Aave holders have voted on a governance proposal for the conversion of 1,600 ETH worth $3 million. It is currently proposed that the Ethereum (ETH) in the protocol’s treasury should be converted into wrapped staked Ether, wstETH, and rocket pool Ether, rETH. Wrapped Ether and rocket Ether are liquid staking derivatives that enable investors to stake their tokens for a yield, retaining liquidity at the same time.

Aave has managed to establish itself as the third largest DeFi protocol, and it currently has a total locked value of approximately $6 billion. At the same time, the platform earns a yield of almost 1.69% from its 1,600 ETH by directly staking it on the Aave v2 platform.

Keeping the proposal in mind, some holders believe that the protocol would manage to earn almost 3.8% by staking wstETH, and around 3.13% if it stakes rETH. Furthermore, a total of 320,000 votes are required for the proposal to be put into action, and almost 252,000 votes have been cast. The voting would end on Friday this week.

The Aave Price Rally Might Eventually Settle Down

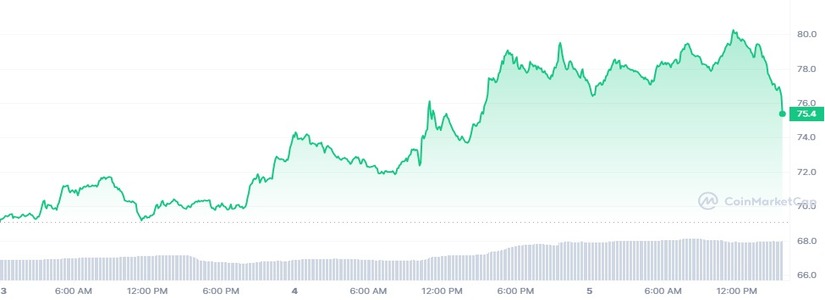

The possible proposal being put into effect has laid the foundation for the trading price of the Aave token to jump up. At the time of writing, Aave has surged by 2.01% within the previous 24 hours, and the surge has catapulted its trading price to almost $75.51. Similarly, the total market cap of Aave currently stands at the $1 billion mark.

The trading price of Aave has surged by almost 25.63% within a span of a week. It has added considerably to the ongoing rally that started on June 16 this year. Since then, the value of the crypto token has grown by over 56%, which resulted in the token achieving a trading price of $78 from $50. Within the span of a few weeks, Aave helped investors in earning decent profits.

However, analysts believe that the altcoin’s trading price might now face a decline as investors seem to be taking breaks. With this in mind, it has become understandable that the whales were the first to back off as their transactions have dropped by 40% within a week. These whales were seen to be conducting transactions of over $116 million just a few days ago.