TL;DR

- The cryptocurrency market lost $800 billion in February 2025, dropping by 20.2%. This was driven by factors such as the historic Bybit hack, trade tensions fueled by Trump, and decreased activity in Solana.

- Despite the downturns, the growth of stablecoins and real-world assets (RWAs) reached historic highs, reflecting a preference for more stable assets during times of uncertainty.

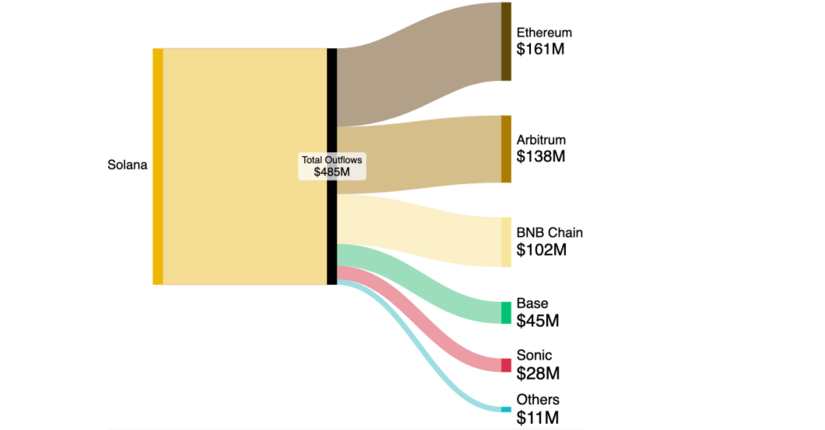

- Solana experienced significant capital outflows totaling $485 million in 30 days, primarily moving to Ethereum and BNB Chain, with a sharp decline in its TVL and memecoin activity.

In February 2025, the cryptocurrency market experienced a turbulent month, witnessing a more than 20% drop in its total value. This decline, equating to a loss of $800 billion, was driven by a series of both internal and external factors. One of the most impactful events was the hack of Bybit, which suffered a $1.46 billion loss due to an attack orchestrated by the Lazarus group. This event, the largest hack in cryptocurrency history, highlighted the vulnerability of certain exchanges and negatively impacted the general market sentiment. The attack raised concerns about the security protocols of major exchanges and added to the growing uncertainty among investors regarding the safety of their digital assets.

Additionally, trade tensions, particularly the 25% tariffs imposed by President Trump on imports from Canada and Mexico, increased uncertainty in global financial markets. Trump’s measures led to higher volatility in risk assets like Bitcoin and other cryptocurrencies, affecting investor confidence. This was compounded by concerns over potential additional tariffs from the European Union, further exacerbating nervousness in the markets.

The Resilience of Stablecoins and Real-World Assets

On the other hand, Solana experienced a massive capital outflow, with $485 million leaving the chain within a month. Most of these funds were directed towards other platforms such as Ethereum, Arbitrum, and BNB Chain. This outflow was accompanied by a significant drop in memecoin activity on Solana, which fell by more than 90% from its peak during the launch of certain tokens, leading to a sharp decline in its Total Value Locked (TVL). As the market sought more secure alternatives, Solana faced mounting pressure to regain investor confidence.

Despite this negative outlook, there are positive aspects worth highlighting. Stablecoins and real-world assets (RWAs) experienced continued growth, reaching new historic highs. In particular, stablecoins surpassed $224 billion in market capitalization, while real-world assets, such as private credit, continued to attract investor interest. This trend reflects an increasing movement of investors toward more stable and less volatile assets during times of uncertainty. Furthermore, many institutional investors are turning to real-world assets as a hedge against crypto market volatility.

Despite the challenges, the crypto sector remains an evolving industry, adapting to changes and seeking new opportunities.