There are many metrics showing promising situations for the NFT market in 2022. The most important one is OpenSea’s good start of the year. Besides, the price of popular NFT projects in marketplaces is showing another positive sign. In a nutshell, the whole market is in a good situation and still can reward collectors or investors.

The NFT industry showed many possibilities for artists, collectors, investors, and crypto enthusiasts in 2021. Many platforms were launched, and lots of artists used this opportunity and earned many rewards. Besides, the concept is being accepted by mainstream users. Now, many metrics show the market still has many possibilities to grow more.

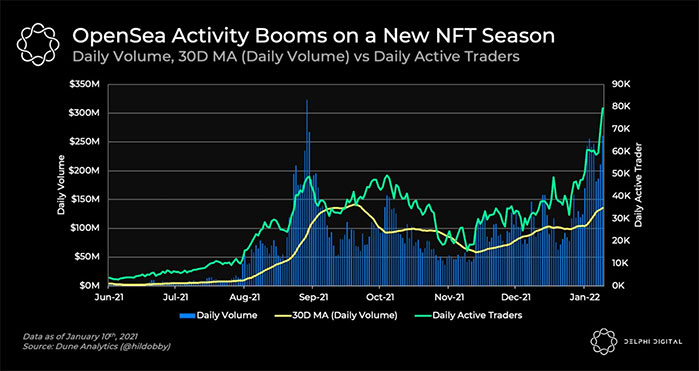

The latest analysis by Delphi Digital describes the current situation of the NFT market next to some data from OpenSea, implied volatility of Ethereum and Bitcoin, and the growth of FXS.

The most important metric for an NFT marketplace is the trading volume. OpenSea showed explosive growth in this metric at the start of the current year. Besides, the active traders metric increased significantly. The current daily volume is averaged around $200M to $250M. The last time that we saw this level of trading volume was from August to September 2021.

Famous projects in NFT markets have a significant effect on the whole market. Their floor price somehow is the index in this market and can result in many sentiment movements among investors. In simple terms, when the price of a collection rises significantly, people become more confident about the market and may start to buy more art pieces.

The latest report by Delphi Digital shows the current state of the famous projects in OpenSea, saying:

“The @BoredApeYC floor has decisively flipped #CryptoPunks and is now 27% higher at 77.99 ETH. Meanwhile, Punks have dipped to a 60.95 ETH floor. PhantaBear is the talk of the town this week, with its floor price growing from 0.34 ETH on Jan. 1 to 6.17 ETH today.”

As mentioned above, the implied volatility of Ethereum and Bitcoin is another factor that Delphi Digital has analyzed in the latest report. It’s showing a continuous compress continuing the last months’ trends. The whole market is showing lower trends. So, the compressing implied volatility is not surprising at all.

The Bitcoin price isn’t showing that promising situation, and it has resulted in many different sentiments in the market. But other crypto-related markets are somehow healthy. NFT sector can be one of these healthy sectors attracting more investors and rewarding them.