TL;DR

- Whales withdrew around 18,000 BTC from Coinbase over the past weekend, totaling nearly $1 billion in value.

- Some analysts view this move as a bullish sign, arguing that the reduction in supply could boost the price of Bitcoin, especially with the upcoming halving on the horizon.

- However, others suggest that whales may be withdrawing funds from Coinbase to conduct over-the-counter (OTC) trades or transfer them to other custodians as a security measure.

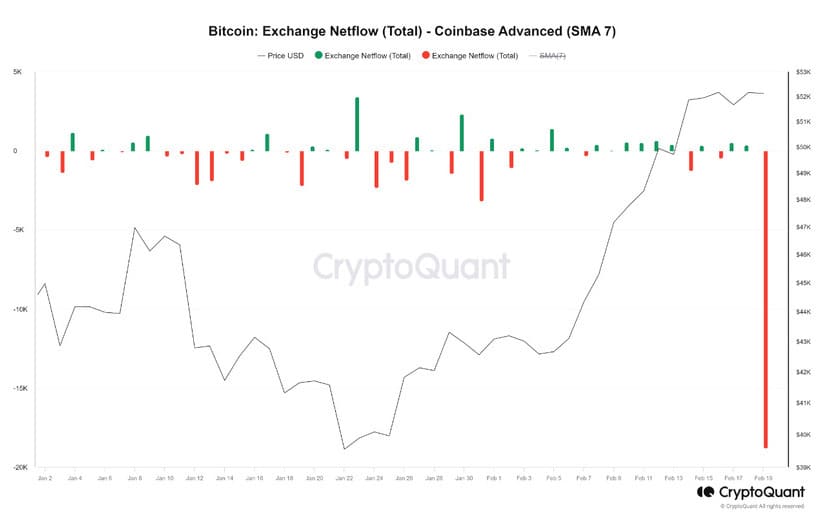

The recent Bitcoin outflow from the Coinbase exchange has caused a stir in the crypto community. According to reports from CryptoQuant, whales have withdrawn around 18,000 BTC from the exchange over the past weekend, which equates to nearly $1 billion in value. This move marks the lowest level of Bitcoin holdings on the platform since 2015 and has sparked intense debate about its implications.

Some analysts believe that the massive withdrawal of Bitcoin from centralized exchanges, such as Coinbase, is a bullish signal for the cryptocurrency. They argue that by removing large amounts of Bitcoin from exchange platforms, whales are reducing the available supply in the market, which could potentially lead to an increase in its price. This interpretation is reinforced by the fact that the upcoming halving is just around the corner, a process that has historically been a catalyst for significant increases in its value.

However, not everyone agrees with this optimistic interpretation. Some suggest that whales may be withdrawing their funds from Coinbase to conduct over-the-counter (OTC) trades, where they can sell large amounts of Bitcoin more discreetly and without affecting prices in open markets. This theory suggests that the movement of funds does not necessarily indicate bullish sentiment but rather a risk management strategy by institutional investors.

Coinbase has the Lowest Level of Bitcoin Holdings Since 2015

Additionally, the possibility has also been raised that whales are transferring their funds to other custodians or cold storage wallets, which could be a security measure to protect their assets from potential risks associated with centralized exchange platforms. This interpretation suggests that the movement of funds does not necessarily reflect a change in market sentiment but rather a preference for alternative forms of Bitcoin storage.

Regardless of the reasons behind the massive withdrawal of BTC from Coinbase, it is undeniable that this event has captured the attention of the community and sparked speculation about the future of the market. With the upcoming Bitcoin halving on the horizon and the growing institutional adoption of the cryptocurrency, volatility in prices is likely to continue in the coming months as investors try to decipher market signals.