TL;DR:

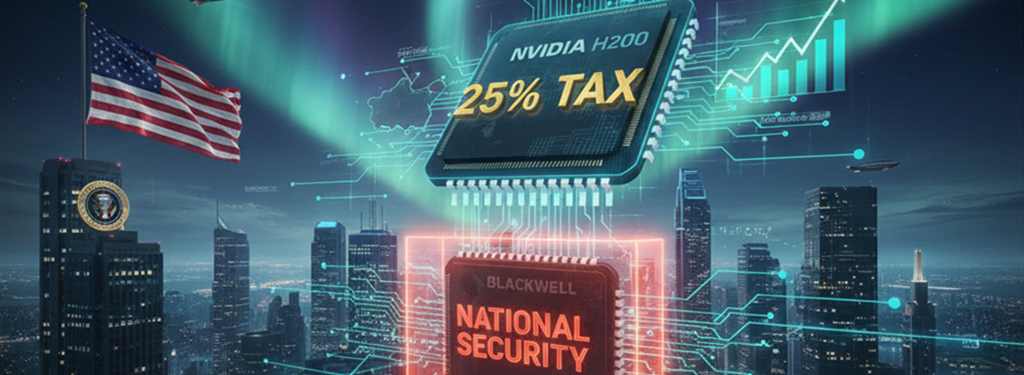

- President Trump announced that he will allow the sale of Nvidia H200 chips to China in exchange for the U.S. government receiving a 25% share of the revenue.

- The policy, which would also apply to AMD and Intel, seeks to unlock a market that Nvidia estimated resulted in $8 billion in lost revenue.

- Despite the potential opening, Nvidia faces a growing challenge from competition and the Chinese government’s promotion of local hardware.

The financial markets and technological geopolitics are shaking following President Donald Trump’s proposal for a new regulatory framework for the export of high-end semiconductors to China. The key to the President’s proposal is the sale of Nvidia H200 chips to China, provided that the U.S. government receives a 25% cut of the revenue associated with those sales.

The proposal, reportedly accepted by President Xi Jinping, represents a significant reversal of previously imposed export control restrictions, which had cost Nvidia (NVDA) at least $8 billion in losses, according to company estimates. The H200 chip, a more powerful version of Nvidia’s Hopper architecture, is essential for training advanced Artificial Intelligence (AI) models and has been used by giants such as OpenAI and Meta Platforms.

As a catalyst, following Trump’s announcement, Nvidia shares rose 2% in extended trading on Monday, while those of Advanced Micro Devices (AMD), another company to which the 25% cut would apply, also experienced a 1.5% rise.

It should be noted that the agreement would only apply to the H200 and not to Nvidia’s latest generation chips, such as Blackwell or Rubin. Trump also noted that similar agreements would apply to AMD, Intel, and other sector players.

The Dual Challenges: Rivalry in China and the Global Market

Despite the imminent opening of the Chinese market for the sale of Nvidia H200 chips, the company faces a dual challenge. On one hand, CFO Colette Kress had already indicated that “sizable purchase orders never materialized” due to geopolitical issues and increasing internal competition.

On the other hand, the Chinese government is actively encouraging local companies, such as Alibaba and ByteDance, to reduce their dependence on Western hardware, fostering the development of their own chips.

According to Richard Windsor, founder of the research firm Radio Free Mobile, the Chinese restrictions could be a strategy to gain negotiating leverage over the U.S. or, more fundamentally, a genuine effort to achieve total independence from American technology.

However, the race for technological autonomy comes at a cost. Windsor argues that, even if China manages to develop competitive AI models, these “will be larger, more power hungry and much more expensive to deploy” than comparable systems from Nvidia or AMD.

Ultimately, both economics and price will be the decisive factors for adoption in non-affiliated countries. For Nvidia, the landscape is complex: while one door opens for the sale of H200 chips, another slowly closes due to the evolution of the Asian country’s industrial policy.