TL;DR

- “Pig butchering” scams led to losses exceeding $5.5 billion in 2024, with 200,000 identified cases, impacting both retail investors and major crypto platforms.

- Among the hardest-hit entities, Cyvers detected that three of the five largest centralized exchanges (CEX), a crypto-friendly bank, and an institutional trading platform had been targeted, exacerbating the sector’s security crisis.

- Generative AI is fueling these scams, making deception easier, prolonging the psychological manipulation of victims, and enabling increasingly sophisticated and harder-to-detect fraud schemes.

“Pig butchering” scams have reached alarming levels within the crypto ecosystem, with losses surpassing $5.5 billion in 2024, according to a report by Cyvers. This fraudulent scheme relies on prolonged psychological manipulation, in which victims are gradually convinced to voluntarily transfer their assets to fraudulent addresses.

What makes this trend particularly concerning is that it is not only affecting small retail investors but is also significantly impacting major cryptocurrency exchanges and financial institutions connected to the industry. Furthermore, the increasing sophistication of these tactics, driven by artificial intelligence tools, is allowing scammers to refine their strategies more effectively, making their deception even more convincing and difficult to detect.

A Bigger Problem Than Hacks

According to Michael Pearl, Vice President of Strategy at Cyvers, this type of fraud represents the most significant threat to the crypto sector in 2025, surpassing even traditional hacker attacks. The key difference lies in the emotional manipulation element, where victims are deceived over weeks or even months before ultimately losing their money.

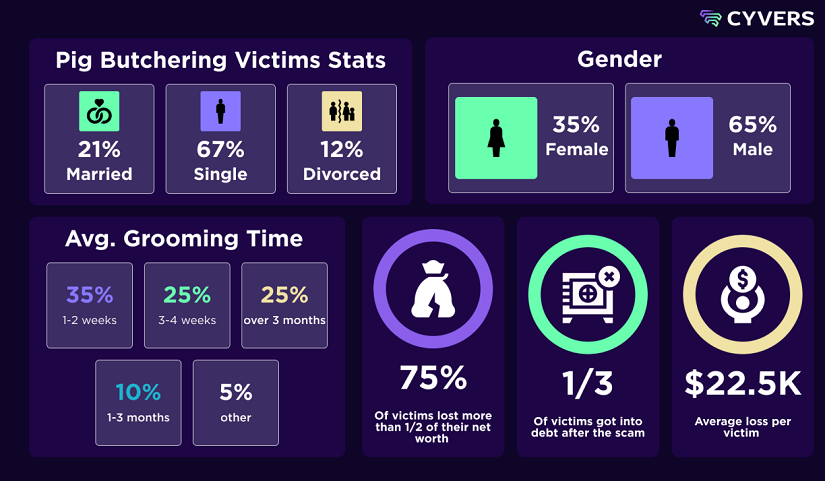

The report reveals that in 35% of cases, scammers succeed in their scheme after just one or two weeks of contact with the victim, while in 10% of cases, the deception extends for up to three months. Additionally, 75% of those affected lost more than half of their total assets, demonstrating the devastating impact of these scams. This growing crisis has led to increased distrust within the crypto ecosystem, raising concerns that widespread adoption could slow down unless stricter protective measures are enforced to curb fraudulent activities.

Exchanges in the Eye of the Storm

Beyond individual investors, centralized exchanges (CEX) are also suffering serious consequences. Cyvers has identified that at least three of the five largest CEX platforms have been targeted by these scams, exposing them to reputational damage, customer loss, and even regulatory and banking challenges. Meanwhile, regulatory pressure is mounting, with lawmakers demanding stricter measures to prevent these criminal activities from continuing to spread unchecked.

However, the crypto community is not sitting idly by. New security measures and AI-powered tools are being implemented to detect fraud patterns more accurately. Some platforms have also started rolling out educational programs designed to help users recognize potential scams before falling victim to them.