The Ethereum price fell below $3,800 this week, signaling another point in its corrective cycle. ETH is now trading at around $3,750, representing a 6% pullback since it reached its last week’s high. Analysts say the drop is part of a larger market correction of a number of large-cap cryptocurrencies. Despite the dip, whale accumulation has picked up, indicating long-term holders see an opportunity to buy during the dip.

Investor sentiment is cautious but far from bearish. Market data indicates heavy buying activity and possible accumulation in the $3,540 – $3,800 support zone. Analysts also point to rising institutional participation helping to strengthen Ethereum’s market dominance in the Layer-1 market. As traders evaluate the current setup, experts are pointing at MAGACOIN FINANCE, XRP, and Chainlink (LINK) as the best cryptos to buy before a fresh major bounce.

Ethereum Chart Signals Wave-Four Consolidation

Technical analysis shows Ethereum forming an Elliott Wave pattern of classical five major phases. The current pullback is within wave four, after a strong rally peaked near $4,700. ETH has retraced towards 0.382 Fibonacci at $3,875, but the next significant support is at $3,540, pointing to the 0.5 Fibonacci zone.

Source: X

A bounce out of this area may confirm the start of wave five with a possible target at the $6,000 region using the 2.618 Fibonacci extension. The existing structure reflects consolidation, not reversal. Whale accumulation and on-chain data remain supportive of a bullish Ethereum price outlook once the momentum picks up.

BitMine Faces $1.9B Unrealized Loss on Ethereum Holdings

BitMine is now facing an unrealized loss of approximately $1.9 billion of its collective Ethereum holdings as prices soften. The firm is also one of the largest corporate buyers of ETH, known for buying during major corrections.

This loss stays floating, which means BitMine still has all its coins. Earlier this year, it introduced over 4800 ETH and bought another $65 million in September, indicating belief in Ethereum’s long-term underpinnings.

MAGACOIN FINANCE Gains Momentum in Accumulation Phase

Chairman Tom Lee called this phase a “1971 moment” for Ethereum by likening it to a historical turning point in the financial world. Still, some analysts caution that mounting exposure via share issuance may cause greater risk in the event of the continued decline of ETH. Others believe BitMine’s strength signals overall optimism for a rebound of the crypto market later this quarter.

Among emerging projects, there is MAGACOIN FINANCE, which is considered one of the best cryptos to buy in the current correction. The project has completed dual audits by CertiK and HashEx to strengthen investors’ trust and ensure transparency. Its limited supply of 170 billion tokens and deflationary burn model are attracting holders looking for scarcity-driven growth.

Analysts point out that the current MAGACOIN FINANCE presale has attracted a solid response from the community, aided by the growing social engagement. With capital rotation from small-caps to large-cap opportunities, MAGACOIN FINANCE is well-positioned to benefit when the Ethereum price stabilizes.

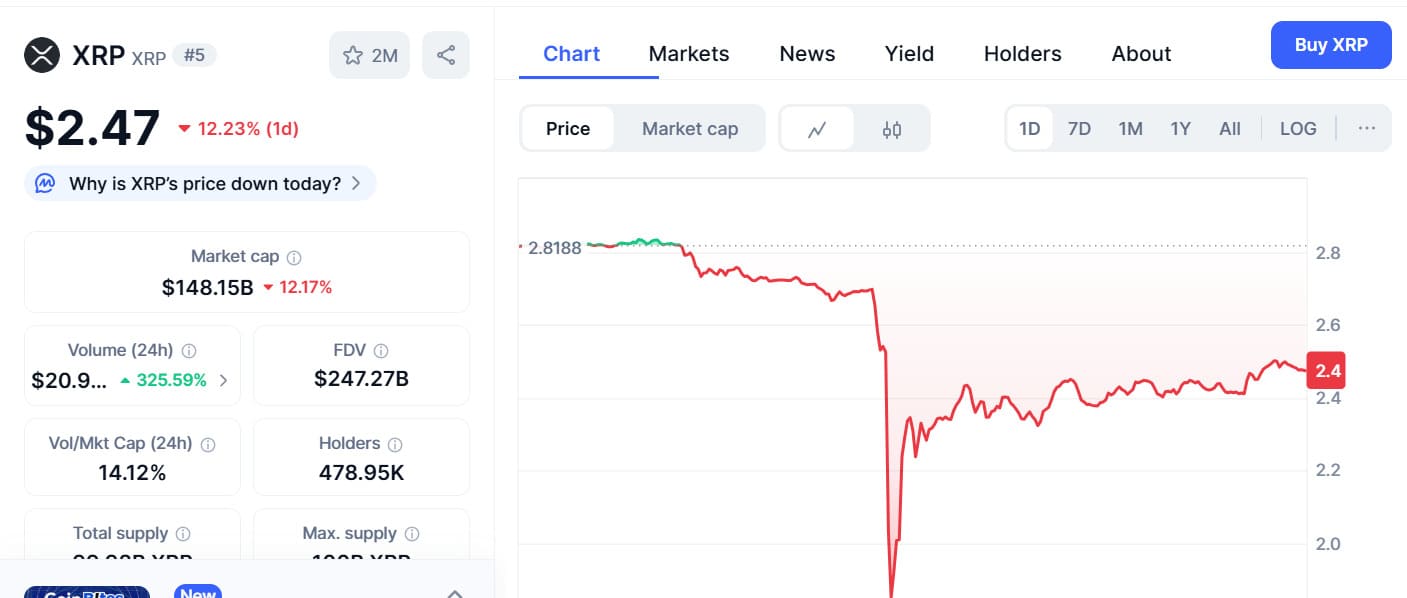

Ripple (XRP) Retains Institutional Appeal

Ripple’s XRP faces less downside near $2.47, and finds support in institutional adoption in cross-border settlements. The network keeps expanding its reach throughout Asia and the Middle East and has solidified its position as a top blockchain payment solution.

Source: CoinMarketCap

Analysts anticipate that the XRP price will rebound shortly when market confidence grows and regulation clarity increases. For investors expecting to rebound in the altcoins market, XRP presents an opportunity to benefit from utility-driven exposure with long-term potential.

Chainlink (LINK) Strengthens Its DeFi Role

Chainlink (LINK) remains integral to decentralized finance. Its DeFi oracle network powers reliable price feeds for major protocols across multiple blockchains.

LINK trades near $18, maintaining stability amid broader weakness. The Cross-Chain Interoperability Protocol (CCIP) continues attracting new developers and institutional partners.

Analysts consider Chainlink undervalued compared to its critical infrastructure role.

A confirmed Ethereum support zone rebound could push LINK higher as liquidity returns to DeFi markets

Conclusion

The recent Ethereum price correction highlights how volatility can create opportunities for patient investors. While the market remains cautious, accumulation trends suggest the groundwork for recovery is already in place. Analysts emphasize that the best results often emerge when buying during fear, not euphoria. The current environment offers attractive entry points for strategic positions before momentum resumes.

As Ethereum consolidates, attention shifts to high-potential projects like MAGACOIN FINANCE, XRP, and Chainlink (LINK). Each demonstrates strong fundamentals, active communities, and clear market relevance. Together, they represent the best cryptos to buy for investors expecting the next crypto market rebound. Once the uptrend resumes, these assets could lead to gains across the broader digital asset landscape.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Access: https://magacoinfinance.com/access

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.