As per the latest Proof-of-Reserves audit report from Binance, the leading cryptocurrency exchange has liquidated a large chunk of its USDC reserves. The report suggests that there was a significant movement of USDC assets in the exchange after the collapse of Silvergate.

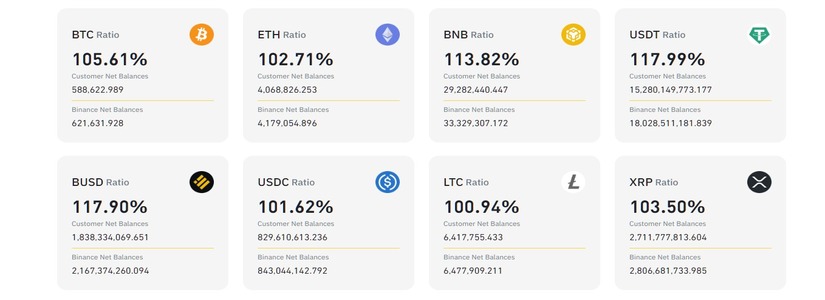

Nonetheless, the report shows that Binance has ample cash and crypto to cover user funds. This is an encouraging sign for the exchange and its users. All the major crypto assets are present in excess in comparison to the net balances of customers on the exchange.

Binance USDC Reserves Fall to $23.9 Million

After the crash of Silvergate, the USDC stablecoin lost its peg to the US Dollar. The development was the talk of the industry at that time, causing major disruptions in the crypto market. Soon after, many platforms with high USDC reserves started facing financial problems.

The audit report shows that the USDC balance was $3.4 Billion at the start of March. However, as of May 1, the USDC balance is only $323.9 million. This is a noteworthy degradation, showing that the exchange converted its USDC assets into Bitcoin (BTC), Ethereum (ETH), and Tether (USDT).

1/ Binance proof of reserves, the table shows how CZ was withdrawing dollars from US banks after the collapse of Silvergate and Signature banks, at the same time preventing the crypto from collapsing… pic.twitter.com/zGKNkve6y6

— Aleksandar Djakovic (@sasadjak72) August 7, 2023

Analysis shows that during the same time period, Binance bought 100,000 BTC and 550,000 ETH. The funds used for this purchase amount to the funds dumped through USDC. Just recently, the Coinbase CEO also stated that Binance is selling USDC for another stablecoin. It was also stated by some experts that Binance is now preferring the FDUSD stablecoin.

CZ + Sun have been exiting $USDT via $USDC to get USD. Tether can't redeem billions.

New stablecoins emerge. $TUSD denominated volumes went from 0% to 20% in just a few months. #Binance controls 90% of $TUSD supply. This is very simple.

The cartel is turning. Please advise. https://t.co/T8PLDNfu2n

— Not Tiger Global 🍐 (@NotChaseColeman) August 4, 2023

Binance Now Holds 2.8 Billion XRP

With the hype around XRP due to the Ripple-SEC case, Binance has noted an increase of 100 Million in XRP tokens held in the last month. The exchange now has over 2.8 Billion XRP tokens in its reserves. These reserves are 103.50% of XRP tokens held by customers on the exchange. Overall, XRP has seen a massive increase in its adoption across the globe.

Crypto holdings of BTC and ETH are also notably higher than the customer funds on the exchange. This shows that the exchange can ensure enough liquidity and manage its risk profile as well. Binance has been releasing its PoR audit reports since the crash of FTX. The report is released publicly to ensure more transparency in the operations of the crypto exchange.