In 2025, the crypto narrative is shifting. Meme coins like Pepecoin (PEPE) have had their moments of explosive traction, but a new class of utility-anchored projects is gaining ground. Among them, Mutuum Finance (MUTM) is outperforming expectations, combining structural token mechanics, transparent presale execution, and a roadmap of usable features. While PEPE still thrives on cultural momentum, MUTM may be laying the foundation for sustained value growth rather than fleeting hype.

Pepecoin (PEPE)

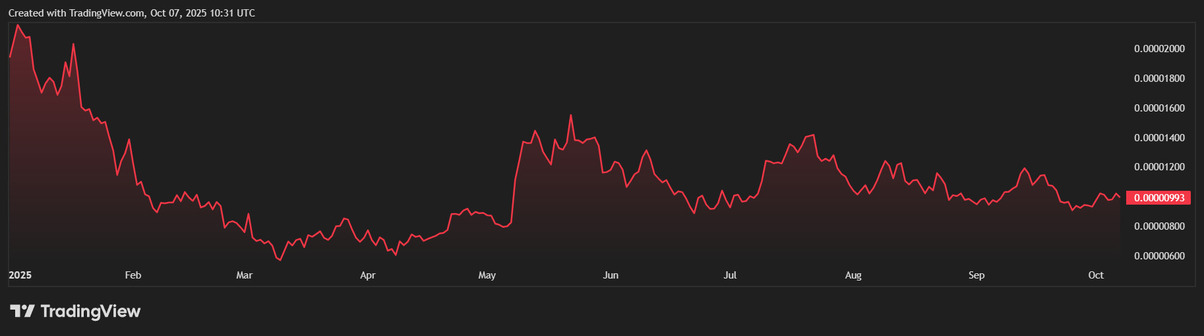

Pepecoin trades at approximately $0.000010 per token, with a circulating supply of 420.00 trillion PEPE and a market cap around $4.5 billion. Memes, virality, and community culture are the force behind PEPE’s appeal. It’s not built for revenue but for social cycles and speculative flows.

Still, those very dynamics also impose ceilings. With such a massive supply and limited utility, price appreciation requires monumental capital inflows to overcome dilution. Analysts caution that without protocol innovation or demand-side mechanics, PEPE’s upside becomes capped by sentiment cycles alone. Some forecasts already anticipate weakness or sideways movement in PEPE through 2025 unless structural changes occur. In essence, PEPE’s rise highlights meme power, but it also showcases the fragility of value that lacks underlying use.

Mutuum Finance (MUTM)

Mutuum Finance is a decentralized, non-custodial lending and borrowing protocol built on Ethereum, designed to embed token demand directly into platform usage rather than rely on hype or fleeting narratives. Every interaction within the protocol, from supplying liquidity to borrowing assets, is designed to feed back into the MUTM token economy, creating a clear and measurable link between real activity and value accrual.

Its presale launched at $0.01 in Phase 1, structured with roughly 20% price increases per stage to reward early adopters and build momentum progressively. Over five completed phases, the price has climbed to $0.035 in Phase 6, representing approximately 250% token appreciation for the earliest participants. To date, more than $17 million has been raised, over 750 million tokens have been allocated, and the project has attracted a community of 16,800 holders.

Phase 6 is already more than halfway sold, with Phase 7 set at $0.04 and a final listing price fixed at $0.06. Early participants from Phase 1 are positioned for potential 500% token value by launch, while even those joining at the current stage can still target nearly 2x MUTM appreciation into listing. This phased pricing model also minimizes chaotic speculation, creating a more predictable framework for both new entrants and long-term participants as the project approaches its next major milestones.

How MUTM Outpaces PEPE

Unlike PEPE, which relies almost entirely on cultural momentum and meme cycles to sustain interest, Mutuum Finance (MUTM) is built with embedded demand mechanics at its core. Every action within the protocol — whether it’s supplying liquidity, borrowing, or participating in the ecosystem — feeds back into the MUTM economy. Through mechanisms like fee-based buybacks, mtToken yield distribution, and protocol-level reward flows, usage itself generates token demand. This structural design gives MUTM a fundamental growth engine that doesn’t depend on external hype to sustain momentum.

A key part of that engine is its dual lending market architecture, which combines Peer-to-Contract (P2C) pooled markets for mainstream assets like ETH and stablecoins with Peer-to-Peer (P2P) isolated agreements for more speculative tokens. This hybrid model enables flexibility while isolating risk between different asset classes. All loans are overcollateralized and governed by strict Loan-to-Value (LTV) thresholds, while borrowers can choose between variable interest rates that adjust with liquidity conditions or stable rates that lock in costs at a premium. This ensures that growth is managed responsibly, without the reckless volatility often associated with purely speculative tokens.

Looking ahead, MUTM’s roadmap includes a layered oracle system combining Chainlink feeds, fallback sources, aggregated data, and DEX time-weighted averages to protect against manipulation and stale pricing. The introduction of a native overcollateralized stablecoin is also planned to strengthen internal liquidity and create a reliable unit of account within the ecosystem. These infrastructure choices give MUTM the kind of stability and scaling potential that meme tokens like PEPE typically lack, positioning it as a utility-driven protocol designed for long-term adoption rather than short-term narrative cycles.

PEPE vs MUTM

PEPE projections vary widely. Some models forecast moderate gains of up to 100–150% in strong market cycles, while others point to potential corrections or stagnation due to overvaluation risks and its reliance on meme momentum rather than utility.

By contrast, analysts modeling MUTM believe that once adoption, staking, and protocol activity scale as intended, post-listing price ranges of $0.20 to $0.30 are realistic within the first 12–18 months. With continued growth, the planned integration of a native overcollateralized stablecoin and eventual cross-chain expansion, more ambitious targets between $0.60 and $1.00 are not off the table in multi-year scenarios. Because MUTM begins from a much lower price base and includes built-in demand loops, its potential upside multiples could far exceed what meme tokens like PEPE can sustain without fundamental evolution.

On the security side, Mutuum Finance has already undergone a CertiK audit, achieving a strong 90/100 Token Scan score, which provides external validation of its smart contract design. Additionally, the team has launched a $50,000 bug bounty program across multiple tiers, encouraging independent developers to probe the code before mainnet launch. This combination of structural utility and security-focused measures sets MUTM apart from purely narrative-driven assets.

For more information about Mutuum Finance (MUTM) visit the links below:

Website: https://www.mutuum.com

Linktree: https://linktr.ee/mutuumfinance

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.