Ethereum’s ecosystem just took a technical hit at the worst possible time. As the broader crypto market struggles to regain momentum, the world’s second-largest blockchain is winding down its once-flagship testnets — Holesky network — signaling the end of an era in Ethereum’s developer architecture.

But the timing couldn’t be more symbolic: Ethereum’s price has slipped below key psychological levels, confidence is waning, and ETH whales who once defined its liquidity backbone appear to be quietly charting new territory. One name in particular, Paydax Protocol (PDP), has started appearing more frequently among ETH whales. Designed as a liquidity-centric DeFi layer, this token’s architecture mirrors what Ethereum (ETH) offered in its infancy.

The End Of The Ethereum Holesky Network Signals A New Era for ETH Whales

The Holesky network, once hailed as Ethereum’s (ETH) largest and most advanced testing ground, is now being switched off. Following the Fusaka upgrade, the Ethereum Foundation confirmed that node operators and developers will begin shutting down the Holesky network within weeks. While the move has been described as “routine maintenance,” it lands at a delicate moment for Ethereum (ETH).

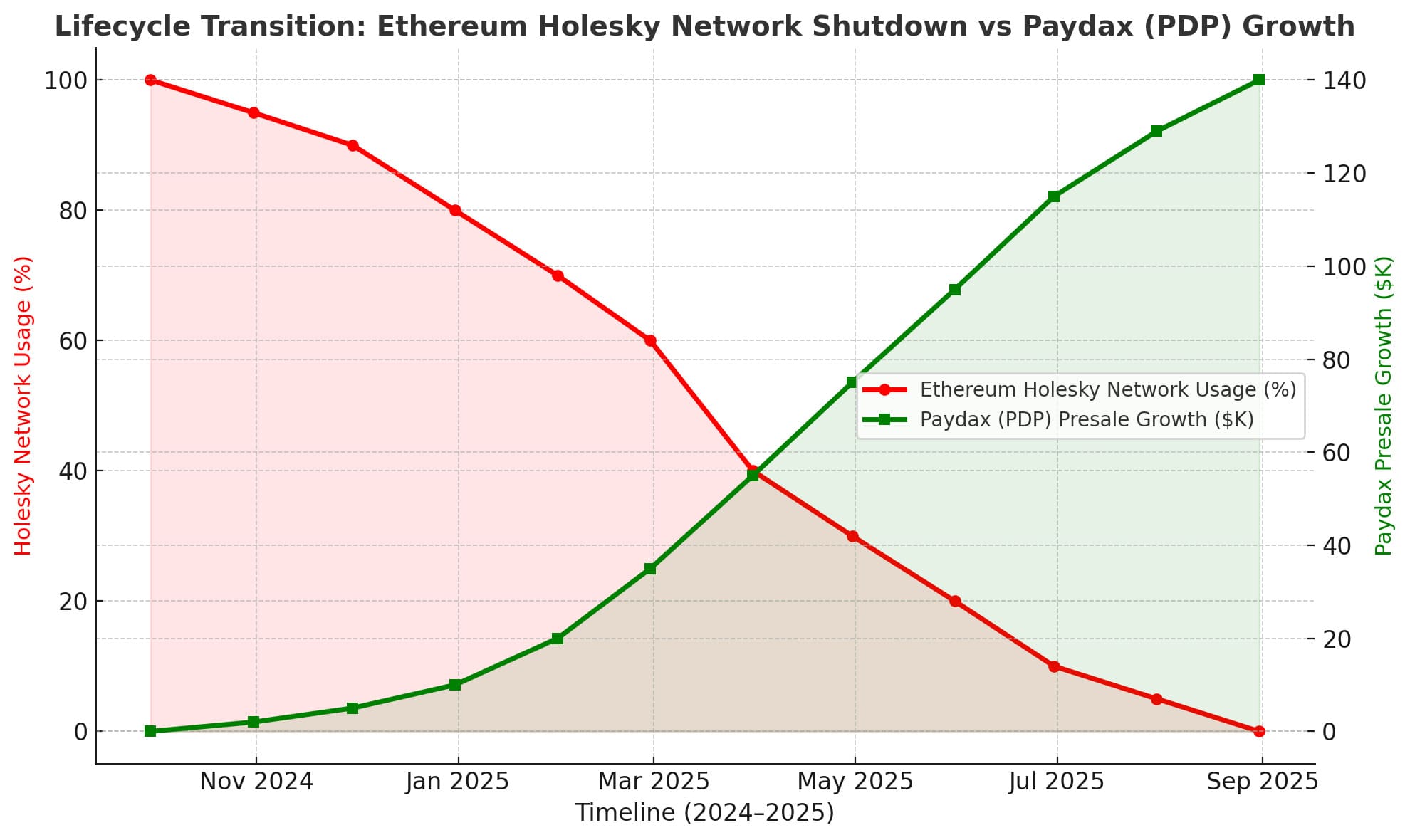

Ethereum’s (ETH) pivot may claim to simplify development, yet it underscores the network’s growing dependence on controlled testing environments. And that’s precisely where new entrants like Paydax (PDP) appear to shine. While the Holesky network winds down, PDP is building upward, creating a decentralized liquidity architecture where scalability isn’t confined to testnets or layered rollouts.

