New data shows that more Bitcoins are going out of exchanges that can be a sign of a continued uptrend for BTC price. When more people are moving their coins out of exchanges, there can be many possibilities.

But the most common one is that they’re going to hodl for more time, and it means the overall feeling about that coin is bullish. Especially, the balance of Bitcoin in exchanges is very important, and the latest data from Glassnode shows that this metric is still declining.

Bitcoin recorded a new ATH last week but started to decline to about $59K. Many experts believe it’s a price correction, and BTC may restart the journey to more new ATHs.

Onchain data and information from exchanges can be very useful in these situations. The feeling of the crowd has a very big effect on the price. When more people feel bullish about a coin, more buying will come, and it means continued price increase.

But if most of the people are feeling bearish and don’t wish to hold their assets, we can expect a price decline.

According to the latest tweet by Glassnode:

#Bitcoin balance held on exchanges has continued to decline this week.

Balances have fallen to 2.474M $BTC, returning to levels last seen in Aug 2018.

Since Feb 2020, the average rate of outflow has been 30.85k $BTC per month.

Live Chart: https://t.co/b45aTTBQwd pic.twitter.com/WOfhz7AK3K

— glassnode (@glassnode) October 28, 2021

“#Bitcoin balance held on exchanges has continued to decline this week. Balances have fallen to 2.474M $BTC, returning to levels last seen in Aug 2018. Since Feb 2020, the average rate of outflow has been 30.85k $BTC per month.”

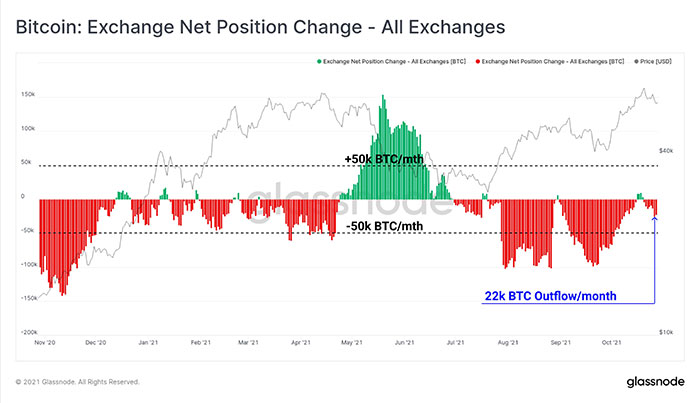

Regardless of the current stats, an interesting fact about this data is that people have been moving their BTC assets away from exchanges since February 2020. But in the May-July period, the inflow started to grow, and more people were trying to sell their coins. The current situation is still in favor of hodling. Users are moving their assets out at around $22k BTC per month currently.

Looking at the chart of Bitcoin balance on exchanges, we see that the ATH for BTC balance on exchanges happened in Feb 2020 with 3.091M BTC in exchange addresses that Glassnode monitors. The balance started to decline since then, and about 617K BTC outflow happened in over 20 months. It’s the period in which the market experienced considerable price rises for Bitcoin and many altcoins.

in the details chart, we see that Bitcoin balance in exchanges and the BTC price almost always have moved opposite to each other, with January to December 2017 as an exception. Currently, the balance is declining, so we can expect an opposite movement in the price chart that is increasing.

If you are interested in this project and want to be informed of everything that happens, visit our Bitcoin News section