It has been an exciting past few days for Bitcoin traders and investors. In an impulsive wave, bulls flew back in droves driving prices first above $8,000, then $9,000, peaking at $9,350 before correcting back to spot prices.

The Surge

It conjured memories of late 2017 and mid-2019 when prices rallied to $20,000 and $13,800, respectively, in days. Although it is the third day today, there are hints of strength if price action guides.

Over and above what the uptick in price tagged, some obsolete miners, reports reveal, are now back to green.

Obsolete Miners back to Green

The Miner Profitability Index tracked by F2Pool and PoolIn shows that the older version of Bitmain’s Antminer S9 yield 10 to 20 percent in gross margin if electricity costs is fixed at $0.05 KWH. But yields could be much higher if efficiency improvement methods such as merging where two S9s are connected, is done.

Commenting on this exciting observation, the CCO of BitRiver, said:

“Today’s price movement would bring back even those miners that were recently disconnected due to profitability concerns. After halving, we believe that the price range of 3 to 4 cents [USD] is sufficient to continue mining profitably with S9 miners if the current price movement continues.”

12 days to Halving, Close above $8,000 is the necessary impetus

Note than in 12 days, miner block rewards will be slashed in half to 6.25 BTC in an event that may either cause a dip in hash rate and a consequent re-adjustment of difficulty or a sudden uptick in price back to June 2019 highs.

It is the expectation of the latter that may be pinned to the sudden gust of tailwinds leading to current prices as BTC rose 25 percent at April 30 peaks.

BTC/USD Price Analysis

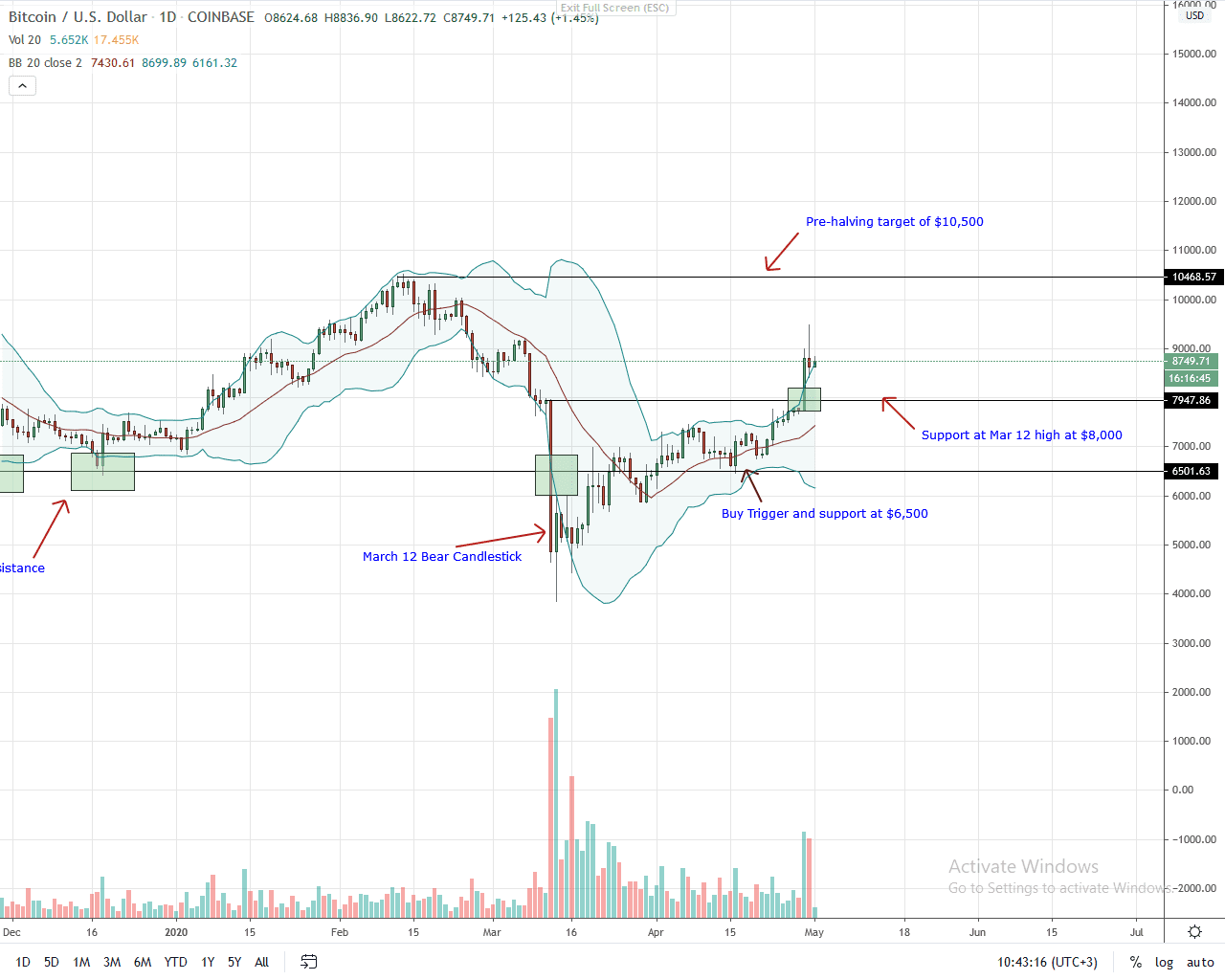

At the time of press, BTC price is up an impressive 16 percent in the last trading week and changing hands above the $8,500 mark.

Although yesterday price action was marked with high trading volumes confirming the breakout pattern that pushed price above Mar 12 highs of around $8,000, a notable observation is that April 29 close above resistance, now support, was at the back of remarkably high trading volumes.

Yesterday’s price action, marked with wild price swings, therefore confirms bulls, defining the immediate term path of least resistance. In light of this, aggressive traders can buy the dips and aim for $10,500 or Feb 2020 highs.

Price dips below $8,000 invalidates this price forecast.

Disclaimer: This is not investment advice. Opinions expressed here are those of the author and not the view of the publication.

If you are interested in this project and want to be informed of everything that happens, visit our Bitcoin News section