Congressman Tom Emmer (R-MN) has proposed a new bill aimed at providing regulatory clarity and defining the classification of digital assets in the United States. The bill, known as the Securities Clarity Act, seeks to differentiate digital assets from securities contracts and ensure that cryptocurrency projects can operate within a compliant framework.

Tom Emmer took to Twitter on May 18 to explain the necessity of distinguishing between digital assets and securities contracts. He highlighted that without such distinction, projects that initially raise capital through securities offerings would remain subject to securities regulations even after fulfilling decentralization.

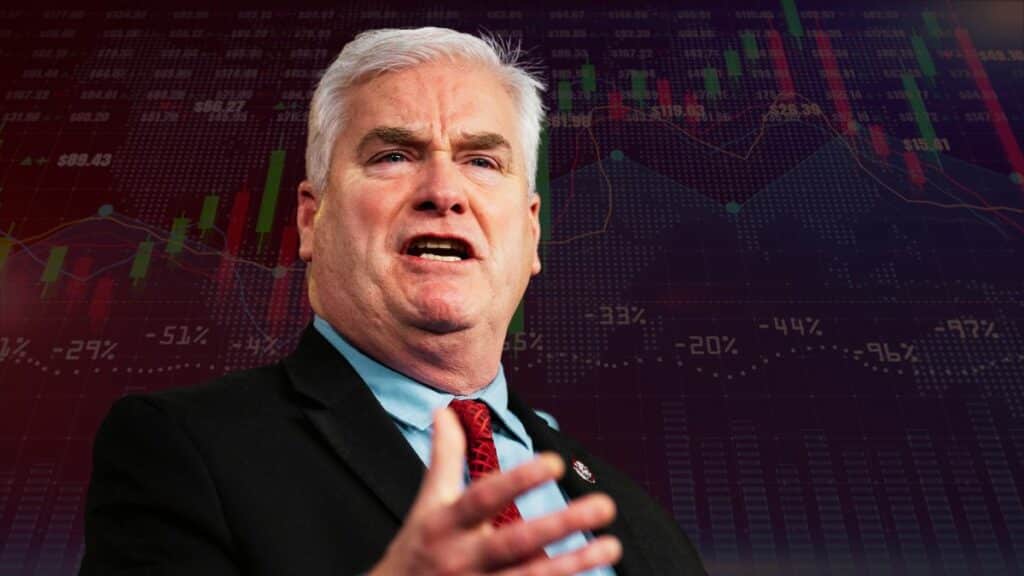

Tom Emmer introduces the Securities Clarity Act with Rep Darren Soto

By amending existing securities laws, the Securities Clarity Act, supported by Rep. Darren Soto, introduces the term “investment contract asset” to better accommodate crypto projects. This addition aims to empower crypto projects to operate in a compliant manner and allow the United States to compete globally in the evolving landscape of the internet.

Today, I introduced the Securities Clarity Act with @RepDarrenSoto. This bill clarifies the regulatory classification of digital assets and provides market certainty for innovators and clear jurisdictional boundaries for regulators. pic.twitter.com/xgsLAm2Yhh

— Tom Emmer (@GOPMajorityWhip) May 18, 2023

“This bill will add critical definition and jurisdiction to create certainty for a strong digital asset market in the United States,” Rep. Darren Soto said. “This is an important step in maximizing the potential of virtual currencies for the U.S. economy, all while protecting customers and the financial well-being of investors.”

Over the past few years, the U.S. Securities and Exchange Commission (SEC), under Gary Gensler’s leadership, has classified various crypto projects as securities based on the presence of an “investment contract” and their alignment with the definition established by the Howey Test.

Under current U.S. law, an investment contract refers to a transaction where an individual invests money in a common enterprise with the expectation of profit from the efforts of a third party. However, the crypto industry has argued that the existing Securities Act does not adequately address the needs of the sector.

The Securities Clarity Act has garnered support from various crypto community stakeholders, including organizations like the Coin Center, Chamber of Digital Commerce, Crypto Council for Innovation, and Blockchain Association.

Legislators push for Digital Assets regulatory clarity

While this bill represents Congressman Emmer’s efforts to provide regulatory clarity for the digital asset industry, it is not the first attempt by U.S. lawmakers to introduce legislation in this space. In the past, Senators Cynthia Lummis and Kirsten Gillibrand presented a bipartisan crypto bill to the Senate, reflecting the growing recognition of the need for comprehensive regulatory frameworks within the industry.

As the crypto industry continues to expand, it is vital for Congress to develop an effective regulatory framework that supports growth and innovation. The introduction of the Securities Clarity Act by Congressman Tom Emmer signifies a positive step in addressing these concerns and fostering a regulatory environment conducive to the development of the digital asset industry in the United States.