TL;DR

- Coinbase-backed Base launched a memecoin as an experiment to bring cultural content on-chain, but the token lost 90% of its value within minutes.

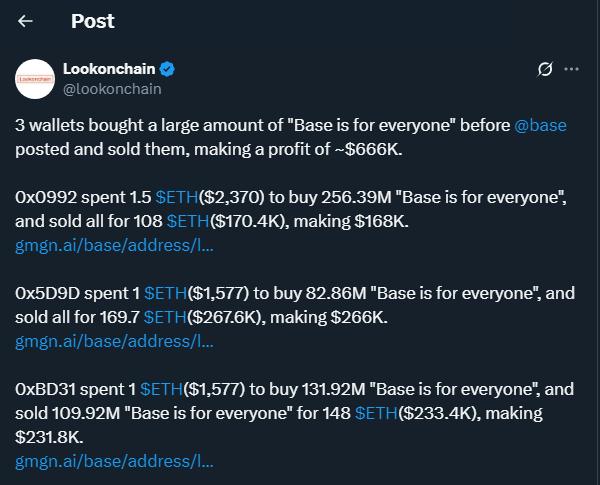

- The community criticized the lack of transparency, especially due to token concentration in a few wallets and suspicions of insider activity.

- Despite criticism, Base defends the initiative as a creative attempt to promote digital culture in Web3, not as an official investment vehicle.

What began as a playful experiment by Base, the blockchain network powered by Coinbase, ended in a whirlwind of criticism and mistrust. On April 16th, Base posted an image on X with the phrase “Base is for Everyone”, accompanied by a link to a token bearing the same name. The initiative, hosted on the Zora platform, aimed to explore how digital content and memes can live permanently on the blockchain.

At launch, the token reached a market value of $17.1 million in just over an hour. However, within the next 20 minutes, it plummeted nearly 90%, dropping to around $623,000. Data from Lookonchain revealed that three wallets controlled nearly half of the total supply, raising suspicions about possible unethical early access.

The Goal Was Cultural, Not Financial

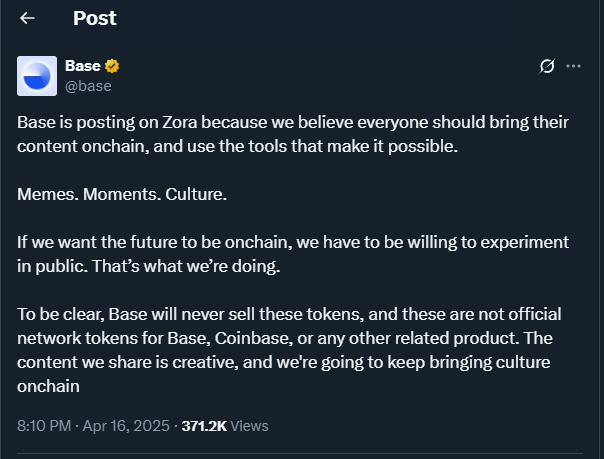

In response to the controversy, Base issued a statement clarifying that the token was not created as an investment product and is not directly affiliated with Coinbase. According to the team, it was a public test designed to encourage decentralized cultural creation and explore how tokens can permanently represent digital content. They also emphasized that they would not sell these tokens or profit from them.

Base’s vision aligns with an emerging trend in Web3: transforming the blockchain into a kind of open digital museum, where memes, artworks, and cultural moments can live beyond the limitations of traditional social networks. However, the execution left much to be desired.

The Risks of Public Experimentation

The crypto community was divided. Some see potential in the idea of tokenizing cultural content. But the way the launch was handled felt rushed and disorganized to many. Two addresses bought 21% of the supply before the initial surge, then sold for an estimated profit of $300,000. This fueled criticism about alleged insider privileges and unfair practices.

A second token launched shortly afterward also failed, further reinforcing the perception of improvisation on the team’s part. Despite the stumble, the crypto ecosystem must continue experimenting and innovating. As Web3 pioneers well know, every misstep is also a lesson. And Base, with all its infrastructure and backing, still has room to course-correct and lead new models of digital expression.