Bitcoin ETF inflows slowed down last month after a few weeks of strong inflows. The pause occurred as traders bagged profits near recent highs. With Bitcoin stabilizing, the focus is turning to altcoins, which have better upside potential.

XRP, ADA, and DOT are leading this new performance wave. Analysts have also revealed MAGACOIN FINANCE as another altcoin appearing to join the list of the best altcoins to buy now. Its increased investor confidence is based on verified security and consistent traction during Q4. Together, these coins underscore the fact that capital is rotating to high-growth, trusted projects.

Bitcoin ETF Cooldown and Market Rotation

Institutional demand for Bitcoin slowed down in September following record inflows earlier in the quarter. Trading volume softened as profit-taking began to emerge as it neared resistance levels. Analysts note that this pullback represented a cooling phase, and not a reversal.

During that same month, Ethereum ETFs overtook Bitcoin ETFs for the first time. This move indicates that investors are more averse to investing in one dominant option and are looking for a balance. As ETF flows slowed, traders began to rotate into altcoins that had more defined growth potential. The trend is indicative of a changing market that is driven by diversity and opportunity.

ETF Inflows Rebound After September Cooldown

Despite the slowdown, inflows have recovered strongly. U.S. spot bitcoin ETFs attracted $3.24 billion last week – the second-largest week since launching in January 2024.

Data from SoSoValue indicated that only the week ending November 22, 2024, had higher inflows ($3.38 billion). The rebound offset the outflows of the previous week ($902 million), bringing four-week totals close to $4 billion. BlackRock’s iShares Bitcoin Trust (IBIT) topped equities with $1.8 billion, while $692 million was added by Fidelity’s FBTC.

Bitcoin’s surge past $125,000 kept optimism alive. Analysts pointed out that this recovery validates the ongoing institutional demand, combined with retail traders looking for faster growth with altcoins.

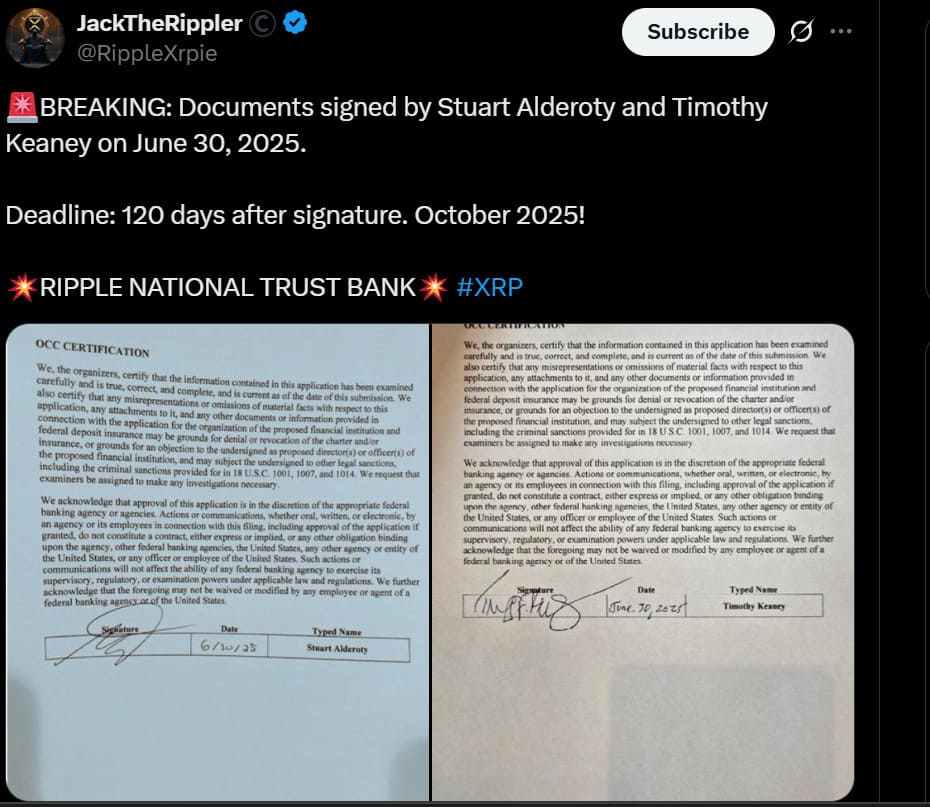

Ripple National Trust Bank Could Boost XRP Utility

Ripple is approaching a milestone that could transform XRP’s role in finance. On June 30, 2025, Ripple’s legal and regulatory departments signed paperwork to launch Ripple National Trust Bank. The agreements did set a 120-day time frame (ending in October 2025) for the approvals and readiness.

Source:X

The bank will link traditional finance to blockchain services. It plans on using XRP for payments, custody, and other financial operations. Meeting the deadline of October would bolster confidence in Ripple’s vision and boost the credibility of XRP as a regulated payment asset.

A successful launch could mean positioning XRP as a bridge between banks and crypto networks. Analysts believe it may also spur the wider usage of XRP for cross-border settlements.

