In 2020, the FED’s balance sheet and its monetary supply will expand by a whopping 70 percent. That is brought about by the central bank printing colossal sums of money every day to prop an ailing economy. For how dire the situation is, the FED was said to be printing $1 million every second back in March—when the economy was in utter shock because of COVID-19 spread rate.

The Global Economy at Risk

The US and the Global economy, if drastic steps are not taken, is tethering on the brink of collapse. The house of cards propped by the FED–which at any time can decide to summon the money printers, may end up falling, permanently shuttering the every-day saver and the FED’s ancillaries of which banks are the major beneficiaries.

The reverberation would be consequential and far reaching. Ideally, the collapse of the traditional financial system could see capital flight into alternatives. Here, assets like gold and Bitcoin will gain for good reasons.

Gold, in a way, inspired the founder of Bitcoin, Satoshi Nakamoto, to create a foolproof financial system that is controlled by math and has the scarcity element. Money should be scarce and in a recession as many people find themselves in, even the USD may not succeed.

Even Satoshi Selloff can’t stop Bullish Projection

Bitcoin, without a government and a central bank, has recovered losses of Black Thursday and is now trading above the $9,000. The coin separates state and money, and that is why for those who understands its mechanics, BTC is bullish in the long term even if Satoshi reactivates his account and liquidates his (or their) 1 million coins believed to be under their control.

BTC/USD Price Analysis

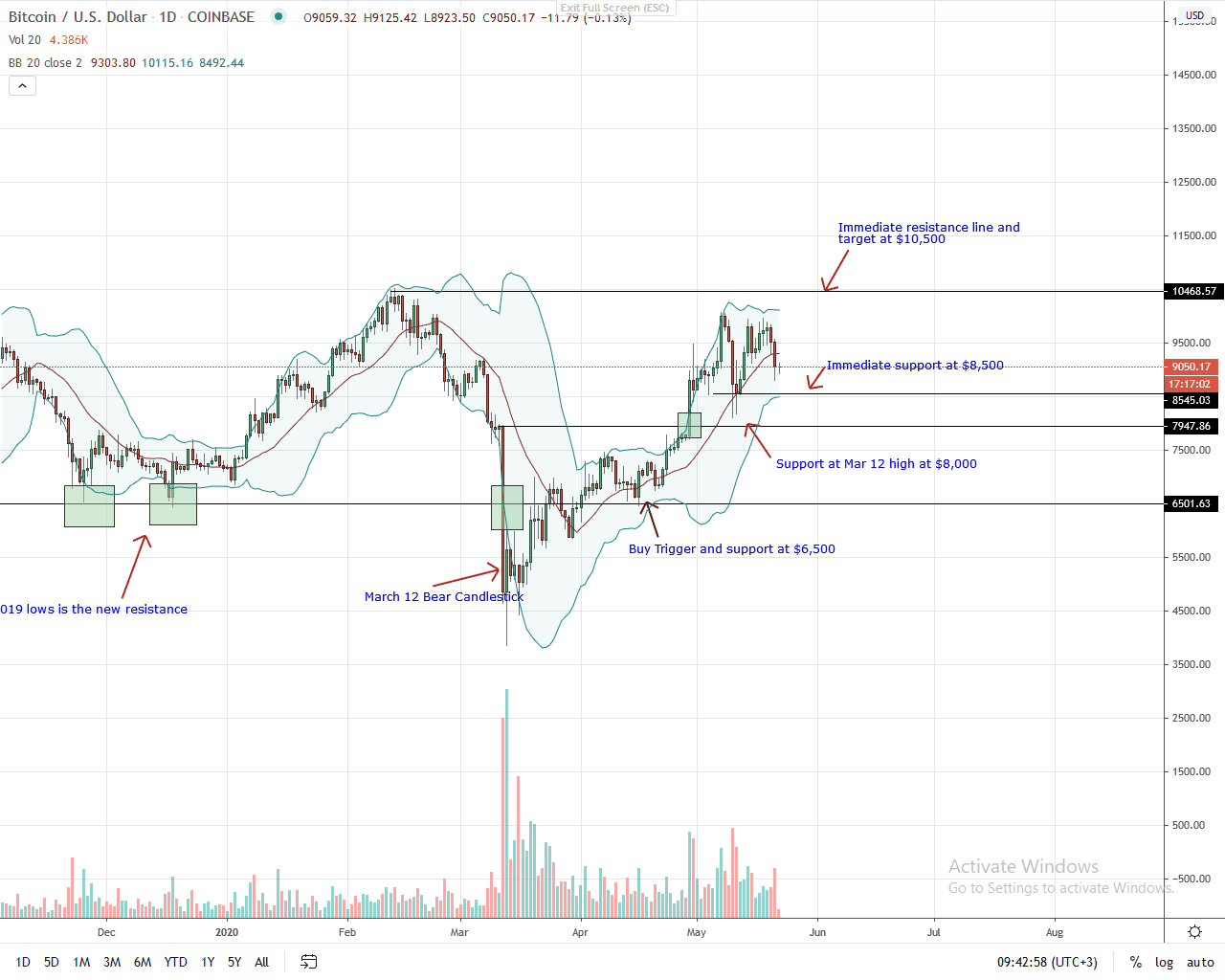

At the time of press, BTC price is under immense pressure. Trading at around $9,050, the coin is down five percent in the last day.

Price action is also retesting the 20-day moving average, or the middle BB, the main support trend line through April and May. It is imperative that bulls prevent prices from falling and closing below the middle BB.

Already, there are lower lows relative to the upper BB. Coupled with average volumes, any firm close below $9,000 and the flexible support line could spur further liquidations and the result could see BTC slide to $8,500 as sellers of May 10 flow back.

Notice that price action and specifically bulls haven’t reverse losses of May 10.

A complete reversal requires a comprehensive, high volume close above $10,500 which from an effort versus results perspective re-affirm buyers and nullify the sell pattern of May 10 and those of Black Thursday.

Any break above $10,500 with high volumes preferable exceeding those of May 10 builds a solid case for $14,000 or June 2019 highs in the immediate term.

Disclaimer: This is not investment advice. Opinions expressed here are those of the author and not the view of the publication.

If you are interested in this project and want to be informed of everything that happens, visit our Bitcoin News section