Unemployment. COVID-19. Infinite QE. This combination has been a disaster for the average investor. And this is less than a month before a decisive Bitcoin halving.

Latest reports that almost twice the number of people as per analysts’ estimates applied for unemployment claims in the United States is deflating.

According to yesterday’s statistics, 6.6 million people applied for claims, a rescue of some sorts from the government, revealing how dire the situation is on the ground.

It appears as if people are losing jobs in droves in this unwanted pandemic that has not only affected supply chains but drastically caused a drop in factory activity in Asia. Further reports reveal that investors in Asia are fleeing to safety.

And the USD is unexpectedly the vehicle of choice not only as a store of value but for capital gains.

The green back is surpassing expectations even as the FED embark on infinite QE to avert a liquidity crisis and increase money supply as people hoard cash so as to afford basic necessities as tissue paper.

While the curve may be flattening in Italy, where deaths exceeds those of China—but there are doubts following US Intelligence reports that the CPC might have under reported number to prevent a scare, the damage has been done and the ECB will intervene just like in the US.

Meanwhile, Bitcoin recovered yesterday. A mix of supportive fundamentals following the halving, and past performance revealing that Q2 is historically strong, challenges presented by COVID-19 will retest BTC bulls resolve.

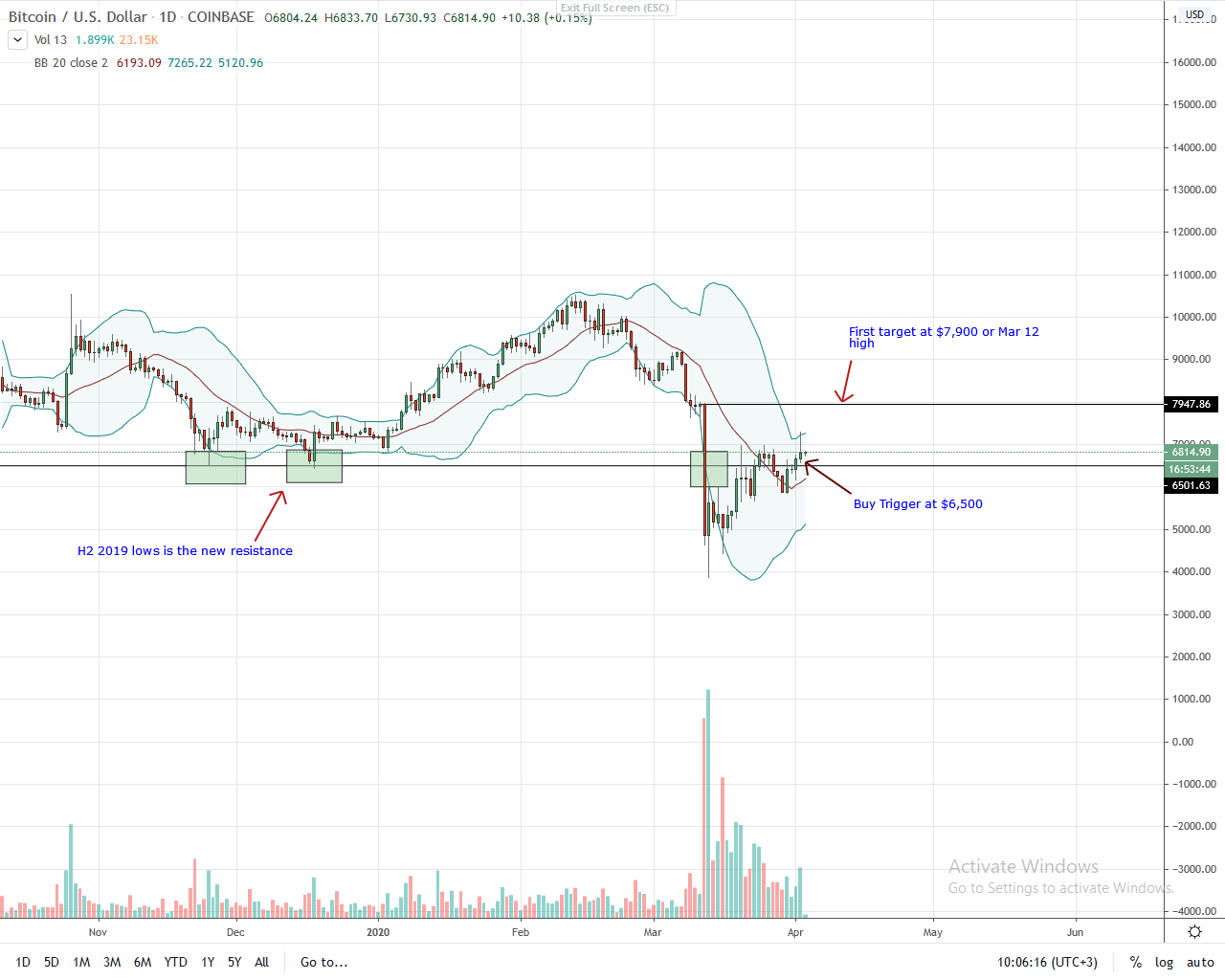

BTC/USD Price Analysis

From charts, BTC Price is stable to bullish, up two percent week-to-date at the time of press.

However, bears have the upper hand as long as prices are trending below $7,000, and most importantly $7,500 in the immediate term.

As it is, even though there are series of higher highs as bulls trend inside a rising channel, BTCUSD is within Mar 12 bear candlestick.

In an effort versus results perspective, bears are in control. There are chances of BTC sliding below $3,800 despite supportive fundamentals of Q2, 2020.

Nonetheless, for aggressive traders, a trading opportunity is available and can buy the dips while aiming at $7,900 or Mar 12 high.

On the flip side, losses below the double bar reversal pattern of Mar 29-30 at $5,800-$5,900, could see BTC slide to the $3,800-900 zone as the retest of H2 2019 lows confirms the bear trend confirmation pattern of Mar 12.

Disclaimer: This is not investment advice. Opinions expressed here are those of the author and not the view of the publication.

If you found this article interesting, here you can find more Bitcoin news