The cryptocurrency market continues to attract capital rotation beneath the surface of Bitcoin’s six-figure push. While blue-chip assets consolidate, traders are increasingly seeking undervalued entry points in altcoins priced under a dollar. This trend has put tokens like Tron (TRX), VeChain (VET), and Stellar Lumens (XLM) into the spotlight, as accumulation patterns and institutional flows provide a strong technical backdrop for September 2025.

Beyond these majors, analysts are also noting that momentum is building in a handful of other low-priced projects — Worldcoin, Sonic, Pump.fun, and AIOZ Network — each offering speculative upside in their respective niches. And, quietly threading through the chatter, MAGACOIN FINANCE is surfacing in discussions as a viral hidden gem with whale activity that traders are increasingly unwilling to ignore.

TRX (Tron) — Institutional Adoption and Stablecoin Strength

Tron has long been a powerhouse in stablecoin settlement, consistently processing over $600 billion in monthly flows . In September, Coindesk reports show TRX consolidating above $0.27, with trading volume spikes suggesting heavy institutional accumulation. Analysts argue that Tron’s efficiency in DeFi and settlement gives it an edge over competitors, and recent inflows confirm that major players are treating TRX as a reliable backbone for stablecoin movement.

From a technical perspective, TRX is holding firmly above its $0.27 support zone, and analysts see breakout potential if momentum carries it beyond $0.28. Its combination of utility-driven demand and institutional endorsement places it firmly among the best altcoins to buy under $1.

VET (VeChain) — Enterprise-Grade Blockchain for Supply Chains

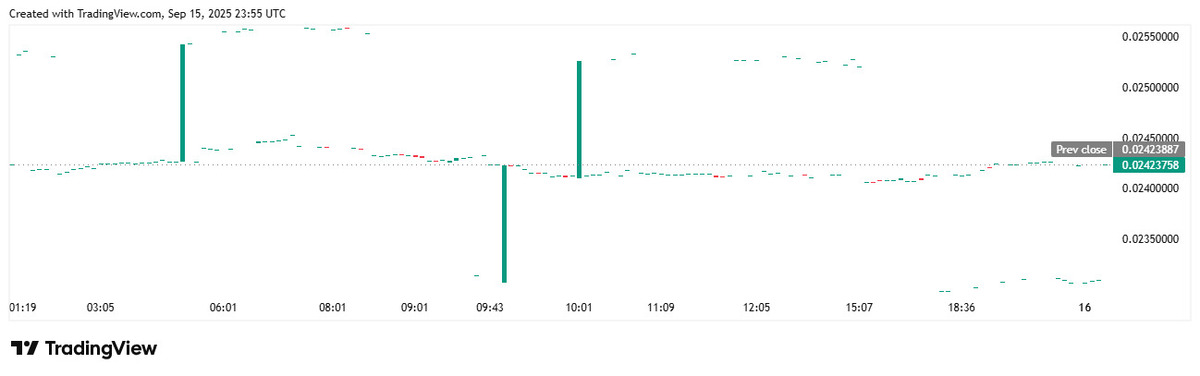

While VeChain has not generated headlines on par with other majors, its fundamentals remain quietly powerful. Cointelegraph’s recent coverage notes rising transaction volume and steady wallet activity tied to enterprise use cases . Corporations outside the crypto-native sphere continue to experiment with VeChain’s tokenization framework, making it a rare case of corporate adoption ahead of speculative hype.

Currently priced between $0.02 and $0.03, VET’s chart reflects consistent support levels that analysts interpret as smart-money accumulation. Its “under the radar” accumulation story, driven by logistics, supply chain, and enterprise tokenization, makes VET one of the most overlooked opportunities under $1 this month.

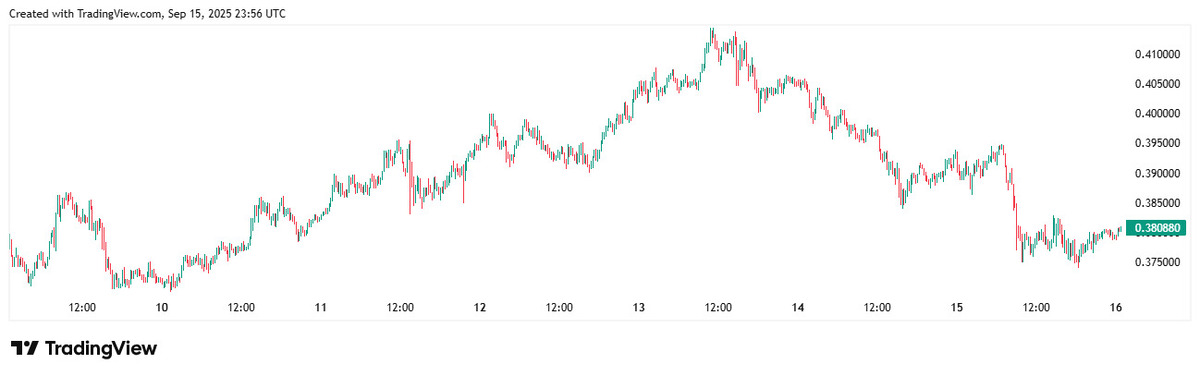

XLM (Stellar Lumens) — Corporate Treasury Accumulation

Stellar Lumens is showing a technical base between $0.36 and $0.39, with analysts pointing to multiple institutional flows entering at these levels . Coindesk reports highlight Stellar’s upcoming network infrastructure overhaul, which has attracted both corporate treasuries and institutional entities looking for a foothold in blockchain-based payments .

