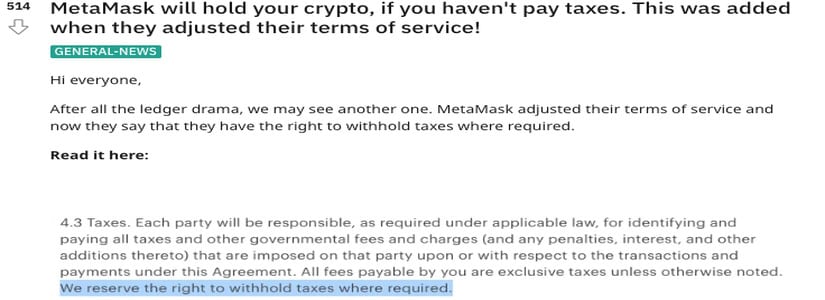

Metamask landed itself in the crosshairs after the rumor of the firm holding crypto of customers for taxes began to float. With the masses pointing fingers at MetaMask for the unethical act, ConsenSys, the firm behind MetaMask, had to step up and make clarifications. The company informed its customers via its Twitter account that these rumors were based on inaccurate information drawn from a misreading of MetaMask’s terms and conditions.

📢 We are aware of tweets circulating with inaccurate information about ConsenSys' terms of service.

Let's clarify one thing upfront: MetaMask does NOT collect taxes on crypto transactions and we have not made any changes to our terms to do so.

This claim is false.

— ConsenSys (@ConsenSys) May 21, 2023

At the same time, it was clarified that MetaMask does not collect any taxes on cryptocurrency transactions, and has not made any changes to its terms and conditions. The firm mentioned how the tax section has nothing to do with all on-chain crypto transactions.

Consensys added,

“The tax section in our terms of service falls under the “fees and payment” section, and it exclusively pertains to products and paid plans offered by ConsenSys. For example, Infura has credit card developer subscriptions which include sales tax.”

The crypto community sensed foul play after some discovered that a section of the terms of MetaMask stated that the firm held the right of withholding taxes wherever it was necessary. With that in mind, many jumped to the conclusion that it was directly correlated with the income taxes of the users.

Does MetaMask Freeze Funds for Tax Reasons?

The thread regarding the possibility of MetaMask holding taxes for crypto first popped up on Reddit in the r/cryptocurrencies sub. Not too long after its publication, the post gained more than 500 upvotes, coupled with approximately 600 comments. As a result, many within the crypto community claimed that MetaMask has followed in footsteps similar to those of Ledger, which recently startled users with a controversial upgrade.

Amid the fiasco, another rumor popped up that suggested how MetaMask could freeze user funds for tax-related reasons. However, anything associated with this is not mentioned in the wallet’s terms and conditions. At the same time, any code confirming the project to freeze user funds is not available either.

MetaMask users may not be bound to pay any taxes, but cryptocurrency investors are required to report and pay taxes on potential capital gains in most jurisdictions. A number of cryptocurrency exchanges report user trading activity to the IRS. In most cases, these companies prove tax forms, which clients can use when they proceed to file their own tax returns.