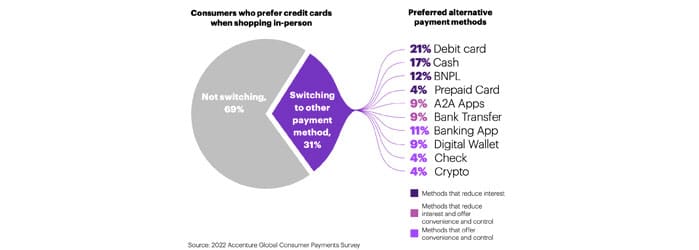

There has been a recent report from Accenture that indicates that consumers are becoming more interested in crypto despite traditional payment methods dominating many markets.

More Personal Payments

According to the report, the pace at which consumer behavior and expectations have changed has quickened in the aftermath of the COVID-19 crisis. It is no secret that geopolitical shifts, the accelerated digitalization of the economy, and significant economic turbulence have reshaped the way people pay and move their money around.

Moreover, social media and e-commerce platforms are providing frictionless experiences for consumers to pay for their purchases through their social media and e-commerce accounts, which is setting new standards for consumer payment experiences in the future. Consumers have shown a greater desire to have more control over their payment choices as the economy has become increasingly volatile in recent years.

The Accenture study found that one in five respondents claimed to own cryptocurrencies among their respondents. There are several reasons why consumers purchase crypto: as a long-term investment, as an act of curiosity, or as a means of speculation.

In spite of this, 17% of the respondents purchased them in order to have access to an alternative payment method, and 12% claim to use them to make cross-border payments.

According to Accenture, consumers have faith both in banks’ ability to provide financial stability as well as the ability to provide a secure environment for transactions, and they generally have a very high level of trust in their ability to do so. It is likely that when fraud or bankruptcy arises, they will be able to rely on the regulators to act.

Contrary to this, the growing confidence consumers have in next-generation payment providers and products like cryptocurrencies as well as high-profile incidents of fraud and mismanagement have shaken their confidence in these instruments.

As a result of the research, it can be concluded that 84% of consumers trust their bank, while only 31% trust BNPL providers.

Over a third of respondents (38%) are comfortable using next-generation payment instruments such as BNPL and crypto in their main bank if they are provided with them by their bank due to their trust in banks to secure payments. With new entrants entering the market, banks are in a great position to provide solutions that level the playing field and make it easier for them to compete.

Cryptocurrencies can have a bright future in many communities if traditional financial institutions get on board with them and support them. This is evidenced by the results of this study.

Nevertheless, the crypto industry can also find its way to success if more large companies emerge and demonstrate the real potential of the industry in the market. There is no doubt that cryptocurrency is here to stay and in the near future, more and more people are going to embrace it.