TL;DR

- Ethena Labs’ USDe stablecoin supply has crossed the 6 billion mark, reinforcing its strong foothold in decentralized finance.

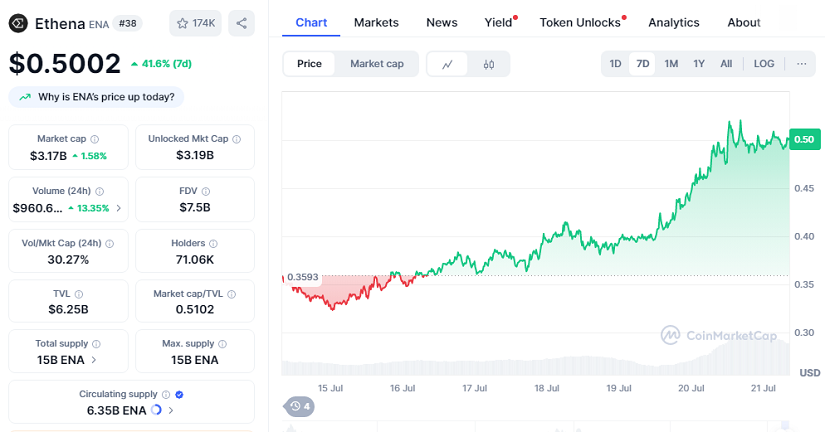

- Meanwhile, the ENA token surged 41.6% in just seven days, trading now at $0.5002 with a market cap of $3.17 billion.

- This rapid expansion fuels optimism among crypto enthusiasts who see synthetic stablecoins as vital for liquidity and yield strategies on-chain.

Ethena Labs’ flagship stablecoin USDe has officially topped 6 billion in circulation, solidifying its relevance for traders and protocols looking for flexible, yield-generating instruments. Etherscan data confirms the milestone was hit on July 20, showcasing how far synthetic dollar alternatives have come in gaining trust across decentralized ecosystems worldwide this year, boosting confidence among users and liquidity providers alike.

At the same time, Ethena’s governance and utility token, ENA, climbed an impressive 41.6% over the past week. It is currently priced at $0.5002, posting a modest 1.4% gain in the last 24 hours alone. With a total market capitalization now standing at $3.17 billion, ENA’s rally reflects robust investor conviction in Ethena’s approach to on-chain liquidity and synthetic dollar exposure.

ENA Token’s Surge Signals Growing DeFi Appetite

Market watchers link this uptick in price to renewed confidence in decentralized stablecoins that can maintain dollar parity without the typical collateral models. Synthetic designs like USDe allow for more flexible liquidity provisioning and capital efficiency, attracting both risk-tolerant yield farmers and larger institutional players exploring DeFi rails.

The ENA token’s consistent upward movement also highlights how participants are positioning themselves ahead of possible governance upgrades and expanded use cases. As Janet Yellen recently remarked that the “dollar is going on-chain,” many view this as an indirect nod to the role synthetic stablecoins might play alongside traditional banking structures.

Regulation And Innovation Shape Synthetic Dollar Future

Of course, questions remain about how regulatory frameworks will evolve to address synthetic assets that mirror fiat currency. Recent trends suggest that policymakers will keep a close eye on liquidity flows and potential systemic risks linked to rapid supply growth. However, this same attention could open doors for clearer legal paths that help onboard mainstream capital and push DeFi further into everyday financial activity.

Investors also point out that new partnerships with major protocols could fuel additional integrations, creating fresh incentives for developers and liquidity providers. With daily trading volumes spiking and more protocols integrating USDe, Ethena appears well-positioned to capture a growing slice of the decentralized dollar market in the coming months ahead, strengthening its ecosystem’s resilience.