Source: Paydax Protocol

For ETH whales seeking early-stage opportunities that still echo Ethereum’s original openness, Paydax’s frictionless staking and liquidity-flow model are quickly becoming the kind of frontier once represented by the Holesky network but with fresher tech, cleaner economics, and faster velocity.

From Holesky To Paydax: How ETH Whales Are Finding Smarter Liquidity

For ETH whales, the shutdown of the Holesky network has underscored an old truth: Ethereum’s infrastructure, while powerful, still struggles to keep liquidity fluid and incentives balanced. As the network retires one of its largest test environments, developers are tightening focus, but ETH whales are widening theirs.

Paydax’s groundbreaking smart liquidity pools solve one of DeFi’s biggest inefficiencies — liquidity fragmentation — winning over lots of ETH whales. Instead of trapping value like the Holesky network often did, PDP’s system unifies liquidity under a single adaptive layer, balancing depth and flow across markets. This allows ETH whales to maintain volume without the friction typically seen in layered DeFi ecosystems.

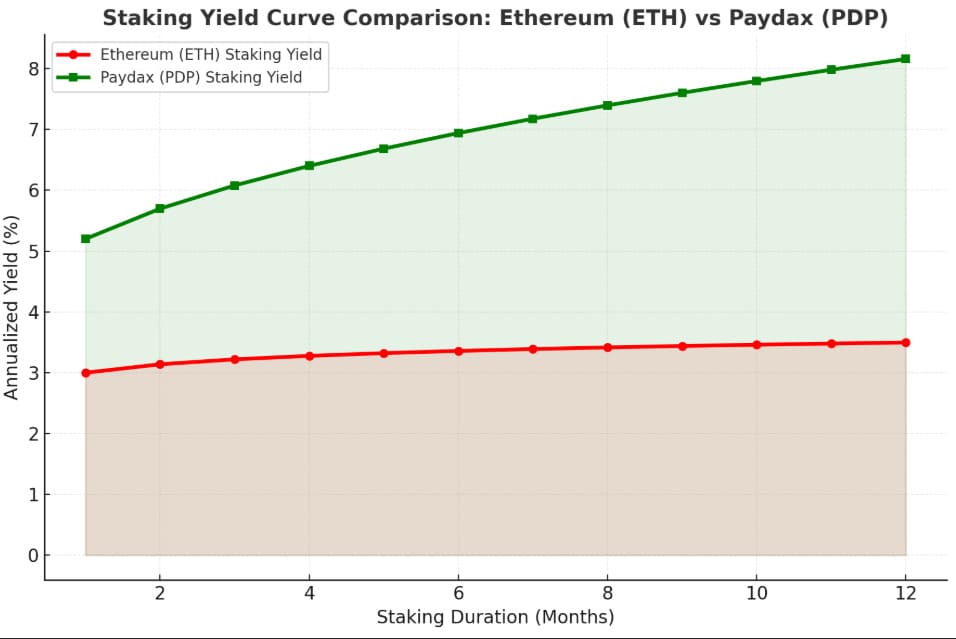

Complementing this is Paydax’s tiered staking reward model, which aligns incentives with participation scale. Larger commitments earn proportionally higher rewards as they simultaneously strengthen network liquidity and governance weight.

Source: Paydax Protocol

It’s a circular system where whales contribute stability and, in return, capture dynamic yield without the constraints of delayed network updates.

Ethereum’s Decline Spurs ETH Whales To Diversify Into Paydax (PDP)

Ethereum’s recent decline has been more than just a price dip. It’s a reflection of deeper inefficiencies within the ecosystem. The Holesky network shutdown, coupled with rising gas fees and scaling bottlenecks, has exposed cracks in Ethereum’s liquidity architecture. For ETH whales, the once-dominant network now feels increasingly restrictive, with yield opportunities thinning and infrastructure updates growing slower.

For these reasons, a subtle diversification is underway. Rather than abandoning Ethereum, ETH whales are hedging it. And the destination for that capital shift is becoming clearer: Paydax (PDP). Unlike traditional DeFi tokens chasing hype cycles, PDP offers an audited foundation with Assure DeFi and real-world asset integration.

At a time when Ethereum continues to face smart contract exploits and patch-based fixes, Paydax’s verified framework offers a layer of operational security that DeFi hasn’t seen in years. Yet what’s drawing the most attention is its tokenization of Real-World Assets (RWAs), a mechanism that bridges tangible assets with blockchain liquidity. This means value in PDP’s ecosystem isn’t just speculative; it’s backed by tokenized commodities, revenue streams, and real-world financial instruments.

Early Investors Rush In As Paydax (PDP) Nears Next Price Stage

As the Holesky network powers down and Ethereum faces mounting challenges, the Paydax (PDP) presale continues to accelerate, raising over $1.29 million and selling nearly 40% of its allocation in record time. The numbers speak for themselves: capital is moving, and ETH whales are leading the charge.

With the next stage set to lift prices from $0.015 to $0.017, momentum around PDP is building fast. Savvy investors aren’t waiting. They’re positioning early before the next valuation shift locks in. To claim a 25% bonus, use the PD25BONUS code and join the train before it moves.

Join The Paydax Protocol (PDP) presale and community:

Website: https://pdprotocol.com/

Telegram: https://t.me/PaydaxCommunity

X (Twitter): https://x.com/Paydaxofficial

Whitepaper: https://paydax.gitbook.io/paydax-whitepaper

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.