In an exciting development, news that PayPal and Venmo may integrate Bitcoin and crypto trading has been chart-topping. And for good reasons.

It is a vindication for Bitcoin and crypto.

First, as a revolutionary technology just like PayPal was when it shifted tables allowing those with a simple internet access to connect and receive payment from people from all over the world.

Second, as a reminder that nothing is permanent and circumstances do change. Understandably, Bitcoin has been tempered over the years. This is so because these coins are largely unregulated. Cognizant of crypto and blockchain developments, policymakers across the world are literally racing to formulate laws so as to streamline activities and earn revenue from the multi-billion dollar industry.

In the formative years of Bitcoin, PayPal infamously switched off the ability of traders to exchange USD/Euros for Bitcoin because back then, trading crypto and Bitcoin was completely peer-to-peer with no developed market.

Also, that’s not forgetting that in 2018—and joining other leaders like Warren Buffett and Jamie Dimon of J.P. Morgan and Chase, to castigate Bitcoin. Then, the Ex-CEO of PayPal Bill Harris said Bitcoin will crater to zero since it had no value.

Bill cited the network’s inability to scale, BTC’s price volatility, and the slow transaction time.

Talking to CNBC, he dismissed Bitcoin’s prospects saying:

“We’ve got digital currencies. And we’ve got digital currencies that are more stable, more widely accepted and have intrinsic value. We’ve already got it — it’s called the dollar, the yen, you name it. Bitcoin makes no revenue, no profitability. The cult of Bitcoin [makes] many claims — that it’s instant, free, scalable, efficient, secure, globally accepted and useful — it is none of those things.”

Just like J.P. Morgan Chase, PayPal may have gone back to the drawing board and are convinced that BTC is worth something.

Bitcoin Price Analysis

Week-to-date, Bitcoin price has stabilized, down two percent despite upticks of June 22, 2020.

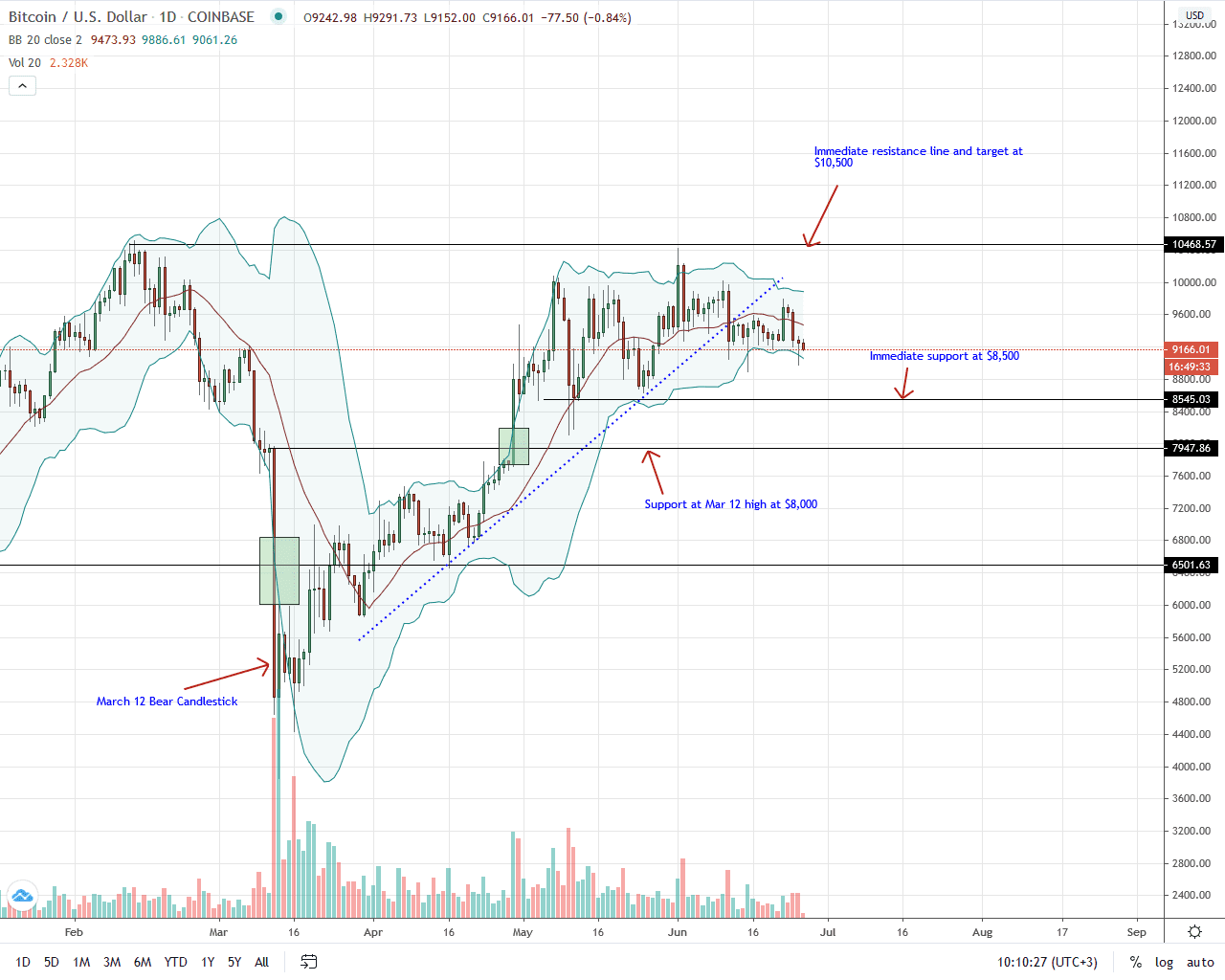

In the daily chart, prices are largely stuck in a consolidation with caps at $10,000 and support at around $8,900, or June 11, 2020, lows. While this may be interpreted as positive, on-chain factors like miner liquidation and technical like the failure of bulls to reverse losses of June 11, 2020 mean sellers may take charge from an effort-versus-results perspective. Notice that prices are ranging within June 11, 2020 high-low.

In the immediate term, any break above $10,000 coupled with decent trading volumes will reaffirm bulls of the past three months. On the flip side, a wave of liquidation pushing BTC below $8,900 or June 11, 2020, lows may spark another wave that may see prices fall to $8,500 and even $8,000.

Disclaimer: This is not investment advice. Opinions expressed here are those of the author and not the view of the publication.

If you found this article interesting, here you can find more Bitcoin news