Alipay’s Threat

Alipay is threatening to crash and stop Zhao’s expansionist dream in China. Through Twitter, Alipay issued a warning:

“There’re several reports about Alipay being used for bitcoin transactions. To reiterate, Alipay closely monitors over-the-counter transactions to identify irregular behavior and ensure compliance with relevant regulations. If any transactions are identified as being related to bitcoin or other virtual currencies, Alipay immediately stops the relevant payment services.”

Binance’s Expansion

Binance is already the largest cryptocurrency exchange by adjusted trading volumes thanks mostly to Zhao’s confidence and innovative products. Binance JEX is the latest-competing with BitMEX, and with branches in Africa and safe-haven Jersey, it was only natural for Binance to test the peer-to-peer trading sphere.

And they did. Upon launch, Zhao claimed that his new platform in China had attracted $1.5 million in trading volumes. All trades were conducted manually and that, by all means, was a feat that deserved praise.

“In the first 24 hours since launching, the service volume was $1.5 million in volume. Considering that all trades are done manually, including off-platform fiat transfers, this is quite an achievement. This also demonstrates the strong demand for such a product.”

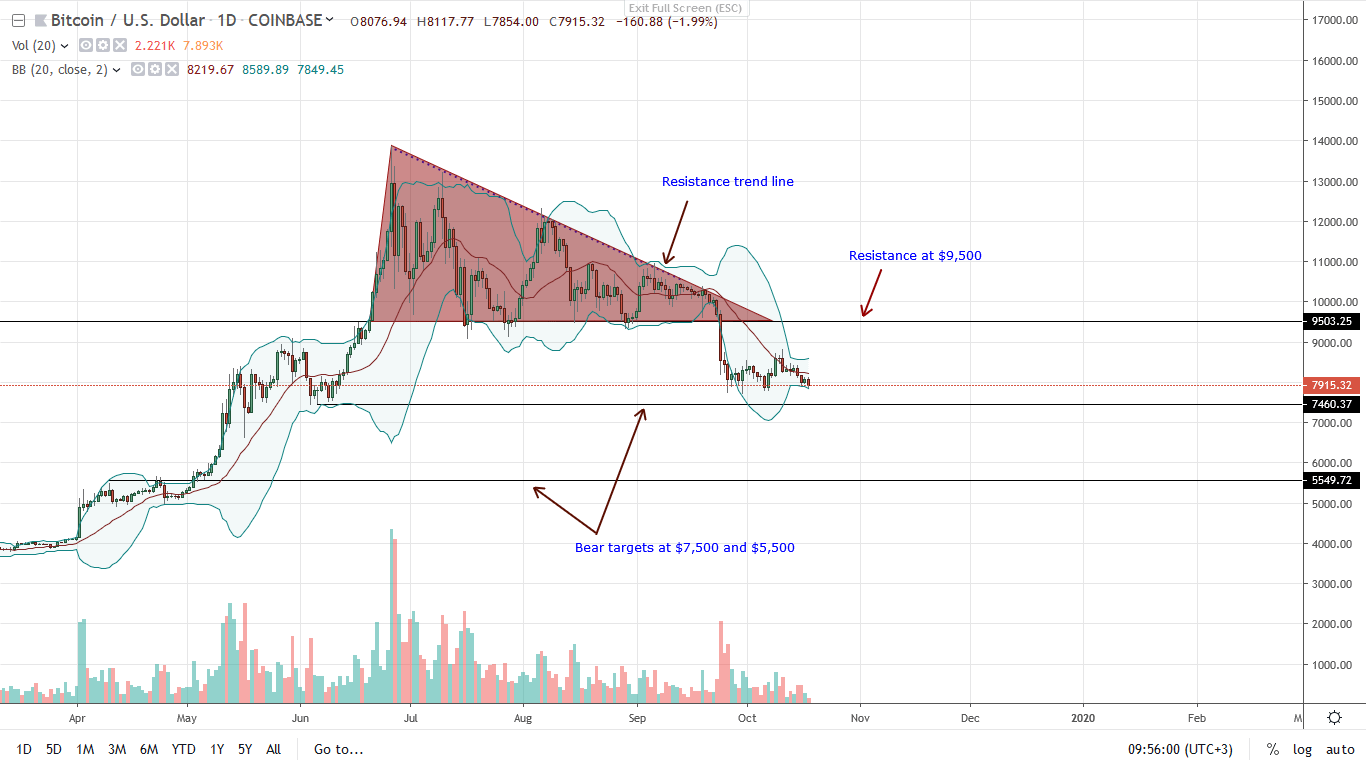

BTC/USD Price Analysis

At press time, BTC is up against ETH, adding 1.25% in the last week but down 6.7% against the greenback.

Analysts are concerned that BTC may not have enough impetus to soar past crucial resistance levels because of fundamental reasons.

In the immediate term, bears have the upper hand. Already, gains of Oct 9 have been reversed and unless otherwise sellers drive prices below the main support level of $7,500 and $7,700, traders should be cautiously optimistic.

Reiterating previous stance, BTC will be bullish if there is confirmation of oct 9 bulls.

Ideally, behind the uptick should be high trading volumes exceeding $38k of Sep 24-on the upper limit, or at least $14k of Oct 9. Any revival that would lift BTC prices above $8,850 could trigger risk off traders to enter long positions with first target at $9,500 and later $11,000.

On the other hand, if there are sharp losses below $7,500, the likelihood of BTC tumbling to $5,500 will be high.

Chart courtesy of TradingView – Coinbase

Disclaimer: Views and opinions expressed are those of the author and is not investment advice. Trading of any form involves risk. Do your research.