Technical charts confirm that XLM has broken above $0.38 resistance with heavy trading volumes, signaling accumulation by long-term players. For September 2025, Stellar combines a strong use case in payments with verified on-chain evidence of large buyers positioning early, making it one of the standout names under $1.

Worldcoin, Sonic, Pump.fun, and AIOZ — Speculative Momentum Picks

Outside of the more established names, analysts are watching several speculative plays gaining traction. Worldcoin (WLD) sits just under $1, supported by whale wallet growth and speculative accumulation tied to AI and identity narratives. Sonic (SONIC) has captured attention with its DAG-based scalability and developer surge following a rebrand and airdrop.

Pump.fun (PUMP) continues to rally as a meme-platform token, with community-driven trading volumes across new exchanges. Meanwhile, AIOZ Network (AIOZ) is cementing its role in Web3 media and streaming, with new partnerships bolstering both retail and developer participation.

7 Best Altcoins to Buy Under $1 (September 2025)

| Altcoin | Latest Price (USD) | Technical/Accumulation Trend | Analyst Highlight | Source |

| TRX | ~$0.27–$0.278 | Consolidation above $0.27; bullish momentum and major institutional accumulation, especially in stablecoin settlements and DeFi | Leading blockchain for stablecoins and top retail adoption; volume spikes indicate accumulation zones | Coindesk |

| VET | ~$0.02–$0.03 | VeChain sees rising transaction volume, unnoticed accumulation by non-crypto corporates, and strong technical support | Blockchain use cases in supply chain and enterprise tokenization attracting long-term holders | Cointelegraph |

| XLM | ~$0.36–$0.39 | Institutional accumulation between $0.36 and $0.39; breakout above $0.38 within a tight range; heavy volume | Institutional/corporate treasuries accumulating, prepping for network overhaul; strong fundamental support levels | Coindesk |

| Worldcoin (WLD) | ~$0.97 | Whale wallet growth, strong volume, consolidation above support, speculative buying, interest from new on-chain entities | Momentum surge linked to AI and identity adoption; whale buying could fuel breakout | Cointelegraph |

| Sonic (SONIC) | ~$0.05–$0.07 | DAG-based scalability, developer surge, rebranding and airdrop propelling volumes | Fast network upgrades and DeFi traction make SONIC a speculation magnet | Cointelegraph |

| Pump.fun (PUMP) | <$0.40 | Meme platform token, community growth, trading volumes, noted on several exchanges | Speculative entry for meme coin fans; volume confirms momentum | Cointelegraph |

| AIOZ Network (AIOZ) | ~$0.12–$0.13 | Streaming and content delivery platform, rising transaction volume, developer and retail wallet expansion | Strategic partnerships for Web3 media adoption; technical strength building | Cointelegraph |

These tokens remain higher-risk, but their niche use cases and accumulation footprints provide speculative entries for traders seeking balance between established plays like TRX, VET, and XLM and riskier momentum bets.

MAGACOIN FINANCE — The True Hidden Gem of 2025

FOMO is brewing around altcoins priced under $1, as traders load up on TRX, VET, and XLM. Yet, it’s MAGACOIN FINANCE that analysts call the true hidden gem of 2025, with viral momentum and early whale backing setting the stage for one of the year’s biggest ROI stories.

Still trading under a cent, MAGACOIN FINANCE combines the core ingredients that have historically driven explosive breakouts: scarcity through a capped supply, credibility via dual audits, and surging retail participation. Blockchain data already reveals whale wallets steadily accumulating, confirming that smart money is positioning ahead of broader adoption.

While most sub-$1 tokens ride market cycles, MAGACOIN FINANCE’s combination of viral traction and whale interest mirrors the early days of meme coins that went on to dominate retail portfolios. Analysts project that its asymmetric entry point could produce exponential multiples — cementing its reputation as the best-hidden gem of 2025.

Final Thoughts

The September 2025 rotation is shining a spotlight on undervalued tokens priced under $1. TRX continues to dominate stablecoin settlements, VET’s enterprise adoption remains a long-term anchor, and XLM’s institutional inflows strengthen its payment network story. Meanwhile, speculative names like Worldcoin, Sonic, Pump.fun, and AIOZ offer diversification for high-risk appetites.

But among all the under-$1 opportunities, MAGACOIN FINANCE is quickly separating itself as the standout narrative. With whales accumulating, viral community momentum, and a scarcity-driven framework, it offers the kind of asymmetric upside that retail and institutional traders crave.

For investors seeking both safety in established names and potential exponential returns, positioning in MAGACOIN FINANCE before the broader market catches on may be one of 2025’s defining strategies.

To learn More:

- Website: https://magacoinfinance.com

- Twitter/X: https://x.com/magacoinfinance

- Telegram: https://t.me/magacoinfinance

This article contains information about a cryptocurrency presale. Crypto Economy is not associated with the project. As with any initiative within the crypto ecosystem, we encourage users to do their own research before participating, carefully considering both the potential and the risks involved. This content is for informational purposes only and does not constitute investment advice.