In the last 24 hours, Binance, the world’s leading cryptocurrency exchange, has witnessed significant financial movement with over $1 billion in net fund outflows.

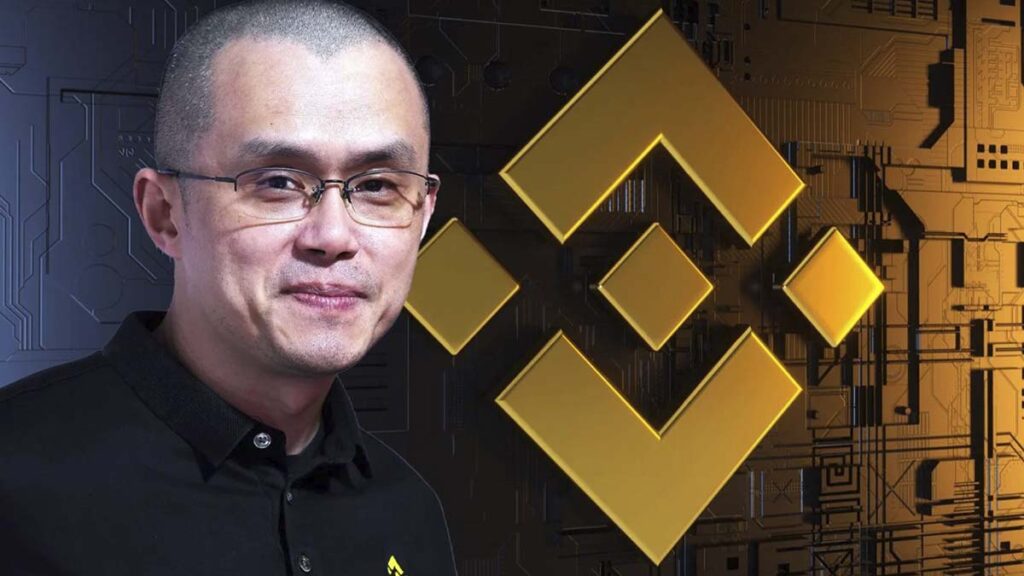

This event arose from the fact that the founder and CEO of Binance, Changpeng Zhao, had to face several criminal charges in the United States.

Data provided by DefiLlama reveals that Binance’s capital outflows surpassed the $1 billion mark around 3:30 p.m. Hong Kong time last Wednesday. This outflow adds up to a considerable amount of $703.1 million over a 7-day trajectory.

These financial movements come after Zhao’s admission of guilt for violating the Bank Secrecy Law, followed by his resignation as CEO of the company.

Binance has appointed Richard Teng as its new CEO

As part of the settlement, Zhao has agreed to pay a fine of $50 million, while the company faces a penalty of $4.3 billion for crimes including money laundering, conspiracy to conduct unlicensed money transmission business, and sanctions violations.

The market reaction has taken a slight hit with Binance’s native cryptocurrency, BNB, recording a 9.5% drop, trading at $233.2 according to data from CoinMarketCap.

Furthermore, other exchanges such as OKX, Bybit and Bitstamp, during the same period, have experienced net inflows, suggesting a transfer of funds from Binance to these alternative platforms, as expected in reaction to the news.

Of the total outflows from Binance, a significant amount of $605.9 million was channeled through various networks, including Ethereum, the BNB chain with a negative variation of 9.49%, Avalanche, Fantom and Polygon.

Additionally, a substantial portion of these funds has been transferred to cold wallets and stablecoins. This move suggests a clear intention to safeguard digital assets outside of exchanges, aiming for greater security and stability in a volatile environment.

These strategies could be aligned with a vision for the future, particularly in the face of the eventual entry of ETFs into the crypto market.

By keeping these assets off exchanges in more secure or stable forms of storage, investors could be strategically positioning themselves to take advantage of emerging opportunities, facilitating agile and timely moves should lucrative options present themselves, such as the imminent foray into ETFs. by Wall Street.

This tactic highlights possible future movements within the crypto market, especially in the face of indications that the US market could face a recession in the short/medium term and cryptoassets such as Bitcoin, Ethereum and others, function as a reserve of value for the portfolio of institutional investors in such a situation.

Various media outlets have also highlighted particular political issues and the incessant regulatory pressure by the SEC on foreign companies operating in the United States.

Jason Atkins, an executive at Auros, has noted that these events could accelerate the exit of projects, exchanges and firms from direct US regulatory scrutiny, making regulatory compliance a priority to avoid failures in anti-money laundering requirements. (AML) and customer verification (KYC).