2021 was a rough ride for Binance. But the cryptocurrency giant may be wrapping the year on a good note.

According to Binance’s official blog post, the platform was awarded an in-principle approval from the Central Bank of Bahrain [CBB]. With this, Binance will now be able to operate as a crypto-asset service provider in the Gulf country. The approval follows Binance applying for a license from the CBB to become a fully-regulated centralized cryptocurrency exchange.

#Binance has received in-principle approval as a crypto-asset service provider in the Kingdom of Bahrain.https://t.co/9GvuYVOYvt

— Binance (@binance) December 27, 2021

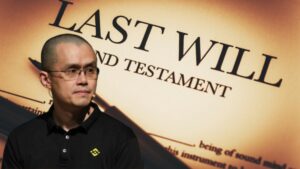

Commenting on the development, Binance founder and CEO, Changpeng Zhao [CZ] stated,

“Recognition and approval from national regulators, such as the Central Bank of Bahrain, is essential to build trust in crypto and blockchain and help further improve mass adoption.”

CBB has become the first entity in the Middle East North Africa [MENA] to give a nod to Binance that has been facing significant regulatory backlash from different parts of the world. Meanwhile, the in-principle approval from the regulatory authority still requires the platform to complete the full application process. Binance noted that this will be completed in the “due course.”

The latest news comes after Binance’s Turkey division was reportedly fined almost $750,000 after it failed the Financial Crimes Investigation Board’s [MASAK] audit for monitoring Anti-Money Laundering [AML] compliance.

Binance’s pro-regulatory stance

Despite facing mounting regulatory threats with numerous global regulators, Binance has always taken a pro-regulatory stance. While talking about cryptocurrency integrations with existing financial institutions, CZ had recently stated,

“I know some die-hard crypto OGs will hate what I am about to say next. These crypto OGs hate anything that is slightly centralized. They want to only live in the fully decentralized crypto utopian island. But the fact is, that’s a very small island. Today, 99.9% of the money is still in fiat. And, the 5% of people who have crypto typically only have a small portion of their wealth in crypto.”

CZ also underscored the need to build fiat on and off-ramps for the cryptocurrency industry to grow. The CEO also said that it was important to build bridges between crypto and fiat which requires integration with traditional financial systems, banks, payment services, etc. To achieve this, on the other hand, the platforms require licenses.

That being said, the exec also highlighted the downsides of regulation and spoke about a certain level of “restrictions in the short term,” which is not just inconvenient for the users but also hurts business. CZ added that “over-regulation” will eventually “kill the industry in the local market.”