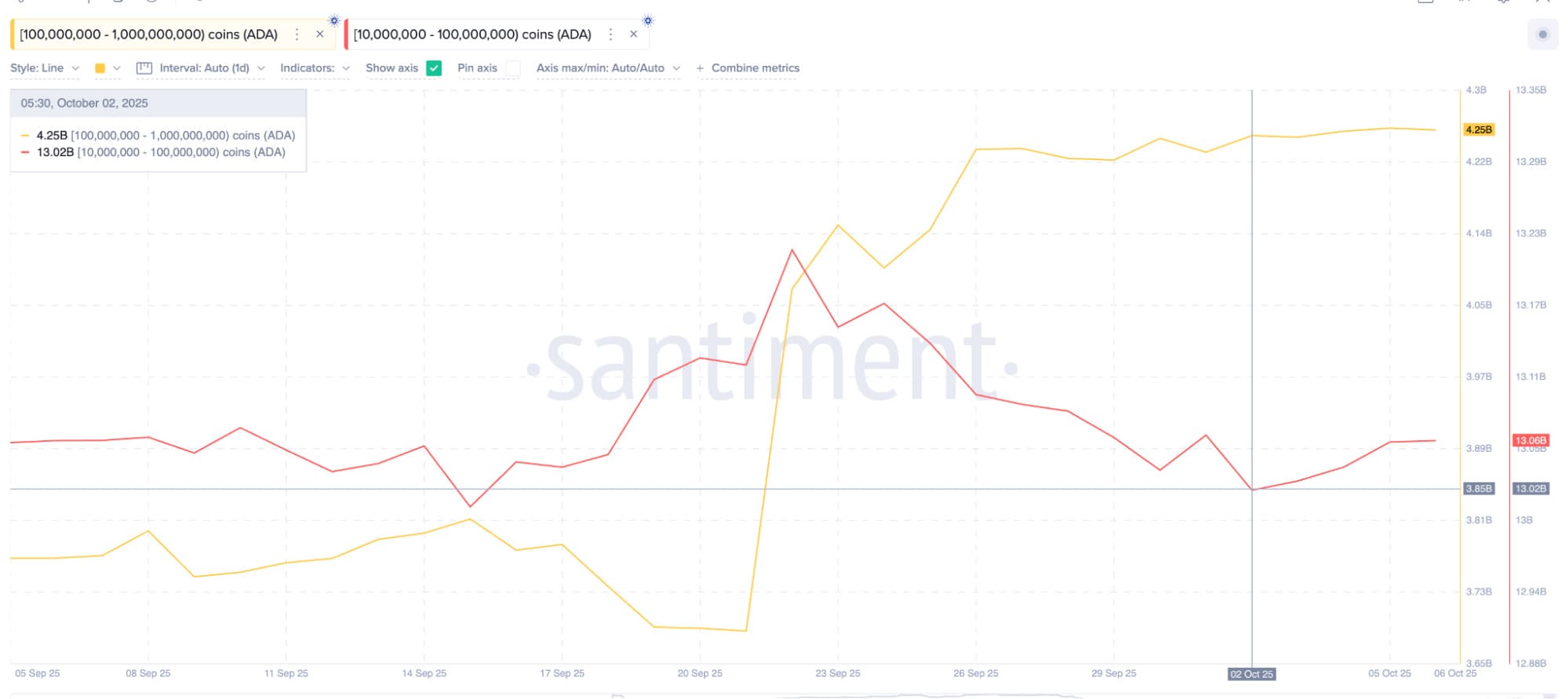

Whales Quietly Accumulate ADA as Retail Traders Stay Cautious

Big investors are quietly accumulating Cardano (ADA). Wallets with 100 million to 1 billion ADA increased from 4.22 billion to 4.25 billion tokens. Smaller addresses with 10 million to 100 million ADA also increased slightly.

Source: Santiment

That amounts to approximately 70 million ADA, valued at nearly $59 million, added in a couple of days. The Chaikin Money Flow indicator turned positive, indicating increasing buying interest.

Retail traders are far more cautious. The Money Flow Index continues to display weaker momentum. Analysts describe this as quiet accumulation – big players getting ready for a purchase early, and retail participants wait for confirmation.

21Shares Polkadot ETF Listing Sparks Fresh Interest in DOT

Polkadot (DOT) had been in the spotlight as 21Shares listed a proposed Polkadot ETF with the DTCC under the ticker TDOT. However, the listing doesn’t guarantee approval but signals the readiness if the regulators agree.

According to the filings, the fund will follow DOT’s live price through a trusted reference rate, and Coinbase Custody will be the custodian. DOT is trading close to $4.17 with $236 million daily volume.

The ETF listing puts DOT back into focus for Q4. Analysts stated that this move could provide a sentiment boost as more altcoin ETFs are awaiting review in the US.

MAGACOIN FINANCE — The Secure Altcoin Standing Out in Q4

Despite the cooling ETF momentum, MAGACOIN FINANCE continues to receive attention from cautious investors. Its steady increase is evidence of how the market now values its reliability on top of growth potential.

The HashEx audit confirmed the safety of MAGACOIN FINANCE’s smart contracts, giving investors peace of mind. As institutions are seeking secure ETFs, retail traders are getting a similar reassurance with such verified altcoins as MAGACOIN FINANCE.

Analysts highlight it as one of the best altcoins to buy now for investors looking for security and consistency in returns. With Q4 optimism on the rise, MAGACOIN FINANCE is a secure and transparent coin with room to grow.

Final Take — Altcoins Step Into the Spotlight as Bitcoin Pauses

Bitcoin’s slower ETF flows have investors looking elsewhere for growth. Ethereum ETFs surpassing Bitcoin’s in September confirmed this wider rotation.

Now XRP, ADA, DOT, and MAGACOIN FINANCE are at the forefront of the conversation. Each shows progress based on fundamentals, not hype. Analysts say MAGACOIN FINANCE especially stands out among the best altcoins to buy, offering verified safety during a period of cautious optimism. As capital diversifies, these assets denote a more balanced and confident crypto market.

To learn more about MAGACOIN FINANCE, visit:

Website: https://magacoinfinance.com

Access: https://magacoinfinance.com/access

Twitter/X: https://x.com/magacoinfinance

Telegram: https://t.me/magacoinfinance

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.