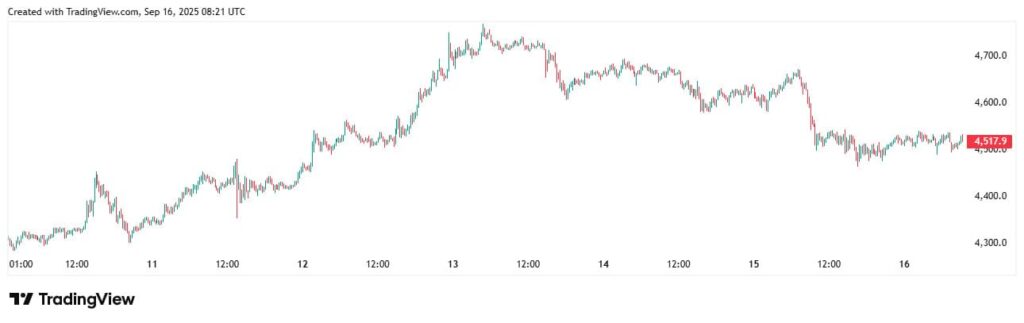

Ethereum remains the backbone of decentralized finance and smart contracts, but recent market softness has raised doubts among retail traders. Despite ETH trading just under $4,500 after its August highs, analysts argue the long-term trajectory is intact. Institutions continue to pour capital into Ethereum via ETFs, while corporate treasuries accumulate aggressively, tightening supply and reinforcing structural demand. MAGACOIN FINANCE, meanwhile, is quietly surfacing as an early upstage opportunity, echoing Ethereum’s early growth days but with a retail-driven, meme-fueled twist that complements Ethereum’s institutional narrative.

Ethereum’s Institutional Backbone: ETF Inflows and Accumulation

Ethereum’s consolidation phase has drawn comparisons to its pre-2017 breakout, when skepticism masked a brewing supply squeeze. According to Standard Chartered’s Geoffrey Kendrick, Ethereum-focused treasuries and ETFs have absorbed nearly 5% of circulating supply since June 2025, a structural shift he sees as underpriced by the market. Firms like BitMine Immersion alone are targeting 5% of total ETH supply, signaling conviction that extends beyond speculative flows.

Options markets currently suggest a 40% probability ETH closes above $5,000 by year-end, while analysts cluster Q4 price predictions in the $4,650–$5,000 range. Technical support sits near $4,250, and whale accumulation across exchanges like Binance provides further evidence that institutional hands are tightening their grip on ETH supply. These dynamics create conditions for a potential rally toward $7,000, even if near-term spot market weakness continues.

NAV Discounts and Staking Yield Advantages

Beyond direct ETF flows, Ethereum treasuries offer advantages not available to Bitcoin-focused counterparts. SharpLink Gaming (SBET) and BitMine Immersion (BMNR), two firms aggressively building ETH holdings, trade at NAV discounts compared to MicroStrategy’s Bitcoin balance sheet. Kendrick notes that Ethereum treasuries also generate a staking yield of ~3%, a structural return mechanism that spot ETFs lack.

SharpLink’s commitment to buy back shares if its NAV multiple drops below 1.0 creates a hard floor under its stock, underscoring the unique resilience of ETH treasuries. The combination of discounted valuation, staking returns, and DeFi integration reinforces Ethereum’s role as a superior institutional allocation compared to purely passive instruments.

While Bitcoin maintains the title of “digital gold,” Ethereum increasingly looks like the “digital balance sheet” for treasuries seeking yield alongside growth.

Why $7K ETH Is Still in Play

Despite near-term weakness, analysts maintain confidence that Ethereum’s setup resembles its pre-2017 breakout phase, where skepticism masked structural accumulation. With ETF inflows, NAV discounts, and whale wallets locking supply, Ethereum has the conditions to launch a fresh leg higher. Kendrick maintains a year-end target of $7,500, while long-term projections place ETH at $25,000 by 2028.

This outlook aligns with broader market forecasts, which see Bitcoin nearing $200,000, XRP rebounding, and stablecoins expanding to a $2 trillion supply in four years. For many institutional desks, Ethereum remains the crown jewel of Q4 portfolios—not just for price upside, but for the staking yield and DeFi access that distinguish it from other large-cap tokens.

MAGACOIN FINANCE: Echoes of Ethereum’s Early Days

While Ethereum builds its security narrative through ETFs and institutional inflows, MAGACOIN FINANCE is emerging as a high-upside counterweight. Analysts point out that the market’s reaction to Ethereum’s consolidation mirrors its pre-2017 breakout phase, yet retail investors today are far more willing to rotate into newer plays that echo ETH’s presale days.

MAGACOIN FINANCE has capitalized on this dynamic—its presale has raised more than $13.5 million, sold out stages in record time, and already implemented a deflationary burn rate cutting supply by 12%.

The project’s appeal lies less in balance sheet utility and more in meme-driven virality and community acceleration. Analysts project returns between 35x and 15,000% by 2025 if momentum continues. For retail investors seeking speedier growth compared to ETH’s steady climb, MAGACOIN FINANCE has positioned itself as the stealth trade of this cycle—an early upstage opportunity that complements Ethereum’s stability with speculative asymmetry.

Conclusion

Ethereum’s structural demand, NAV advantages, and institutional flows keep the path to $7,000 ETH in play, even amid spot market weakness. The pre-2017 comparison underscores the idea that skepticism may again precede breakout, while supply tightening builds a bullish foundation.

MAGACOIN FINANCE, echoing Ethereum’s presale era but accelerated by meme culture and deflationary tokenomics, offers investors a chance to balance stability with speculative firepower.

By Q4 2025, successful portfolios will likely hinge on this balance—leaning on Ethereum’s resilience while recognizing MAGACOIN FINANCE as the wildcard that could define the cycle’s season.

Visit MAGACOIN FINANCE today to explore before the next move.

- Website: https://magacoinfinance.com

- X: https://x.com/magacoinfinance

- Telegram: https://t.me/magacoinfinance

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.