Altcoin Season is Back?

Is the altcoin season on? Maybe, who knows. We can take some leads from the performance of Ethereum [ETH] in the last two weeks as a guide. At spot rates, ETH is outperforming the slumping BTC, adding 4.5 percent in the last week but pretty stable against the equally strong green back.

There are several explanations around this flipping. First, it has to do with BTC weakness and possible fall to $7,500 that is sparking concerns and therefore flight to ETH.

Ethereum’s developers are firm and as the year enters its tail end, there is understandable optimism around Istanbul and the Phase 0, the testnet of the Beacon chain. A period of high throughput in their millions will cement Ethereum’s position as a leader in smart contracting.

Developer Activity is Up

That will be positive and exactly what investors are banking on. Second, it is the apparent spike in network activity. From September, Ethereum’s network activity spiked, pushing the prices of gas to new highs.

Those are indicators of demand which is overly bullish for traders waiting for a solid break above $200 and even $300 assuming conditions are welcoming. But it isn’t about gas only, developer activity, according to Santiment, is up, retesting May 2019 levels. Often, developer activity and prices positively correlate.

“ETH development activity has been going parabolic the past three weeks, early 2020 we are going to be seeing some major announcements from the Ethereum team… It will take other blockchains years to catch up in terms of development.”

ETH/USD Price Analysis

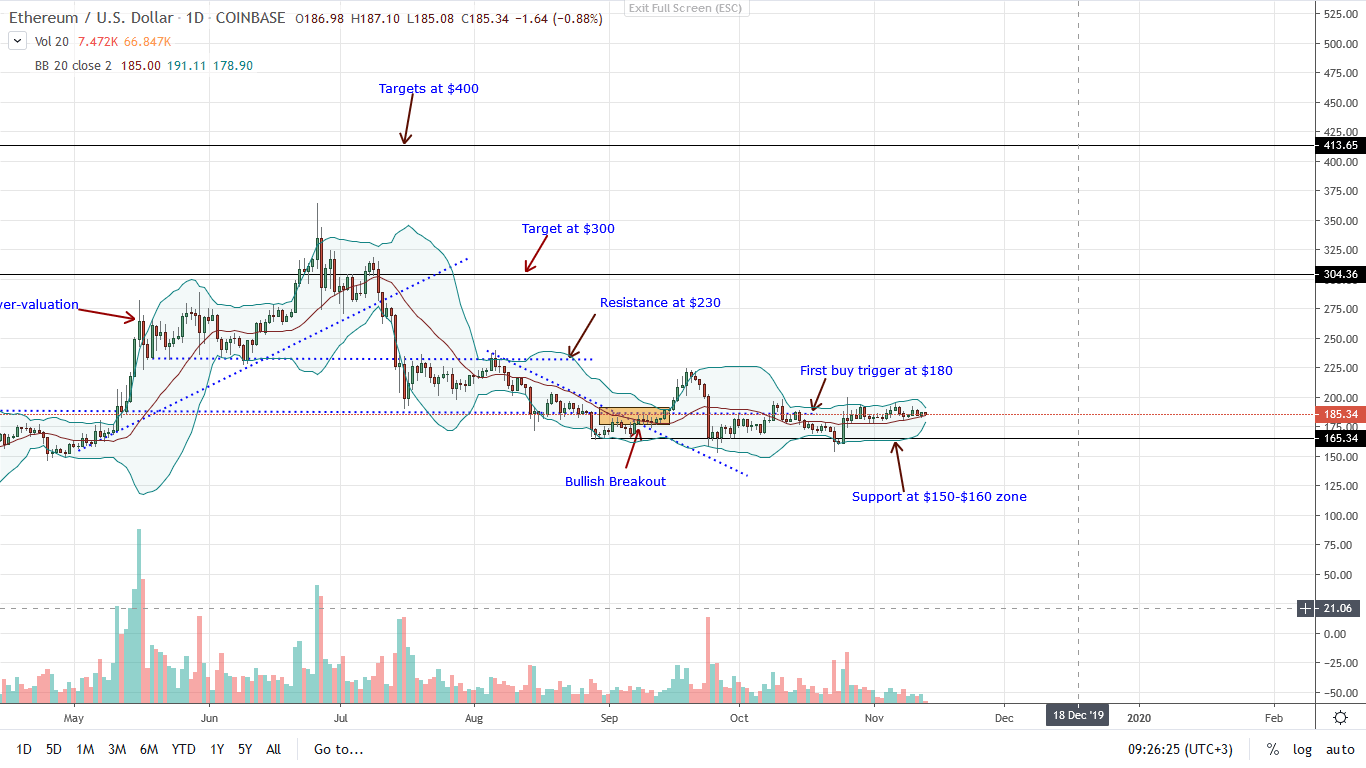

At press time, ETH prices are stable against the USD. Technically, bulls have the upper hand because despite the sell pressure of the first 13 days of November, prices are steady above the 20-day moving average.

From an effort versus results point of view, there is an opening for aggressive buyers to load up at spot rates. The reasoning behind this is that prices are consolidating inside Oct 25-26 candlestick and the BB is constricted meaning volatility is low.

As it is, a risk-averse trader should wait for prices to close above $200 before loading the dips with a first conservative target at $230. On the flip side, if prices drop below the 20-day MA at around the $170-$175 support, odds are ETH will drop to $150 in a retest.

Chart courtesy of Trading View-Coinbase

Disclaimer: Views and opinions expressed are those of the author and is not investment advice. Trading of any form involves risk. Do your research.