The cryptocurrency market was swayed by intense volatility in recent weeks. But the latest reports suggest, DeFi lending has been pretty consistent.

Things move fast in the cryptocurrency industry. Bitcoin [BTC] fell from an all-time high above $67,690 to as low as $43,041, meaning a drawdown of 35%. While the flagship crypto hasn’t much recovered, the wider market also faced its brunt. But not DeFi lending space.

The decentralized finance realm has turned up to become a multi-billion dollar market. Today, it offers several decentralized services to the community within the cryptocurrency industry and beyond. Zooming in, it can be said that lending protocols are some of the most prominent players in this sector. However, the ongoing volatility hasn’t been able to effectively deter these protocols.

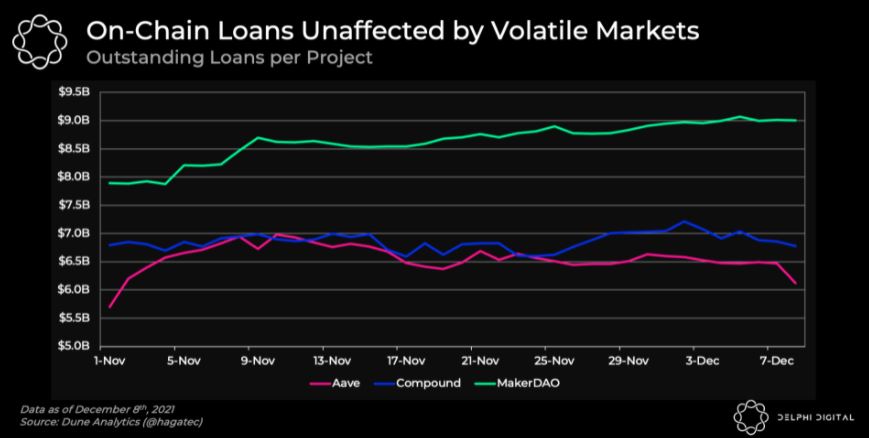

As a matter of fact, the latest analysis by Delphi Digital stated that on-chain leverage users have remained unfazed despite the volatile markets over the past month. DeFi project MakerDAO’s loan growth has been steady since the beginning of November and was now near $1 billion.

On the other hand, DeFi protocols Aave and Compound have not exhibited any distinct trend and instead laid flat over the same period. To put things into perspective, Aave suffered a massive liquidation in May this year following the year’s biggest sell-off. But the latest pullback did not trigger large-scale damage and the liquidation was only around $3 million.

Stablecoin’s Growth Trajectory

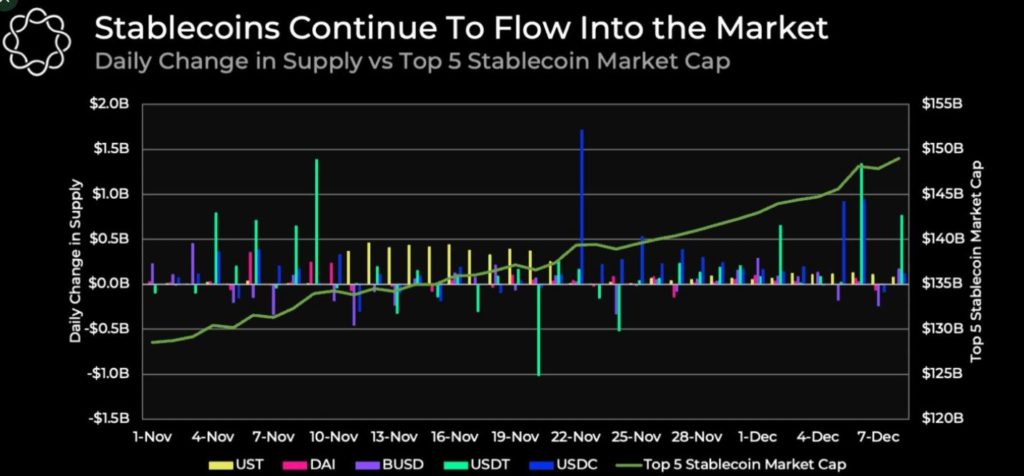

Stablecoins, which have emerged as popular vehicles for facilitating decentralized lending and borrowing platforms, have also surged significantly in the past month. According to the analytic platform, the top five stablecoin market capitalization has amplified from $129 billion to almost $150 billion.

Undoubtedly, Tether [USDT] and USD Coin [USDC] were the biggest contributors to the supply growth. USDC recorded growth of $7.8 billion while USDT witnessed a $6 billion rises. According to the research and analytic platform, the growth in stablecoin supply, especially for centralized collateralized stablecoins such as the USDT and USDC, is a positive indicator that signals the inflow of money in the markets.

Besides, USDC has been slowly growing against USDT in market share throughout the year. Along the same lines, Delphi Digital noted,

“The USDC/USDT ratio has grown from 0.19 at the start of the year to 0.53 today, a sign of market preference for USDC which is considered to have less risk compared to USDT.”