The crypto market is buzzing. There is a revival. An uptick in participation coupled with higher prices is the reason why investors are positive, and expectant of better prices. Behind this are supportive fundamentals as well as favorable technical candlestick arrangements, pointers of market confidence.

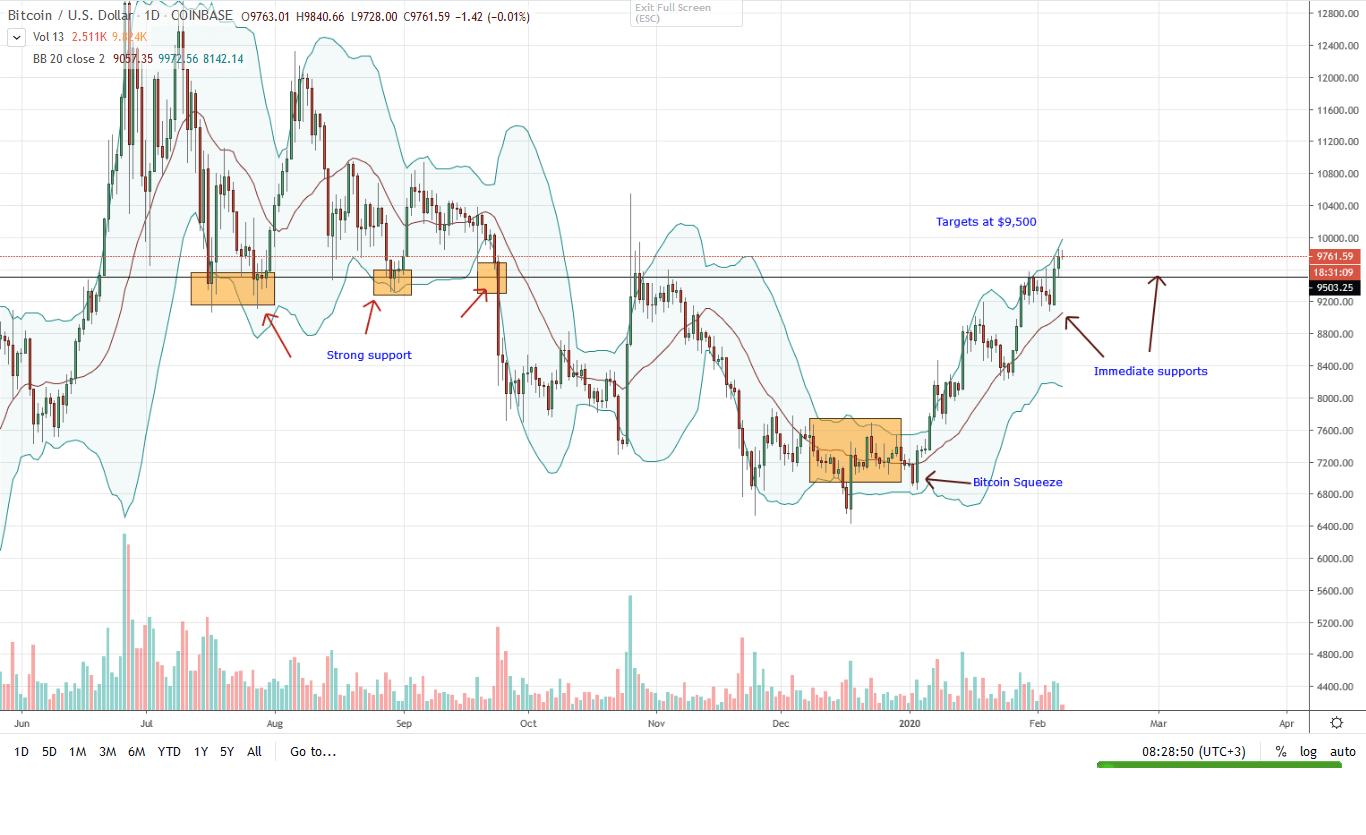

For example, in the daily chart, BTC price has soared above the $9,500 resistance level.

In the weekly chart, bulls are fully in control, commandeering price action, and steady above the 20-week moving average.

New All-time Highs in Open Interest at Bakkt

The divergence away from the middle BB points to a higher momentum. From the fundamental view, there is hint of better prices ahead judging from the soaring number of open interest.

Earlier yesterday, it was reported that the number of Bakkt’s physically delivered Bitcoin Futures market open interest printed new highs of $13 billion.

Last week, the number of open interest at BitMex, the world’s largest crypto derivatives trading platform, broke past the $1 billion mark, and towards $1.3 billion.

In total, the number of open interest from leading crypto derivatives platform is in excess of $4 billion.

Coronavirus Fears, BTC could Jump higher

Assuming Bitcoin halving isn’t factored as asserted by leading analysts, it is highly likely that BTC will edge higher going forward.

Although undesired, if Coronavirus is not reigned, and turns out that a pandemic breaks out in the United States, and say in Europe, a lockdown may be announced and that would likely cause capital flight to safe havens of which BTC, for its digital nature and censorship resistance, is a stand out.

BTC/USD Price Analysis

From the chart, BTC is up 3% in the last trading week. Most visibly, bulls are in command. Aforementioned, in the weekly chart, prices are above the 20-week moving average while in the daily chart, prices are trending above $9,500.

Behind this is an uptick of trading volumes and a sure confirmation of early last week’s bulls. As it is, aggressive traders can buy the dips and expect further gains towards Oct 2019 highs of $10,500.

A firm close above $9,500 nullifies the sell momentum of Q3 2019, and ushers in a new period of BTC price expansion to the above buyers’ target or better.

A reversal from spot level to below $9,500 could also see a shake out, as prices dip towards $9,000 or the middle BB, the 20-day MA.

Chart courtesy of Trading View-Coinbase

Disclaimer: Views and opinions expressed are those of the author and is not investment advice. Trading of any form involves risk. Do your research.