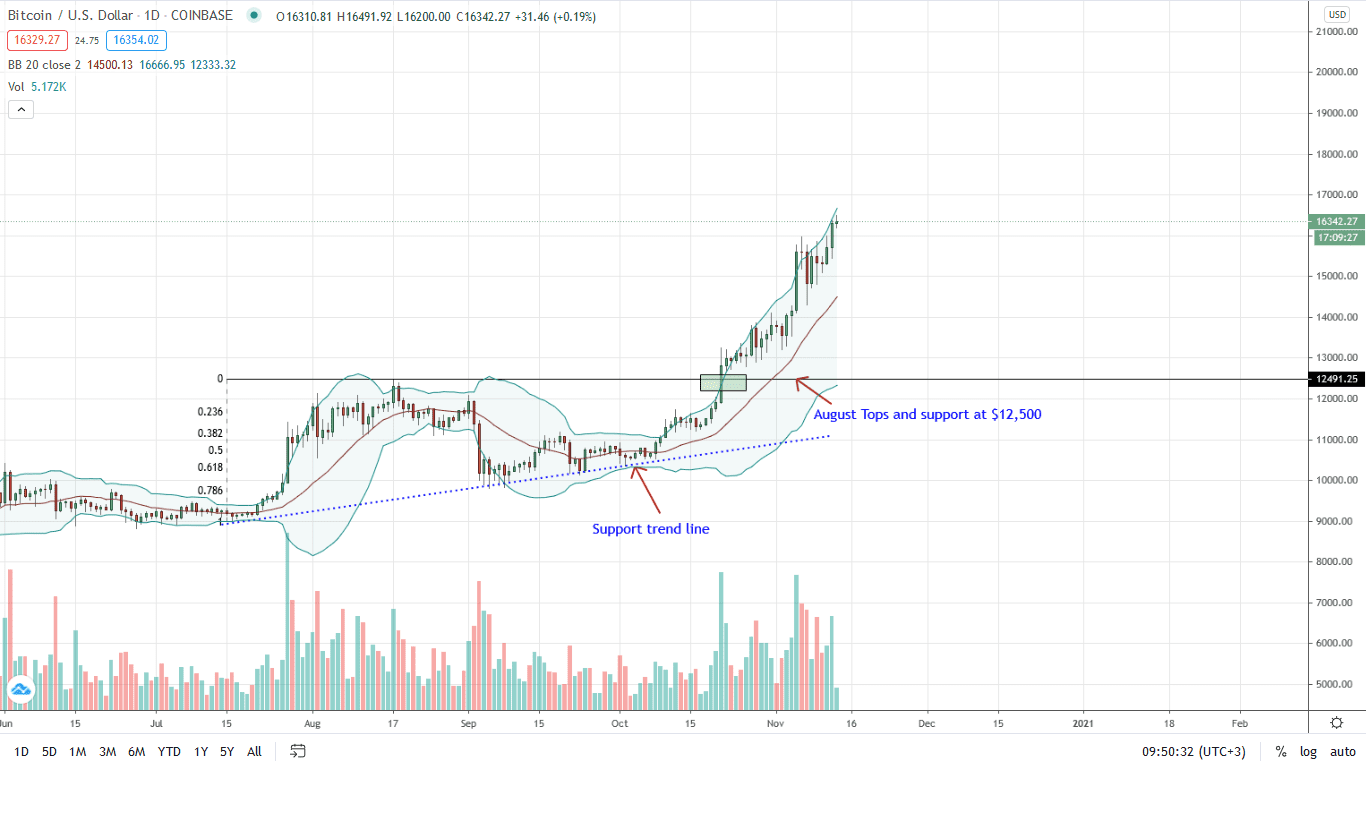

The Bitcoin price is firm above $16,300, adding an impressive nine percent against the greenback.

In the daily chart, today marks the 22nd day since prices broke above Aug 2020 highs, officially marking the beginning of an uptrend.

From candlestick arrangement and the divergence of BB, the underlying momentum and volatility is high. For this reason, every high is technically a loading opportunity with targets at Jan 2020 highs of around $20,000.

The immediate support line is the middle BB. A high volume break below $14,000, wiping out gains of Nov 5 may spark a sell-off and the beginning of a reversal towards $12,500 in a retest of Aug 2020 highs.

For this reason, bulls must maintain prices above $16,000 and above $14,000 as the Nov 5 trade range (between $14,000 and $15,800) acts as accumulation zone for traders aiming for $20,000.

Chart courtesy of Trading View

Disclaimer: Views and opinions expressed are those of the author. This is not investment advice. Do your research.

If you found this article interesting, here you can find more Bitcoin news