Ripple’s XRP is once again in the spotlight, consolidating tightly between $3.05 and $3.18. Analysts from Cointelegraph and Coindesk agree that ETF speculation has become the dominant narrative steering XRP’s momentum into October. The question now is whether this sustained buildup of institutional inflows and retail anticipation can push XRP through its long-standing resistance zone toward the coveted $3.50 level.

But while XRP investors debate resistance levels, speculative attention is broadening. Early adopters are also flocking to MAGACOIN FINANCE, a meme-driven project approaching $14 million raised, with analysts projecting 30x–50x ROI potential for those positioning early before the next wave of altseason hype.

ETF Buzz Fuels Ripple’s Momentum

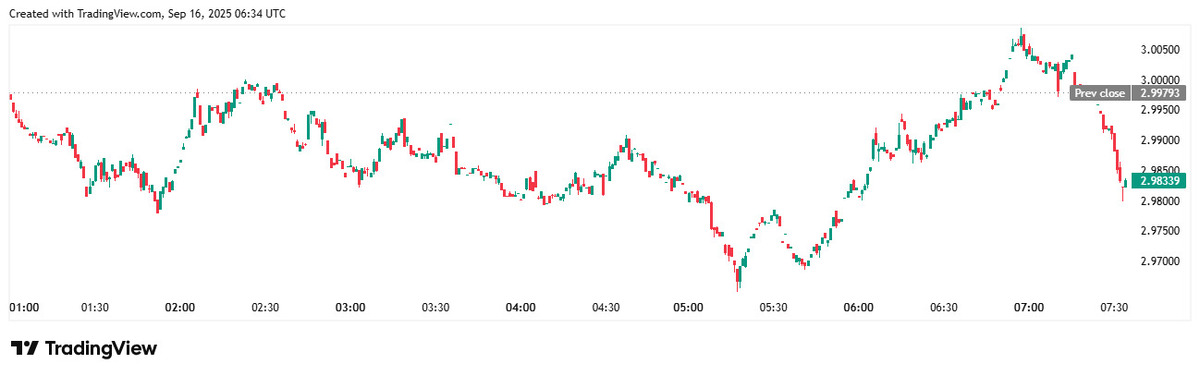

ETF speculation is nothing new to crypto markets, but its growing role in Ripple’s outlook is hard to ignore. Over the past two weeks, institutional flows into regulated futures products have helped XRP stabilize above $3.00, even as broader market sentiment oscillated. According to Cointelegraph, daily trading volumes nearly doubled on September 11 when ETF chatter gained traction, sending XRP as high as $3.16 before short-term profit takers stepped in.

Analysts highlight that for XRP to gain serious momentum, a confirmed close above $3.20 is needed. This level has acted as a ceiling multiple times this year, and without an ETF green light or tangible regulatory progress, XRP may remain locked in its current channel. Still, the psychological magnet of $3.50 continues to draw speculation, especially with October shaping up as a pivotal month for regulatory filings.

Technical Landscape: Resistance Meets Optimism

From a technical standpoint, XRP is at a crossroads. Coindesk reports that whale accumulation has been steady, with larger wallets adding positions in the $3.00–$3.10 range. This signals confidence that XRP is undervalued relative to potential ETF-driven inflows.

The bullish case rests on ETF approvals or positive regulatory headlines, which could accelerate XRP toward $3.41–$3.50 in October. Cointelegraph notes that a breakout could even extend as high as $3.60, though failed attempts in the past highlight the fragility of such moves without strong catalysts. On the downside, losing $2.85 support would expose XRP to sharp corrections toward $2.66 or even $2.50, particularly if macro conditions sour.

What stands out most is the balance between bullish institutional flows and the heavy overhead resistance stacked above $3.20. In other words, XRP has the setup for a breakout — but only if external forces, particularly the ETF storyline, translate into concrete action.

Institutional Buying and Market Psychology

Beyond charts, market psychology is now playing an outsized role. Analysts stress that XRP has become a test case for regulated crypto exposure. If ETF speculation materializes, it would cement XRP’s role alongside Bitcoin and Ethereum as an institutional-grade asset.

For traders, this narrative creates both opportunity and risk. On one hand, there’s optimism that institutional legitimacy will validate higher prices. On the other, skepticism lingers about whether the hype cycle is simply front-running approvals that may not materialize until later in the year. This tug-of-war is precisely why XRP remains range-bound yet resilient above $3.00.

MAGACOIN FINANCE: Scarcity Narrative in the ETF Era

With analysts eyeing $3.50+ for XRP if ETF approvals land in October, speculation is driving a fresh wave of bullish sentiment. But while XRP’s upside looks strong, traders are also piling into MAGACOIN FINANCE — a meme coin emerging as a hidden gem — with forecasts of 30x–50x ROI as momentum accelerates toward $14M raised.

MAGACOIN FINANCE stands apart from typical meme assets by leveraging a scarcity-driven supply model and dual audits, giving it a rare combination of hype and structural fundamentals. Community traction is snowballing, with whales and early adopters signaling confidence that it could mirror the breakout paths of past cycle-defining altcoins.

Final Thoughts

Heading into October, XRP remains delicately positioned between consolidation and breakout. ETF speculation has kept it buoyant, institutional inflows are supportive, and technical setups point to the potential for a push toward $3.50. Yet, resistance remains formidable, and without regulatory clarity, consolidation around $3.00–$3.20 may remain the dominant theme.

For investors, the playbook is twofold: monitor XRP for confirmation above $3.20 while acknowledging that capital rotation often favors hidden gems before mainstream breakouts. In this cycle, MAGACOIN FINANCE is capturing that early momentum, with its early settlement nearing $14M and analysts calling for 30x–50x gains.

The dynamic is clear: while XRP’s $3.50 battle will command October’s headlines, the smart money is already diversifying into projects like MAGACOIN FINANCE — the kind of early-stage altcoin that often writes the next chapter of crypto’s biggest rallies.

Learn More About MAGACOIN FINANCE

- Website: https://magacoinfinance.com

- Twitter/X: https://x.com/magacoinfinance

- Telegram: https://t.me/magacoinfinance

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.