TL;DR

- VanEck is set to launch the NODE ETF on May 14, providing exposure to 30 to 60 stocks tied to the crypto ecosystem, including exchanges, Bitcoin miners, and data centers.

- NODE aims to democratize access to the sector without requiring direct purchase of digital assets.

- Despite SEC delays on other products, this ETF marks a major step toward institutional adoption of blockchain technology.

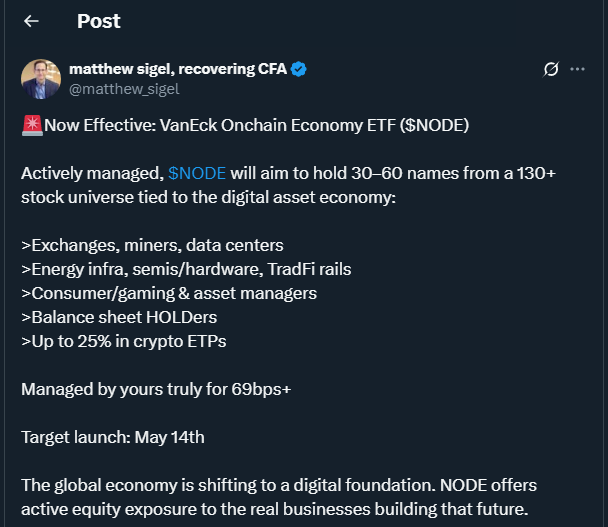

VanEck, one of the world’s leading asset managers, has announced the upcoming launch of the VanEck Onchain Economy ETF (NODE), an exchange-traded fund that will allow investors to gain active exposure to companies that are driving the growing world of cryptocurrencies and blockchain technology. Scheduled to debut on May 14, NODE will hold a portfolio of 30 to 60 companies selected from a pool of more than 130 stocks tied to the emerging digital asset economy.

This new ETF will include companies from various sectors connected to decentralized digital infrastructure, such as crypto exchanges, Bitcoin mining operations, data centers, and other key players in the Web3 ecosystem. According to Matthew Sigel, Head of Digital Asset Research at VanEck, the fund’s goal is to represent the tangible growth of the crypto sector through companies with real revenue, avoiding speculative entities lacking operational substance.

Additionally, NODE offers an innovative alternative for investors seeking diversification, as it merges technology, finance, and digital transformation into a single financial instrument. In times of regulatory uncertainty, this kind of indirect exposure is especially appealing to those looking to bypass the technical complexities of wallets or DeFi platforms while still benefiting from the momentum of the industry.

Beyond Bitcoin: Infrastructure, Technology, and Adoption

NODE does not aim to simply track the performance of Bitcoin or Ethereum. Instead, it focuses on the economy being built around these networks. By investing in traditional stocks with strong ties to the crypto environment, the fund becomes an ideal tool for those wanting to participate in the market without the high volatility that often characterizes digital tokens.

Meanwhile, VanEck is still awaiting regulatory decisions from the SEC regarding other products, including its Bitcoin and Ethereum ETFs that propose “in-kind” creation and redemption mechanisms, allowing the use of actual crypto assets instead of cash for share transactions. It has also filed proposals for ETFs tied to BNB and Avalanche.

Although the U.S. regulator has postponed its verdict on these other ETFs until June 3, the launch of NODE represents a meaningful advance. In a world where institutional demand for digital assets continues to grow, this ETF serves as a bridge between traditional finance and the new digital economy.