The Bitcoin price continues to see-saw, oscillating within a wide $700+ range with bottoms at $11,200-$300 accompanied by low trading volumes.

Amid the fluctuation, there are solid fundamentals that provide reliable tailwinds for expectant bulls.

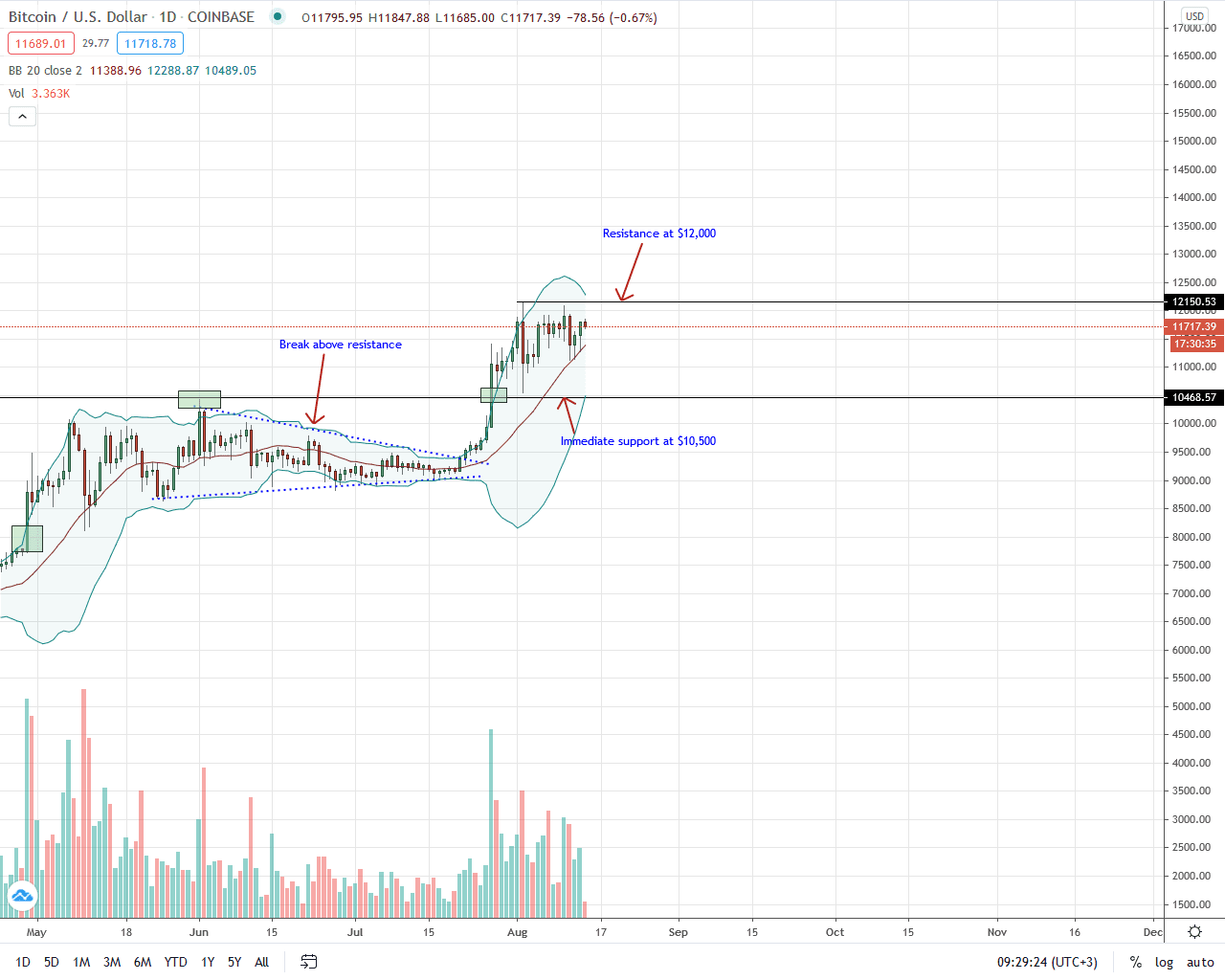

For one, the trading community is actively tracking whether bulls will blast by the solid sell wall at $12,000.

If by any chance there is a close above this level, analysts expect June 2019 highs to be cleared with relative ease and even Bitcoin prices to retest its all-time high of $20,000 following May 2020 miner reward halving.

Bitcoin Miners Pause their Liquidation

At the third epoch, Bitcoin miners anchor the network and for their role, they are incentivized to participate with irresistible rewards.

At over $65,000 worth of BTC released per block, miners are ironically the ones exerting pressure on Bitcoin prices due to their regular liquidation to cover operational costs.

Good news is that mining is at the moment profitable. At spot rates, there is no pressing incentive to sell. Instead, from their perception, odds of further higher highs in coming weeks is convincing enough and are therefore encouragingly net HODLers.

MicroStrategy Purchase of $250 Million in Bitcoin

While price action favor miners, institutions are now beginning to accept Bitcoin. MicroStrategy, a publicly-traded firm whose shares are listed at the NASDAQ, decided to purchase $250 million worth of Bitcoin as a hedge against inflation and part of its treasury reserve.

This comes barely weeks after the U.S. OCC allowed national banks and savings associations to custody cryptocurrencies.

The CEO of MicroStrategy said the decision was reached at because of Bitcoin’s attractive properties being an asset superior to money and a reliable store of value.

Bitcoin Price Analysis

At the time of writing, the Bitcoin price was up stable against both the USD and ETH in the last week of trading.

From the daily chart, immediate support is the 20-day Moving Average (MA), or the middle BB, and on the lower end, $10,500, roughly $1,100 away from spot prices. Regardless of recent pullback, the uptrend is still firm and bulls can still purchase the dips as long as prices oscillate above the flexible support line.

If prices close above $12,000, reversing losses of Aug 2 at the back of high trading volumes, as aforementioned, the Bitcoin price may rally to $13,800 and $14,000 of June 2019. On the flip side, losses below the 20-day moving average and lows of Aug 2 may trigger a wave of sellers that may see BTC drop to $10,500 in a retest.

Determining immediate and medium term trajectory will be the breakout direction and most importantly, the accompanying trading volumes. Ideally, any break out above or below the current $700+ consolidation must be with high participation exceeding those of July 27 (data from Coinbase) re-confirming trend continuation, or reversal.

Technical Chart courtesy of Trading View.

Disclaimer: This is not investment advice. Opinions expressed here are those of the author and not the view of the publication.

If you found this article interesting, here you can find more Bitcoin news