The world’s leading cryptocurrency exchange Binance has made a large investment in crypto derivatives platform FTX to grow its market share in derivative world.

In a blog post published today, December 20, Malta-based exchange announced its strategic investment in the cryptocurrency derivatives exchange FTX. Binance has acquired an equity stake in Alameda Research-backed crypto derivatives platform.

Binance did not disclose the amount of investment but according to Sam Bankman-Fried, founder and CEO of FTX, it is in tens of millions.

The exchange said that it will work together with FTX to develop the cryptocurrency ecosystem. Binance will help FTX token (FTT) to enable a sustainable growth of the FTX ecosystem.

According to the blog post, FTX will help Binance to create liquidity and institutional product offerings across the main Binance exchange and its over-the-counter (OTC) trading desk. Binance and FTX will also work together to build a wide range of products to build better crypto trading products and platforms.

This is not the first derivative platform acquired by Binance. As reported by crypto-economy, the exchange acquired Seychelles-based spot-trading and derivatives market platform JEX in September of this year. The exchange then renamed it to Binance JEX but FTX will continue to operate as an independent entity.

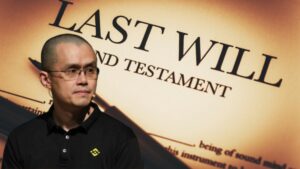

Changpeng Zhao (CZ), CEO of Binance, commented on the partnership:

“The FTX team has built an innovative crypto trading platform with stunning growth. With their backgrounds as professional traders, we see quite a bit ourselves in the FTX team and believe in their potential in becoming a major player in the crypto derivatives markets. We are pleased to have an excellent partner joining the Binance ecosystem and aim to grow the crypto market together.”

California- based FTX, launched in May of this year, is a cryptocurrency derivatives exchange built by traders, for traders. It claims to have $500 million in trading volume per day but the market share is still in very bottom as the market is currently dominated by big players like BitMEX, Huobi and OKEx. But in just six after the launch, it has earned its name as the most liquid markets in the industry, including perpetual and quarterly futures on over twenty different products.

Sam Bankman-Fried, Founder and CEO of FTX, commented:

“Binance is a market leader which has strong synergy with derivatives platforms, and we appreciate their global industry leadership, consistent execution and innovation. The investment will help accelerate the growth of FTX with support and strategic advisory from Binance while FTX maintains its independent operations.”