TL;DR

- Franklin Templeton analysts caution that the corporate crypto treasury model, while promising, faces a potentially “dangerous” negative feedback loop if market conditions shift.

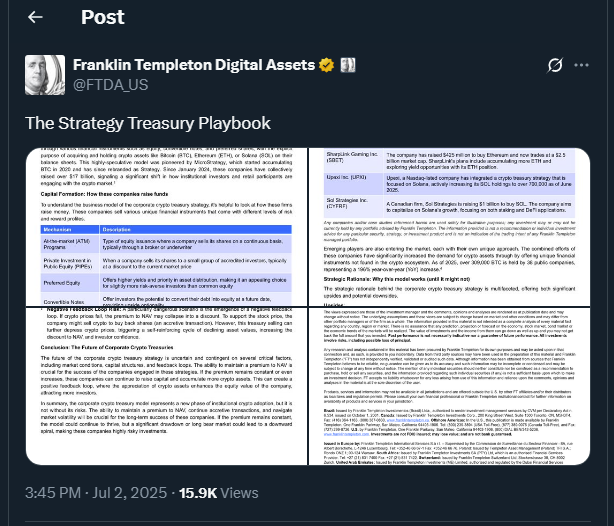

- Over 135 public companies have adopted Bitcoin-centric treasury strategies, driven by capital raised at premiums and staking opportunities in Proof-of-Stake assets.

- Despite potential for asset appreciation and shareholder value growth, maintaining a premium to NAV is crucial to avoid dilution and capital formation collapse.

Corporate crypto treasury strategies are gaining traction, especially among firms leveraging blockchain-based assets to boost long-term shareholder value. However, analysts at Franklin Templeton Digital Assets are warning that this emerging model carries structural risks that could amplify in periods of market stress.

As of mid-2025, more than 135 public companies have adopted some version of the crypto treasury model, predominantly holding Bitcoin. Inspired by Michael Saylor’s strategy at MicroStrategy (now simply Strategy), other firms like Metaplanet, Twenty One, SharpLink, and Sol Strategies have followed suit, acquiring significant positions in Bitcoin, Ethereum, and Solana.

Crypto Volatility Can Enable Financial Innovation

Analysts highlight the model’s ability to raise capital at a premium to net asset value (NAV), allowing firms to issue equity without immediate dilution. This works especially well when crypto prices are rising, drawing in more investors and enhancing share valuations. For holders of Proof-of-Stake assets, staking offers a way to earn passive yield, adding another source of income.

The crypto market’s natural volatility, often cited as a weakness, becomes an advantage in this context. It boosts the embedded value of financial tools like convertible notes and structured equity, enabling more flexible financing. When properly executed, this can lead to a positive feedback loop, where rising valuations and strategic issuance drive capital growth.

Downward Spiral Threatens Long-Term Stability

However, risks emerge if the NAV premium collapses. In such cases, any new capital raised becomes dilutive, reducing shareholder confidence and undermining capital formation efforts. Falling asset prices can pressure companies to sell holdings in order to protect their stock, leading to further drops in crypto markets and investor sentiment.

Franklin Templeton emphasizes that success depends on firms maintaining the right balance between asset accumulation and capital strategy, especially during volatile periods. Prolonged bear markets or sharp drawdowns could threaten the stability of these companies and even introduce systemic stress across related financial instruments.

While other analysts, such as those from Presto Research and Coinbase Institutional, have echoed similar concerns, they agree that the current situation remains fundamentally more stable than past crises. Still, the crypto treasury model will require thoughtful risk management and investor discipline to prove its durability in the years ahead.