The Importance of Bitcoin [BTC]

It’s a capitulation in the cryptocurrency market. Bitcoin, altcoins, you name it, are registering losses. However, investors and traders have their focus on Bitcoin. The coin is significant in the space and positively correlated to most digital assets.

Not only is it the most liquid and a base currency from where altcoins as ETH, XRP and the rest are paired against, but its role in the space means any weakness is contagious.

At press time, the cryptocurrency community is still trying to figure out the possible triggers. Looking at the chart, BTC is down more than $5,000 from 2019 highs.

Facebook is Pro-Regulation; Mark Zuckerberg calls for Innovation

This meltdown was perhaps sparked by Mark Zuckerberg’s “underwhelming performance” during his House Financial Services Committee congressional hearing on Oct 23.

Widely anticipated, the theme quickly shifted and the tech leader said Facebook of whom he is the face doesn’t control Libra, the stablecoin that will be backed by several currencies and securities including the USD.

In the 6-hours of hearing, Mark responded to congress men and women, urging them to be pro-innovation, stoking concerns that if Facebook and the Libra Association will not build this stablecoin then the door would be swung open for the Chinese to build their version.

Although his business acumen was lauded, there were no direct support for Libra even though Zuckerberg had expressed his intention of opening up to regulators should the stablecoin be backed mainly by the USD.

BTC/USD Price Analysis

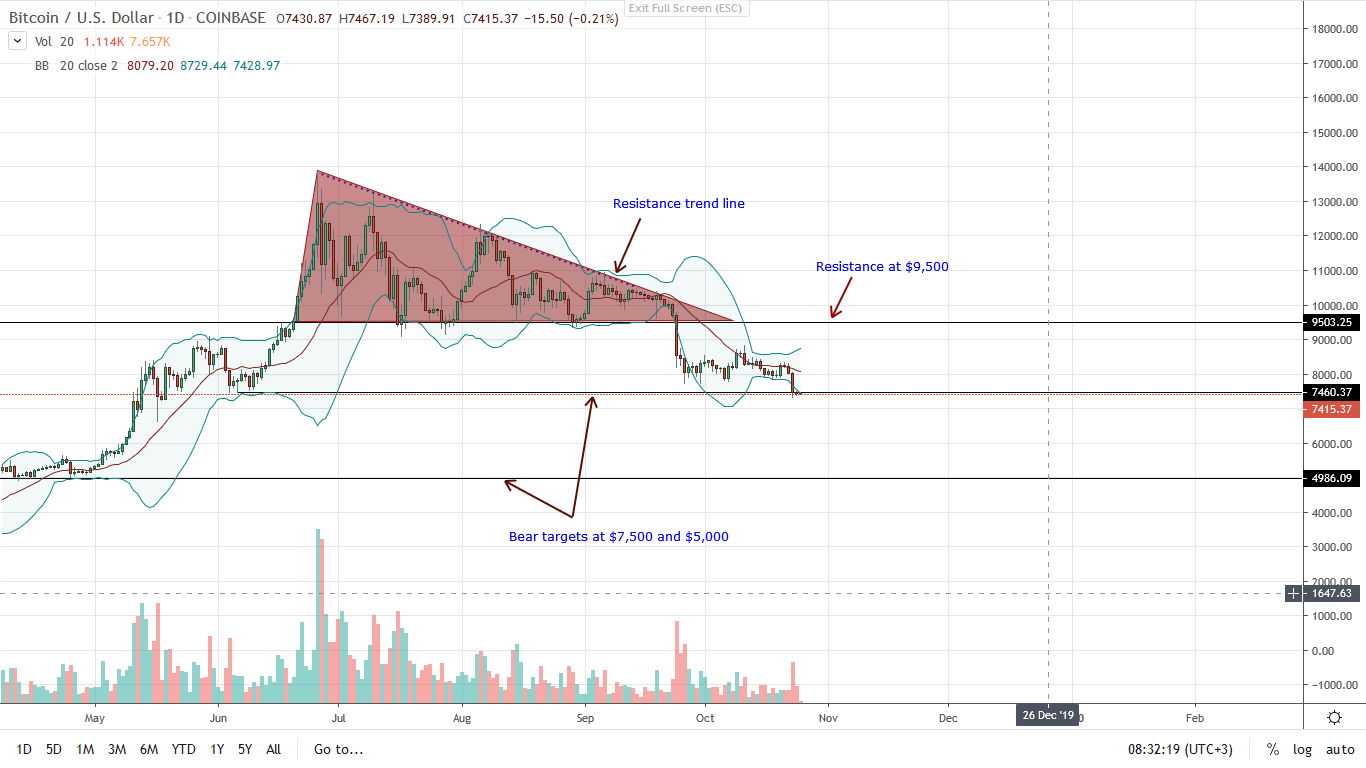

By dropping 8.48 percent in the last week, BTC is down 10.91 percent in the last month but up 14 percent year-to-date. Trading at current valuations, the coin is at June 2019 lows and risk falling to $5,000 or May 2019 lows if bears press lower in days head.

The best course of action for risk-off traders is to wait for a decent pull back before loading the dips with first target at $9,500. However, if prices close below $7,500 as price action mirror the steep losses of Oct 23, odds are prices will tumble to $5,500 especially if the accompanying trading volume is above the average of $7.6k.

Conversely, Oct 23 rapid depreciation could have been climactic, marking the end of Sep-Oct losses and the begging of an uptrend. In that case, risk-off and patient traders should wait for a reversal of Oct 23 losses with equally high trading volumes preferably above $20k, forcing prices above the middle BB. Note that there was some undervaluation of BTC on Oct 23 because prices closed below the lower BB.

Although the slope is bearish, it is likely that price action will seek equilibrium and correct higher, a reprieve for bulls.

If that sparks further participation as BTC prices rally to above $8,000, risk-off traders can take that as a cue and buy the dips with a first target at $9,500 as aforementioned, and with a stop-loss order just below June 2019 lows-$7,300-$7,500.

Chart courtesy of TradingView – Coinbase

Disclaimer: Views and opinions expressed are those of the author and is not investment advice. Trading of any form involves risk. Do your research.